May 20, 2002. The Gold Jungle Book

The British gold auctions were announced on May 7, 1999, as gold prices rose to around $290/oz. and threatened to breach $300 due to doubts that proposed gold sales by the International Monetary Fund would proceed. The final auction took place March 5, 2002, at an allotment price of $296.50/oz. (www.bankofengland.co.uk/pressreleases/2002/027.htm). It was the highest price accepted by the British Treasury in the entire series of 17 bimonthly auctions, which resulted in the sale of some 400 tonnes at an average price of approximately $275/oz.

The British got what they wanted and what they deserved: suppressed gold prices. As pointed out in a prior commentary (Cycles of Manipulation: COMEX Option Expiration Days and BOE Auctions) with the help of a chart from Don Lindley, the British gold auctions were timed to coincide rather closely with the option expiration days for the major COMEX gold option cycles which close on the second Friday of every other month. Indeed, the auctions were so closely locked into these cycles that the British could not even take advantage of the short-lived spikes over $300 precipitated in late 1999 and early 2000 by the Washington Agreement. Instead, as Don’s chart graphically shows, each of these spikes was bracketed by auctions at sub-$300 prices.

Law of the Jungle. On March 26, three weeks after the last British auction, Judge Lindsay issued his decision dismissing the gold price fixing case. Within two days gold breached the $300 barrier, and except for three days in April, the London P.M. fix has stayed above that level ever since. Contrary to predictions that a dismissal by Judge Lindsay might be a short-term negative for gold, in fact what has transpired is the first extended rally over $300 since early 2000.

Don Lindley has provided two insightful charts depicting gold activity on the COMEX since 1995 (i.e., the price fixing period), together with gold prices over the same time frame. The first chart shows total COMEX gold open interest in tonnes by summing the open interest for futures, puts and calls, and then converting the total contract ounces to tonnes. The second details the breakdown of COMEX open interest among futures, puts and calls. As can readily be seen, changes in call volume are what drove the explosion and contraction in total open interest.

As discussed in a prior commentary (The New Dimension: Running for Cover), call options on gold or gold futures are often employed not as a bet on higher prices but to delta hedge short sales. In this sense, calls are ammunition for short sales and bear raids. In a falling market, they provide easy premiums for call writers and cheap insurance for call buyers, thereby reinforcing the trend and making it a friend to both sides of these transactions. So it is hardly surprising that with the announcement of the British auctions in May 1999, call open interest began to explode, peaking just after announcement of the Washington Agreement.

In 2000, call options collapsed to their 1995-96 levels, recovering slightly in the first half of 2001. In a recent update of his study on preemptive selling in COMEX gold (Upon Further Review), Mike Bolser shows that the last episode of preemptive selling in excess of two standard deviations occurred in the first quarter of 2001, coinciding with the last bottom for gold. In May 2001, right around the date of the GATA conference in Durban, South Africa, the gold price spiked upward as call volume began another leg down. Since the GATA spike, gold has continued to rally and call volume has declined to around half of 1995-96 levels. This year, futures open interest has exceeded call open interest for the first time since early 1996.

More than One Way to Skin a Lion. In an 1848 speech to the House of Commons, Lord Palmerston laid down a fundamental principle of sound foreign policy: “We have no eternal allies and we have no perpetual enemies. Our interests are eternal and perpetual, and those interests it is our duty to follow.” While it is unclear what British interests were advanced by its gold auctions, it is quite clear that the interests of South Africa, the world’s largest gold producer, were severely hurt.

At the GATA conference in Durban, more than one attendee raised the possibility of South African government support for the gold price fixing case. But as suggested in a prior commentary (South African Gold: Still Prey for the British Lion), South Africa is quite capable of defending its own interests in the gold market without help from the American courts. One of the most intriguing questions emerging from the gold rally since the GATA spike is whether South Africa is undertaking to challenge the gold market machinations of the British imperial lion and the G-10 pride.

South African gold producers were late to adopt forward selling programs, but eventually bowed to advisors like Jessica Cross (see Jessica Double-Cross Study Puts Q(uisling).E.D. on the WGC) and “encouragement” from the South African Reserve Bank, where her husband, James Cross, was a top official. Mr. Cross retired from the Reserve Bank at the beginning of this year reportedly for health reasons.

