MPEG COMMENTARY - Page BA

May 8, 2002. Mike Bolser Further Updates His Study of Gold Manipulation on the COMEX

Upon Further Review: Preemptive Selling -- 1985 through March 2002 This commentary will update my COMEX gold preemptive selling series through March 2002. The non-random character of the conspicuous, high standard deviation preemptive selling events will also be described in some additional detail.

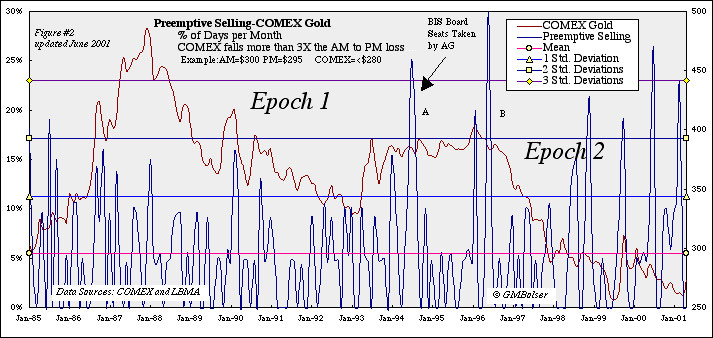

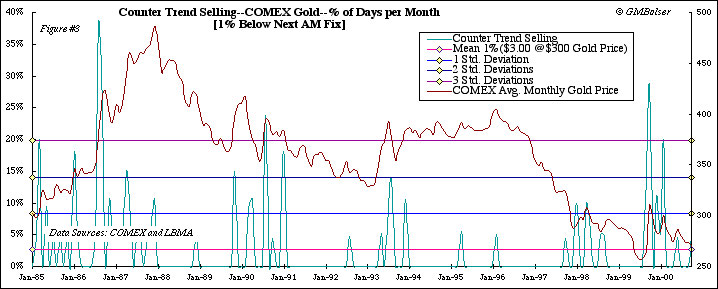

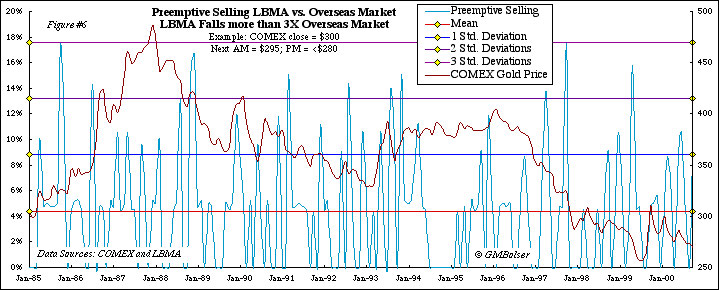

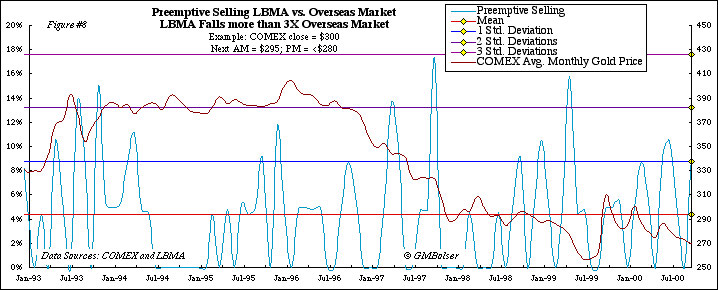

Recall that preemptive selling, which is a fraud detection algorithm, measures very aggressive COMEX gold market selling when compared to the London gold market (LBMA). Figure 1 displays the percentage of days per month in which the COMEX gold price falls 300% more than the London gold price. The probability of changing macroeconomics being the cause for such extreme New York price drops is highly diminished because the two markets trade the same commodity on the same day. Preemptive selling should not be confused with price volatility or rate of change, which are measures of rapid price fluctuation. In addition, preemptive selling is a measure of relative activity between two markets. Recall also that it does not measure the volume of comparative selling, only its effect as measured by gold market prices.

Figure 1 Figure 1 displays the preemptive selling record from 1993 through March 2002. Note the labeled spikes and their associated standard deviation values. (More on standard deviation below.) We can see also from figure 1 that the mean or average level of preemptive selling is shown by a red horizontal line that falls near the 5% of days-per-month point (left scale). Each standard deviation upward is represented by another, equally spaced horizontal line. The fourth standard deviation is shown with a dotted line near 28% of days per month. The price of gold is indicated with a yellow line with its 240 day moving average affixed in black.

The numbered spikes are correlations to other gold-related events as follows: (1) Federal Reserve assumes two board seats at Bank for International Settlements; (2) steadily rising gold price threatens to pierce $400; (3) important change downward in the long-term gold price; (4) failure of Long-Term Capital Management, reportedly involved in the gold carry trade; (5) Washington Agreement provokes sharp rise in gold prices; and (6) Canadian Imperial Bank of Commerce works to resolve Ashanti hedge book failure.

