[Note: Presentation on Thursday, May 23, 2002, to a seminar at the Grocers Hall, London, organized by the Association of Mining Analysts and sponsored by Durban Roodepoort Deep on Prospects for Gold – A new era or more toil ahead?]

As indicated on the program, your chairman, Michael Coulson, has asked me to address: “The gold anti-trust action – the Boston court judgement and the road ahead.” While I will speak to the assigned topic, my own title for this talk is Money in Court: Paving the Road to Ruin, and I will speak from the perspective of the American Constitution.

Gladstone described it as “the most wonderful work ever struck off at a given time by the brain and purpose of man.” W.E. Gladstone, “Kin Beyond Sea,” The North American Review (September-October 1878), p. 185. The Constitution grants to Congress exclusive power “To coin Money [and] regulate the Value thereof.” The states are expressly forbidden to “coin Money; emit Bills of Credit; [or] make any Thing but gold and silver Coin a Tender in Payment of Debts.” These provisions have never been changed or amended.

Until the Civil War, no one would have disputed this statement by Daniel Webster in a speech to the Senate on the Specie Circular in 1836:

[T]here can be no legal tender in this country, under the authority of this government or any other, but gold and silver. … [This is] a constitutional principle, perfectly plain and of the highest importance. … To overthrow it would shake the whole system.

The financial demands of the Civil War brought about the federal government’s first experiment with a paper legal tender, the so-called “greenbacks.” The issue of their constitutionality did not reach the Supreme Court until after the war ended. In 1869, in the case of Hepburn v. Griswold, 75 U.S. (8 Wall.) 603, a closely divided Court held that the greenbacks were unconstitutional. A year later, following a change in the composition of the Court, this ruling was reversed in the Legal Tender Cases, 79 U.S. (12 Wall.) 457, by a 5 to 4 vote. The majority opinion stated (at 553):

The legal tender acts do not attempt to make paper a standard of value. We do not rest their validity upon the assertion that their emission is coinage, or any regulation of the value of money; nor do we assert that Congress may make anything which has no value money. What we do assert is, the Congress has the power to enact that the government’s promises to pay money shall be, for the time being, equivalent in value to the representative of value determined by the coinage acts … .

Fourteen years passed before the legal tender issue again came before the high Court. In the 1884 case of Juilliard v. Greenman, 110 U.S. 421, the question was whether Congress could make paper a legal tender in time of peace as well as war. With the cooling of Civil War passions and the effective reinstatement of the gold standard, many expected that the ruling in the Legal Tender Cases would be curtailed if not reversed, and that the monetary principles of the Constitution would be reasserted. When the decision in Juilliard disappointed these hopes, it provoked considerable popular criticism.. The New York Times wrote (as quoted in C. Warren, The Supreme Court in United States History (Little Brown, 1924), vol. 3, pp. 378):

[It is a decision] which, while it must command obedience, cannot command respect, a decision weak in itself and supported by reasoning of the most defective character, inconsistent with the previous decisions of the Court on like issues, and singularly, almost ridiculously, inconsistent with the traditional interpretation of the Constitution, with the spirit of that instrument and its language.

Although the Legal Tender Cases and Juilliard had little real effect on the monetary system of the era, they set unfortunate precedents that were later used to support the monetary measures of the New Deal. The greenbacks also caused widespread use of gold clauses in bonds and other debt instruments, which regularly provided for payment “in United States gold coin of the present standard of value [then $20.67 per ounce].”

In 1933, Franklin Roosevelt nationalized the U.S. gold supply and began the process of devaluing the dollar from $20.67 per ounce. Under the Gold Reserve Act of 1934, Congress set a new value for the dollar at $35 per ounce and invalidated all existing obligations to pay in gold at the former parity. The constitutionality of this measure was addressed by the Court in 1935 in the Gold Clause Cases, 294 U.S. 240.

One of these cases, Perry v. United States, 294 U.S. 300, involved the gold clauses in government bonds, which presented a special problem because the government was altering the terms of its own obligations. In a 5 to 4 decision, the Court held that Congress could, pursuant to its power to regulate the value of money, invalidate gold clauses in private contracts but not in government bonds. As the Court explained in Perry (at 350-351):

There is a clear distinction between the power of the Congress to interdict the contracts of private parties … and the power of the Congress to alter or repudiate the substance of its own engagements … . By virtue of the power to borrow money “on the credit of the United States” [emphasis in original], the Congress is authorized to pledge that credit as an assurance of payment as stipulated, — as the highest assurance the Government can give, its plighted faith. To say that the Congress may withdraw or ignore that pledge, is to assume that the Constitution contemplates a vain promise, a pledge having no other sanction than the pleasure and convenience of the pledgor. This Court has given no sanction to such a conception of the obligations of our Government.