AngloGold (www.anglogold.com), which currently produces around 400 tonnes annually, is South Africa’s largest producer. It is also second only to Barrick Gold as the largest (by volume) forward seller (see prior commentary, Hidden Faces of Modern Imperialism: AngloGold, Barrick and the BIS). In a press interview on January 28, 2002 (copy of Bloomberg release at http://groups.yahoo.com/group/gata/message/984), an AngloGold spokesman indicated that it had cut 3.5 million ounces from its hedge position in the prior year. On April 10 (copy of Reuters release at http://groups.yahoo.com/group/gata/message/1076), AngloGold announced that it was “aggressively” running down its hedge book. The story continued:

Though the company gave no details, saying only that it was taking advantage of market conditions, June gold accelerated a mild morning ounce back above the $300 an ounce level around which it has consolidated recent gains all week. The active contract ended up $3, or 1 percent, at $302.50, trading from $298.10 to $302.90. Estimated volume was a moderate 31,000 contracts.”That last thrust up to $302.90 was all on the back of that. They came out, and I guess it was the way they phrased it,” said a floor broker. Spot gold was quoted at 301.00/50, up from the close Tuesday at $298.10/60. The afternoon London fix was $298.

When AngloGold released its 2002 first quarter results on April 30, CEO Bobby Godsell stated (http://biz.yahoo.com/iw/020430/041383.html):

In the context of the firmer price, we have continued to actively manage our hedge book and increase exposure to the spot price. In this quarter we have reduced the book by a further 1.7 million ounces (or 120% of this quarter’s production), and we have also eliminated the low-price rand gold forward contracts in the book for the remainder of this year. Whereas at December 31, 2001 we had 60% of our forecast 2002 gold production sold forward, today we have only 32% of the remainder of this year’s anticipated production sold forward.

Soon afterwards, he gave a very upbeat forecast for gold prices in an interview with South Africa’s Moneyweb (www.moneyweb.co.za; see http://groups.yahoo.com/group/gata/message/1094).

By itself, AngloGold’s change of tack on forward selling is a major development. But what is perhaps even more noteworthy is its apparent use of this information to affect market prices, and especially to hold them over $300 on April 10. Normally any company trying to shrink its hedge book — not to mention an industry leader like AngloGold — would take silent advantage of market pull backs, not publicly try to thwart them. What is more, in this particular case the announcement merely previewed what CEO Godsell would say more formally at a scheduled event three weeks hence.

For years central banks have held gold under the $300 level by pre-announcements or threats of gold sales, thereby depressing prices for the very metal they proposed to sell. Now AngloGold appears to have used the same tactic in reverse: announcement of purchases to hold gold over $300, thereby increasing the cost of closing its hedges. When things are this upside down, or downside up, it’s at least a good bet that governments are pulling some of the strings.

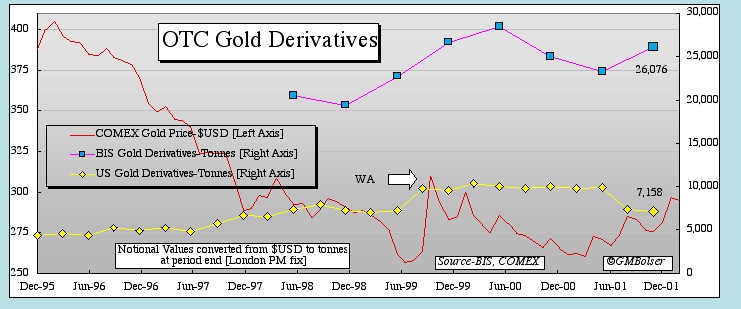

Famine Strikes the Pride. Open interest on the COMEX is analogous to notional values of over-the-counter derivatives. Mike Bolser has provided a chart depicting changes in the total notional values of gold derivatives as reported semi-annually by the Bank for International Settlements for major banks and dealers in the G-10 countries and quarterly by the Office of the Comptroller of the Currency for U.S. commercial banks.

Like total COMEX open interest for gold futures, puts and calls, OTC gold derivatives have traced a pattern of growth and contraction. However, the retrenchment in OTC derivatives since 1999 has been far less pronounced. Surprisingly, the most recent figures from the BIS (see www.bis.org/press/p020515.htm) show that total gold derivatives on the books of G-10 banks and dealers actually grew in the last half of 2001, from a notional value of $203 billion to $231 billion.

This figure supports two inferences. First, the third and fourth quarter reductions reported by the OCC in the gold derivatives of J.P. Morgan Chase and Citibank, respectively, likely represent transfers to non-commercial bank entities that do not report to the OCC. See Current Comments at Gold Regression Charts. Second, because it covers only commercial banks, the OCC is failing to pick up very significant volumes of gold derivatives on the books of other major players such as Goldman Sachs and American International Group. See, e.g., D. Gleason, “$300 m hedging fracas in court,” Miningweb (May 15, 2002) (www.mips1.net/MGGold.nsf/Current/4225685F0043D1B242256BBA00422E3D?OpenDocument).

As Jim Sinclair has pointed out (see, e.g., The Madness of Gold Producer Hedging at Le Metropole Cafe), OTC derivatives are neither as liquid as COMEX contracts nor subject to clearing house regulations, making OTC positions more difficult to exit and substantially increasing the risk of counterparty failure. See, e.g., T. Wood, “Newmont’s dire hedging prediction comes true,” Miningweb (May 15, 2002) (www.mips1.net/MGGold.nsf/Current/4225685F0043D1B285256BBA0080A180?OpenDocument; T. Wood, “Hedgers wipe out more than 1- billion,” Miningweb (May 17, 2002) www.mips1.net/MGFin.nsf/Current/4225685F0043D37A85256BBD0009E398?OpenDocument. In the same vein, the year-end 2001 figures on gold derivatives at UBS and Deutsche Bank provide a telling comparison, particularly in light of the recent figures from the BIS.

The total notional value of UBS’s gold derivatives continued to decline in 2001, from CHF118.6 billion at end 1999, to CHF92.5 billion at end 2000, to CHF72 billion at the end of last year. See 2001 annual report available at www.ubs.com. In both 2000 and 2001, nearly all the reductions were in options, where UBS was heavily weighted (80% of total gold derivatives at end 2000, 75% at end 2001), rather than in forwards. The Swiss National Bank continued its program of gold sales in 2001, but took management of the sales away from the BIS. A fair inference is that the BIS was channeling too much of this gold to suppressing gold prices and not enough to helping UBS reduce its exposure to gold derivatives.

At Deutsche Bank, on the other hand, while gold derivatives declined from E50.9 billion in notional value at end 1999 to E39.6 billion at end 2000, they rose to E41.6 billion at end 2001. See 2001 annual report available at http://group.deutsche-bank.de/ghp/index_e.htm. Recent statements from the Bundesbank have raised the possibility of future gold sales to improve management of its reserves, perhaps by buying equities. Another fair inference: Deutsche Bank is unable to pay back the gold it has borrowed from Buba, which reportedly lends its gold only to German banks.

The BIS, in addition to its regular semiannual statistics on derivatives in the G-10 countries, publishes a triennial survey of derivatives on the books of banks and dealers in almost 50 countries. As of June 2001 (see www.bis.org/press/p020318.htm), the total notional value of gold derivatives in this larger universe had grown to $278 billion from $228 billion three years earlier. At $300/oz., $278 billion equates to nearly 29,000 tonnes, or almost as much as total reported central bank gold reserves.

Two acknowledged gold experts of frequently contrary views, Jim Sinclair and Mitsui’s Andy Smith, have recently pegged total hedging by gold producers at around 3000 tonnes. Gold Fields Minerals Services (see www.gfms.co.uk, April 24, 2002, Official Sector press release) claims that total central bank gold lending decreased to 4651 tonnes in 2001 from 4815 tonnes at the end of 2000. This reduction is hard to square with either the absolute size of total gold derivatives reported by the BIS or their increase in last half of 2001.

Since June 1998, forwards and swaps have comprised on average around 45% of the total gold derivatives reported in the BIS’s G-10 surveys. Applying this percentage to 29,000 tonnes yields total gold forwards and swaps of 13,000 tonnes in mid-2001. (The BIS tries to eliminate double counting of transactions in which reporting entities are on both sides.) This figure, which excludes all options, falls within the range of central bank lending estimated by Frank Veneroso last May in his presentation at GATA’s conference in Durban.

Thus, assuming that all 3000 tonnes of producer hedging consists of forward contracts and that all options reported by the BIS could be settled in cash rather than metal, outstanding forwards and swaps on the books of bullion banks and dealers appear to exceed new mine production committed to them by some 10,000 tonnes, or approximately four years of new mine supply. Under these circumstances, banks and dealers are unlikely to permit producers to reduce forward contracts calling for payment in gold other than by delivery of metal itself.