But recognizing the general decline in prices during the Depression era, the Court continued:

Plaintiff [Mr. Perry] has not shown, or attempted to show, that in relation to buying power he has sustained any loss whatever. … On the contrary, payment to the plaintiff of the amount which he demands [i.e., $35 for each $20.67 previously owed] would appear to constitute not a recoupment of loss in any proper sense but an unjustified enrichment.

So, at the end of the day, the “unjustified enrichment” or windfall profits arising from the devaluation did not go to Mr. Perry and other holders of the government’s gold bonds, but to a new Exchange Stabilization Fund in the U.S. Treasury.

After World War II, although American citizens still could not own gold, the gold parity of the dollar remained set at $35 per ounce under the Bretton Woods Agreements, and foreign central banks were able to convert dollars at this rate until President Nixon closed the gold window in 1971. The constitutionality of this measure, which also violated the treaty obligations of the United States, has never been addressed by the Supreme Court. More generally, the Court has expressly refused on several occasions since 1971 to consider the constitutionality of the post-Bretton Woods system of unlimited paper money having no defined value.

Since 1974, Congress has made gold ownership by Americans legal again, re-authorized the use of gold clauses in private contracts, and provided that gold should trade in a free market like other commodities. In 1978 Congress also approved the Second Amendment to the Articles of the International Monetary Fund under which member nations agree (Art. IV, s. 12(a)) to: “the objective of avoiding the management of the price, or the establishment of a fixed price, in the gold market.” This amendment also bars members from linking their currencies to gold.

Now, with the legal and constitutional stage set, let me turn to the gold anti-trust action. The complaint was filed in December 2000 in the federal district court for Massachusetts. I was the plaintiff, asserting claims both as a private shareholder in the Bank for International Settlements and as a holder of gold preferred shares of Freeport McMoran Copper & Gold. The defendants included the BIS, certain U.S. Treasury and Federal Reserve officials, and several large, well-connected international banks active in gold trading.

The complaint was posted on the Internet and received wide circulation, including many repostings at different sites. Accordingly, I have no idea how many times it was downloaded. What I do know is that when the German translation of the complaint was posted a year later, 1000 copies were downloaded within the first two weeks. Also, over 20,000 copies of GATA’s Gold Derivative Banking Crisis (www.gata.org/test.html), in many ways a precursor document to the complaint, were downloaded from the GATA website prior to the filing of the complaint.

Although factually complex and procedurally complicated, the case at heart asserted two straightforward propositions that flow logically from gold’s current legal and constitutional status as a commodity rather than money.

Proposition One. The power to set gold prices rests exclusively with Congress. Because Congress has mandated that gold trade in a free market rather than serve as legal money and the constitutional standard of value, statutes passed during the gold standard era authorizing the U.S. Treasury and the Federal Reserve to deal in gold cannot now be read to permit them to intervene in the gold market for the purpose and with the intent of affecting gold prices.

Proposition Two. As an ordinary commodity trading in a free market, gold is covered by the Sherman Act’s prohibition on price fixing. Under U.S. antitrust law, price fixing is per se illegal, meaning that it cannot be justified by any sort of rule of reason analysis, and it is frequently prosecuted as a criminal offense.

Factually, the case revolved around two intertwined events: the freeze-out by the BIS of its private shareholders and price fixing in the gold market, allegedly orchestrated through the BIS by officials from the U.S. Treasury and Federal Reserve, and carried out through the defendant bullion banks. The scenario might loosely be described as a 1990’s reprise of the London gold pool, cobbled together in the 1960’s in a futile effort to save the Bretton Woods system.

With respect to the price fixing allegations, the complaint included a bunch of statistics and information from official and corporate reports. It also relied on the words of participating officials themselves. In 1998, Alan Greenspan testified to Congress that “central banks stand ready to lease gold in increasing quantities should the price rise.” In late 1999, after the price of gold rallied sharply in response to the Washington Agreement, Edward George, Governor of the Bank of England, was reliably reported to have confided to a mining company executive:

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The U.S. Fed was very active in getting the gold price down. So was the U.K.

The complaint alleged that the motives for the price fixing were to thwart gold’s function as an indicator of U.S. inflation and the health of the dollar, as well as to rescue the bullion banks from risky short positions in physical bullion — positions built up through gold leasing from the central banks and apparently confirmed by Mr. George’s statement on the consequences of the Washington Agreement.