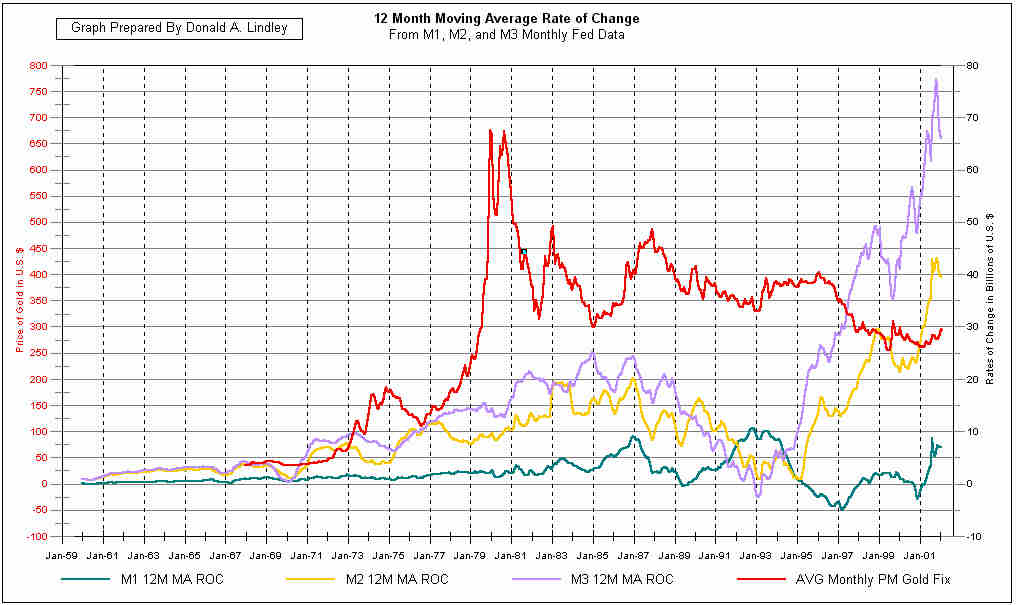

Beware of Elephants. Don Lindley offers another duo of graphs in possible explanation of gold’s recent strength. The first tracks the U.S. debt ceiling minus the debt, and indicates that gold has mounted powerful rallies over the past decade whenever this measure turned negative, as it is today. The second, which charts the debt limit against various measures of the money supply, shows U.S. debt and the two broader measures of money moving together. It implies that a rather substantial increase in the debt ceiling is now necessary to restore the normal equilibrium between government debt and M-2 and M-3 as well as to allow further growth in these two aggregates.

The United States is claimant to the world’s largest hoard of gold: more than 8000 tonnes of official reserves. As discussed in a prior commentary (Judicial Holding Pattern: Giving the Defendants Plenty of Rope), nearly all of this gold is reported to be in “deep storage” by the U.S. Mint. What this new classification means is anyone’s guess. Suspicions exists that it may refer not to .9999 gold in the vaults of the largest elephant in the gold jungle, but to the proven and probable reserves of a company run by an Oliphant.

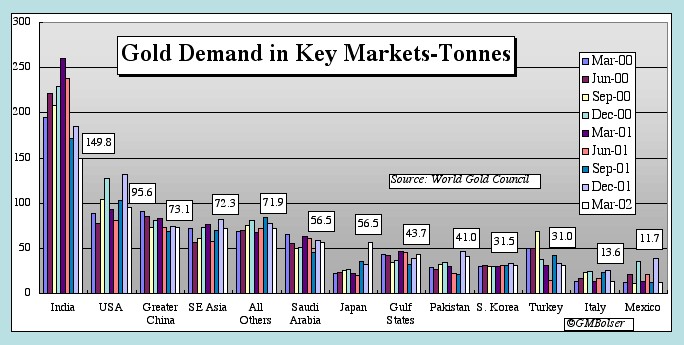

In the chart above, Mike Bolser provides a visual summary of gold demand in key markets as tracked by the World Gold Council. The white bars and boxes show the demand figures just released by the WGC for the first quarter of 2002. See www.gold.org/finalgold/gold/Gedt/Gdt39/Press.htm; see also Gold Regression Charts. Of special note, chronic banking problems in the world’s second largest national economy seem finally to have whetted the Japanese appetite for gold.

Among the hungriest elephants with a taste for gold are the world’s two most populous nations, India and China. The former absorbs roughly an additional 800 tonnes of gold annually. The latter is in the process of liberalizing its gold market to meet popular demand. With over $200 billion in foreign exchange reserves, China is also reported to be adding to its gold reserves. See, e.g., B. Haynes, “Not All Central Bank Activity Negative,” January 28, 2002, at www.gold-eagle.com/editorials_02/haynes012802.html. Starving lions and hungry elephants competing for limited physical supplies should make the gold jungle an exciting place in the months ahead.

Patriot Plays Tarzan. The laws of the jungle as laid down in The Jungle Books by Rudyard Kipling do not give much guidance in the gold jungle, where creatures with ordinary intelligence and common sense must deal with politicians as well as each other. Yet every jungle needs a Tarzan, swinging from spot to spot, sounding a distinctive yell, saving those in distress, and generally setting right some of the wrongs common in any Hobbesian scene. Bill Murphy — once split end for the old Boston Patriots of the American Football League, now proprietor of Le Metropole Cafe and chairman of GATA — is Tarzan of the gold jungle. Some of his best advice to those who want to survive in this dangerous environment is summed up in a bit of Kipling doggerel:

And the epitaph drear: “A fool lies here who tried to hustle the East.”

“The Naulakha” (ch. 5, heading, 1892)

April 19, 2002. Motion Denied: Raise the Union Jack over Boston’s Federal Courthouse

On the evening of December 16, 1773, the Sons of Liberty, unconvincingly disguised as Mohawk Indians, held the Boston Tea Party. The American Revolution opened at Lexington and Concord on April 19, 1775, and within eleven months the British were driven from Boston. All of Massachusetts celebrates Patriots Day, now on the third Monday of April, also the date of the Boston Marathon. Two additional holidays honoring the Revolution are celebrated in Suffolk County (Boston, Chelsea, Revere and Winthrop). Bunker Hill Day marks the war’s first major battle, fought June 17, 1775, mostly on neighboring Breed’s Hill. Evacuation Day, which is also St. Patrick’s Day, commemorates the departure of the British for Halifax, Nova Scotia, on March 17, 1776, after their fleet and positions came under attack from artillery brought overland from Fort Ticonderoga by Colonel Henry Knox in the middle of winter and secretly placed on Dorchester Heights the night of March 4-5, the eve of the sixth anniversary of the Boston Massacre.

So far as I am aware, from that day until today, no British official has ever received judicial clearance to act adversely toward the personal property in Massachusetts of one of its citizens, let alone to do so without the injured citizen having recourse to the American courts. But today, at the new federal judicial palace on the shores of Boston Harbor, Judge Lindsay denied my motion to amend judgment without hearing and without opinion. Sir Edward George, Governor of the Bank of England, along with his fellow directors of the Bank for International Settlements, including two officials of the Federal Reserve, have thus gotten away with their illegal “mandatory share redemption” at one-half of admitted net asset value. No American jury will be allowed to decide whether the BIS breached the terms of its contract with the holders of its American issue, or whether these shareholders ever agreed to arbitrate any such dispute at the Hague or elsewhere.

Even worse, by refusing to clarify whether the “power to deal” in gold includes the power secretly to manipulate the free market price of gold, Judge Lindsay has in effect decreed that the power to deal — at least when given to U.S. government officials — includes the power to deal from the bottom of the deck. When this sort of conduct is tolerated at the highest levels of the U.S. Treasury and the Federal Reserve, no one should be surprised at an Enron or an Arthur Andersen.

Since the United States and certain of its officials are parties, I have sixty days within which to file a notice of appeal, or until June 18, the day after Bunker Hill Day. Whether to file an appeal is a question that I will consider over the intervening weeks, during which I plan to write and publish several commentaries on the fundamental legal and constitutional questions that are at issue. Indeed, these questions are of such transcendent importance, and the federal courts have in recent years so irrevocably compromised their independence under the Judicial Compensation Clause, that the only useful and potentially effective appeal on any issues involving gold and the monetary provisions of the Constitution probably must be to the people of the United States and to future historians.

April 8, 2002. The Battle Ahead: Truth and Justice in the Gold Market

Since Judge Lindsay issued his decision on March 26, I have received numerous e-mails — far too many to answer individually. So this commentary is by way of grateful response to all these messages. Without exception but in different ways, all were supportive. Many assumed that the case is over. Others expressed hope that it is not. A retired U.S. Navy submariner sent me a copy of his April 2 e-mail to James Turk: “Since Quitters never Win, and Winners never Quit, I doubt that Reg will ‘roll over and play dead.'”