After the complaint was filed, the GATA army went to work searching for additional evidence. Last summer, in the course of following up one of their leads, I came across former treasury secretary Lawrence Summers’ 1988 essay on “Gibson’s Paradox and the Gold Standard,” which sheds further light on the motives for the price fixing scheme.

Lord Keynes gave the name “Gibson’s Paradox” to the observed correlation under the gold standard between long term interest rates and the price level. Restated for today’s world, Gibson’s Paradox holds that real long term interest rates should move inversely to gold prices, and that is what then Professor Summers demonstrated, at least to his own satisfaction, for the period from 1971 to 1985. At my request, Nick Laird at www.sharelynx.net prepared this chart:

As you can see, the relationship described by Gibson’s Paradox held true from 1977 to 1995, but then began a period of severe breakdown. According to Professor Summers, all prior breakdowns over the two centuries covered by his research were attributable to what he called “government pegging operations,” such as occurred at the end of the Bretton Woods period. It is not my purpose here to engage in an extended discussion of Gibson’s Paradox. For more on this subject, including a link to Mr. Summers’ original essay, see Gibson’s Paradox Revisited: Professor Summers Analyzes Gold Prices.

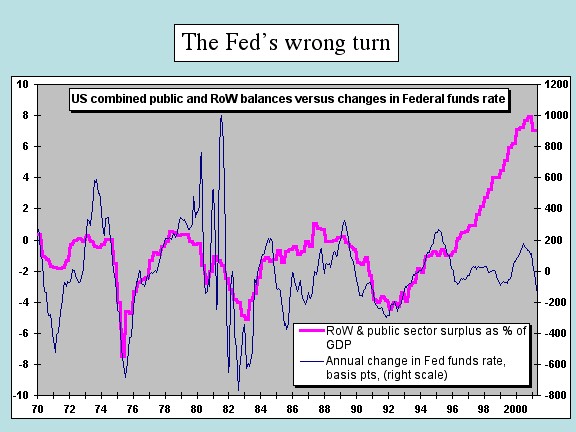

However, I cannot pass from Gibson’s Paradox without noting one further point. In today’s first presentation, Peter Warburton of Economic Perspectives put up a chart to show what he called “The Fed’s wrong turn” (copy of chart below courtesy of Dr. Warburton, author of the highly regarded Debt & Delusion (Penguin Books, 1999) and former chief economist at Robert Fleming). As you can see, the wrong turn took place in 1995, a date that is associated not only with the breakdown in Gibson’s Paradox, but also with several other key events relating to the gold price fixing scheme.

[Note: “RoW” denotes “Rest of World,” so that its net acquisition of financial assets (“NAFA”) equates to the balance of payments on current account with the opposite sign. The complete flow of funds equation is Private Sector NAFA + Public Sector NAFA + RoW NAFA = 0. Thus, when as in 2000 the public sector and rest of world are both in strong surplus, the private sector counterpart is in heavy deficit, and thus a net borrower of funds from the financial system. As described by Dr. Warburton: “The Fed’s wrong turn was the implicit or explicit decision to ignore an escalation of the public and RoW surplus (= combined private sector deficit) and not to raise interest rates/tighten credit conditions. Basically, it was the Fed’s responsibility to reactivate the private sector saving reflex to help finance the corporate deficit and to restrain the corporate sector from taking on too much debt.”]

In November 2001, after extensive briefing, the case was heard on the defendants’ motions to dismiss. This is a procedure under which defendants argue that even if all the facts alleged in the complaint are taken as true, the plaintiff for one legal reason or another is not entitled to any relief from the court.

On March 26, two months ago, the district judge issued a lengthy published opinion (copy available at www.zealllc.com/files/Dismissal.pdf) in which he stated the facts in some detail, including the Greenspan and Eddie George quotes, but dismissed the case on two legal grounds: first, that I lacked “antitrust standing” to bring the price fixing claims; and second, that the Treasury and Federal Reserve officials had qualified immunity from my claims based on their lack of legal or constitutional authority to manipulate gold prices.

A plaintiff in a price fixing case must not only meet the statutory requirement of injury to his business or property caused by the price fixing, but also a judicially imposed requirement that his injury be sufficiently direct, making him an “appropriate” plaintiff. Thus common shareholders in a company ordinarily lack standing to complain of price fixing in the company’s markets. The company itself is deemed a more appropriate plaintiff because it has suffered direct injury. Any injury to the shareholders is simply derivative of that to the company. On the other hand, where cash prices for copper were set by reference to prices for copper futures on the COMEX or LME, purchasers in the cash market were granted standing to sue for price fixing in the futures markets. Similarly, farmers selling soybeans in the cash market were given standing to complain of price fixing in soybean futures on the CBOT.