The motion and memorandum filed on April 4 should lay to rest any fears that the GATA army will be easily defeated. They know, as do I, that at heart we are fighting for something more precious than gold: the Constitution and the rule of law itself.

A Dutch citizen, writing in French, quoted the father of her country, William the Silent (1533-1584), Prince of Orange: “Point n’est besoin d’espérer pour entreprendre, ni de réussir pour persévérer.” [C’est un petit défi pour mon français, mais ma traduction: “No need for hope to get started, nor for success to persevere.”] Americans in general, and my family in particular, are in debt to the Prince of Orange, who founded the Netherlands on the principle of religious freedom and as a Calvinist sanctuary amidst the turmoil of the Reformation. After the Orangists broke the siege of Leyden and defeated the Spanish in 1574, William honored the courage of the city’s citizens by establishing a university there. Within a generation, the University of Leyden became one of Europe’s leading academic centers.

Persecuted in England, many early Puritans fled to Holland, including our Pilgrim Fathers, who during most of the Twelve Years Truce (1609-1621) lived in Leyden. In chapter 33 Of Plymouth Plantation, Governor Bradford recounts how their elder, William Brewster, who had received some university training at Cambridge, taught English to Dutch and other students with great success, “for he drew rules to learn it by after the Latin manner.” He also arranged the publication of “many books which would not be allowed to be printed in England.” Sailing on the Mayflower in 1620, the good reverend was among the first of my ancestors to arrive in the New World. (My mother, a Virginian, never misses an opportunity to point out that with more precise navigation or better luck, the Pilgrims would have landed where they intended, in warmer Jamestown, established in 1607.)

The Mayflower was just one of many small ships that ferried various Protestant sects from Europe’s religious wars to America’s beckoning shores. None of these groups had greater influence on the development of law and constitutional government in the rising American nation than the Puritans of Massachusetts Bay. As described by John F. Kennedy in Profiles in Courage:

The Puritan loved liberty and he loved the law; he had a genius for determining the precise point where the rights of the state and the rights of the individual could be reconciled. The intellect of the Puritan — of John Quincy Adams and his forebears — was, as [Senator] George Frisbie Hoar has said: “fit for exact ethical discussion, clear in seeing general truths, active, unresting, fond of inquiry and debate, but penetrated and restrained by a shrewd common sense. … He had a tenacity of purpose, a lofty and inflexible courage, an unbending will, which never qualified or flinched before human antagonist, or before exile, torture, or death.”

Ten years before the Revolution, in an essay provoked by the Stamp Act and entitled A Dissertation on the Canon and the Feudal Law, John Adams wrote that “liberty must at all hazards be supported.” He continued (D. McCullough, John Adams (Simon & Schuster, 2001), p. 60):

And liberty cannot be preserved without a general knowledge among the people who have a right from the frame of their nature to knowledge, as their great Creator who does nothing in vain, has given them understandings and a desire to know. But besides this, they have an indisputable, unalienable, indefeasible divine right to the most dreaded and envied kind of knowledge, I mean of the characters and conduct of their rulers. [Emphasis supplied.]

Whatever else he may have done, Judge Lindsay did not minimize the factual allegations of the complaint. He did not say that if proven, they were insufficient to establish price fixing. Instead, he republished them in considerable detail, including: Alan Greenspan’s statement on gold lending by central banks to control the price; Eddie George’s admission of cooperating with the Fed and other central banks to suppress gold prices in the wake of the Washington Agreement; Mike Bolser’s statistics on preemptive selling of gold on the COMEX as well as other evidence of manipulative practices on that exchange by the defendant bullion banks; and evidence of gold price fixing contained in various government reports, both those relating to official activities and to the changes in the gold derivatives of the bullion banks.

The larger message contained in these allegations is that American officials have preached free market principles to the world while subverting them at home, that they have condemned crony capitalism abroad while practicing it here.

Acknowledging that I had standing under the constitutional test of “injury-in-fact, causation, and redressability,” and that judicial decisions imposing stricter requirements for standing in antitrust cases did not “compel a particular result” in my case, Judge Lindsay nevertheless held that I did not have standing to assert price fixing claims under the Sherman Act, largely because there are supposedly better potential plaintiffs: gold mining companies, central banks not involved in the gold price fixing scheme, or private investors in the physical gold market. Left unclear is why Congress reauthorized gold clauses like that contained in my Freeport-McMoran gold preferred shares but did not intend to confer on the beneficiaries of these clauses protection under the Sherman Act against the manipulation of gold prices.