My Freeport gold preferred shares pay quarterly dividends equal to the cash value of a specific weight of gold based on the average London PM fix over a preceding five day period. They will be redeemed in 2006 for the cash value of one-tenth ounce of gold calculated in the same way. Because these payments are the exact equivalent of selling gold in the London market while New York is open, I argued my case should be governed by the copper and soybeans cases, not the common shareholder cases. Close, but no cigar. The judge conceded that I had a point, but ruled that a gold mining company would be a “more appropriate” plaintiff.

What may sound like an open invitation to a gold mining company to take up the cause is withdrawn by the judge’s decision on the immunity issue.

Here the judge ruled that the statutory provisions from the gold standard era granting Treasury and Federal Reserve officials authority to “deal in gold” were sufficiently elastic to give these officials reasonable grounds for believing, perhaps mistakenly, that they have authority to manipulate gold prices. In other words, the power to deal might include the power to deal from the bottom of the deck. Does it in this case? Do these officials in fact have statutory or constitutional authority to manipulate gold prices? The judge did not say. He just said they might reasonably have thought that they did.

Ordinarily questions of legal or constitutional authority are decided before the question of qualified immunity. Proceeding in this fashion, as the Supreme Court itself has noted (Wilson v. Layne, 526 U.S. 603, 609 (1999)), “promotes clarity in the legal standards for official conduct, to the benefit of both the officers and the general public.” That is, first decide whether the challenged conduct was illegal or constitutional. Then, if it was, decide whether the defendant officials are nevertheless entitled to qualified immunity because they had reasonable grounds for believing in good faith that were acting in a legal and constitutional manner even though they were not.

Accordingly, the person who brings the first case challenging specific illegal or unconstitutional conduct may lose, but by establishing its wrongfulness, he sets the necessary groundwork for future successful cases based on the same conduct. However, should a gold mining company bring a price fixing case like mine, it will lose to the same qualified immunity defense. It is a defense that cannot now be overcome except by a ruling in a prior case that Treasury and Federal Reserve officials lack authority to manipulate gold prices. Qualified immunity thus becomes absolute immunity when courts refuse to determine the legality of the underlying conduct as happened in my case.

Where does that leave us? What’s ahead? Three observations:

Power of the Internet. First, although the case was dismissed, the point was made. Even without pre-trial discovery under court procedures, the GATA army has produced ample evidence. It may never be presented in court, but much of it has been presented on the Internet. Facts speak for themselves. The allegations of the complaint are widely accepted (see, e.g., http://groups.yahoo.com/group/gata/message/1149) because all the assembled evidence permits no other reasonable conclusion. We may never know all the details, but we do know to a virtual certainty that gold prices have been officially suppressed in a major way since sometime beginning around 1995. What’s more, they have been rising steadily since the judge’s March 26 decision, hardly a vote of no confidence in the truth of the basic allegations.

Power of Gold. Second, if gold were not permanent, natural money, I would have had antitrust standing just like the copper users and the soybean farmers did. What’s more, if gold were the barbarous monetary relic that many like to claim, the G-10 central bankers would not have been so interested in rigging the gold market. Nor would they have tried to have their cake and eat it too by leasing huge amounts of gold for sale into the market rather than selling it outright.

Power of the Constitution. Third, the American Constitution is neither a technical legal document nor simply a declaration of rights. It is a plan of government. But it is not self-executing. Its power rests on the fidelity of the governed to the plan and to the wisdom that it embodies. The proof of Gladstone’s statement lies in the results, which have been pretty good when the Constitution is followed, as happens most of the time, but not so good on the few occasions when it has been seriously violated.

The nation’s greatest constitutional convulsion — the battle over slavery — came in the one area where the plan could not be perfected at the time of its adoption due to irreconcilable sectional differences. More recently, the Vietnam experience demonstrated the folly of sending an army of half a million men, mostly draftees, to fight on the other side of the world without obtaining at least the practical equivalent of what the Constitution expressly requires: a declaration of war by Congress.

At its most fundamental level, the Constitution provides for three branches of government — legislative, executive, and judicial — not four. It does not confer a separate banking power — and certainly not the power to issue unlimited amounts of paper money — on an independent central bank, let alone one that is effectively exempt from any serious judicial review. Yet in the real world, that is what exists today.

The road ahead is the road we are on — a road paved by the courts and already taken too far. It is, and it has always been, the royal road to ruin: the well-worn path which, as the framers of the Constitution knew from both history and personal experience, is traveled by all who chose government paper over gold or silver as their standard of value.