The usual and best plaintiff in a price fixing scheme like that alleged in the complaint is not a civil litigant at all, but the United States proceeding under a criminal indictment. All the evidence cited by Judge Lindsay was in the possession of the Department of Justice on May 10, 2001, when Melvin Lubinski, an attorney with the New York office of the Antitrust Division, wrote to Mason O’Keiff, a GATA supporter:

At this time, the Antitrust Division of the United States Department of Justice does not intend to open an investigation of the alleged manipulation of gold prices because the direct evidence of collusion by officers and employees of the bullion banks is insufficient to warrant investigation. Also, the alleged price fixing in the gold market is already under litigation in the United States District Court for the District of Massachusetts in Boston. Moreover, two of the defendants in that case, Alan Greenspan, Chairman of the Federal Reserve, and Lawrence H. Summers, former Secretary of the Treasury, are represented by the Office of the United States Attorney for the District of Massachusetts, which is also part of the United States Department of Justice.

Judge Lindsay’s decision of March 26 may have given the gold cabal temporary shelter from the law, but it was at best a pyrrhic victory for the Department of Justice. Its job is to defend the Constitution and laws of the United States, not errant officials trying to get around them. A few more such victories and the Department of Justice will have evolved into the Department of Selective Justice, and in the process reestablished the need for a new Special Prosecutor law.

“JUSTICE IS BUT TRUTH IN ACTION.” When the future Justice Brandeis used these words, now inscribed in the lobby of Boston’s new federal courthouse, he meant to emphasize the fact-finding role of the courts in the pursuit of justice. As noted in a prior commentary, the quotation itself was not original with Brandeis, but drawn from French philosophy and experience. Yet Brandeis had a point in making it specific to American courts. Justice may be truth in action in a philosophical sense, but truth in action brings legal justice only when the action is in the courts, when it enforces the principle that no person is above the law, and no official above the Constitution.

The gold cabal may escape legal justice. But these perverters of law cannot forever escape the justice of the market place. In the fifteen months since the complaint was filed, aided by additional evidence uncovered by GATA, most acute observers of the gold market have come to accept that the price fixing allegations are true.

Richard Russell has been watching markets and writing about them almost since the day he returned from World War II service in bombers over Europe. His Dow Theory Letters is among the oldest and most successful investment letters. Last Friday, he reviewed the bullish factors affecting gold, concluding:

Against all the above, of course, is the position of the central banks. Precious metals, real intrinsic money, is outside the system — and the central banks want to control the system and they want to own the system. Therefore, the central banks will do everything in their power to protect their monopoly over the world’s money, and in my opinion that includes manipulation of the precious metals market, particularly the gold market.

As gold approaches the 300 dollar level, I believe the battle is on. The central banks (who have been selling gold) do not want gold above 300 dollars an ounce. And they will do everything in their power to keep gold below 300 dollars an ounce. As I said, the battle is on … .

The central banks will lose this battle. Exactly when, none can say. Don Lindley’s updated graphs of money supply growth, reproduced at the end of this commentary, suggest that judgment day for Alan Greenspan and his Federal Reserve is not far away. (For earlier versions of these graphs, see U.S. Money Growth: Words Unnecessary.) With the dirty secret of their manipulative activities exposed, the central banks are no longer an unseen enemy and their manipulations will be correspondingly less effective. Thus recent statements from the Bundesbank that it may sell gold to buy equities, and endorsement of this nutty idea by the European Central Bank, were quickly seen for what they were: transparent attempts to keep gold prices under $300/oz.

The federal courts can shield Mr. Greenspan from the law and the Constitution. They cannot shield him from the verdict of history, which will peg him as the most destructive monetary charlatan since John Law.

March 27, 2002. Judge Lindsay Dismisses BIS Case

By a memorandum and order dated March 26, 2002, Judge Lindsay entered a judgment of dismissal in Reginald H. Howe v. Bank for International Settlements et al., United States District Court for the District of Massachusetts, Civil Action No. 00-12485-RCL. The 38-page opinion is available at the following URL: http://pacer.mad.uscourts.gov/recentopinions.html. Scroll down to: howe memorandum and order.pdf.