Looking at the detailed trace in figure 1, we see that preemptive selling was quiescent from May 2001 until December 2001, when it rose to significant levels. At this writing, the gold market shows signs of upward instability.

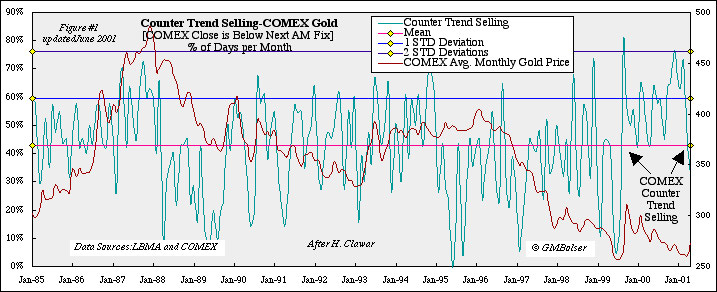

Figure 2 Figure 2 shows the full interval from 1985 through January 2002. The series has been divided into two epochs by the clustering of extreme preemptive selling events in epoch 2 and the absence of these extreme events in epoch 1. The demarcation between epochs appears to be the election of President Clinton. Each spike above 2 standard deviations is a rare, independent event. A cluster of such events encountered in a fifteen year plus series is even more extreme as their respective low probabilities must be multiplied to obtain the cluster's aggregate probability.

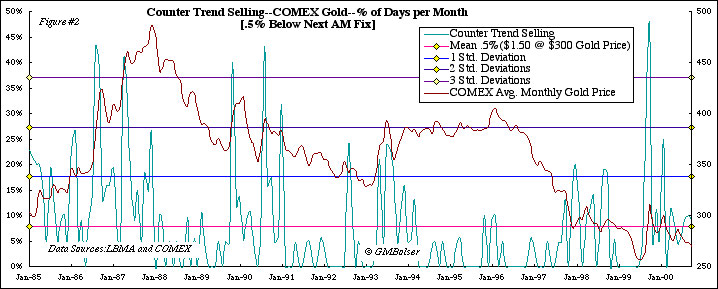

Figure 3 The updated counter-trend selling series is seen in figure 3. Counter-trend selling is defined as the London AM fix closing higher than the COMEX previous day's close. It represents selling against "overseas buying" as defined by Dr. Harry Clawar (www.gold-eagle.com/editorials_01/clawar020201.html). The very long, above-the-mean, counter-trend selling has abated somewhat. However, it remains persistently higher than random trading would suggest. Another way to regard the counter-trend selling at the COMEX is to think of it as strong overseas buying which is consistently met with COMEX selling. Clawar, a statistics professor, had this to say at the above link:

The pattern of selling down NY spot following an overseas gain is 3 times as likely as buying on top of that gain. Even though overall, losses in New York are more likely to occur than gains, they are MUCH more probable if there has been an overseas gain. This is a highly likely combination of patterns if the goal is to keep the price of gold low.

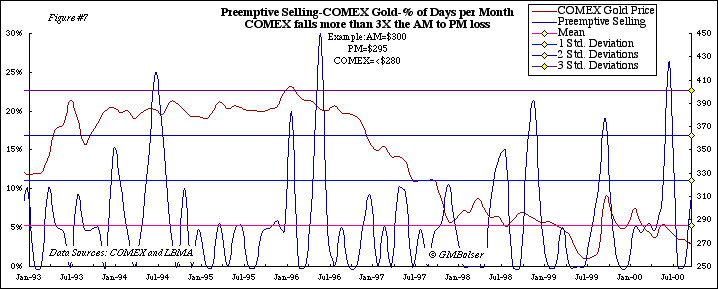

June 1996: Once in 1,538 Years In past reports, I have referred to the June 1996 preemptive selling event as a four standard deviation event. Upon further review, it measures 4.22 standard deviations. Let us examine more closely the implications of these high standard deviation preemptive selling episodes.

We are all familiar with the idea of a bell-shaped distribution of, say, human height. Some people are tall (falling to the right on the curve), some are short (falling to the left), but most are "average" (falling in the middle of the curve). The shape of such a population resembles a bell, thus the term "bell shaped curve." In school many of us anxiously encountered the phrase "grading on a curve." With rare exceptions, it is the same phenomenon for any randomly distributed population. If preemptive selling truly were a random process, then its distribution must also be a bell shaped curve.

Figure 4 Figure 4 shows the rightmost portion (as if the bell had been vertically split) of what is known as a Gaussian distribution, a bell shaped curve of probabilities. The centermost portion of the "bell" is located at the mean or 1.0 on the horizontal axis. The other "half" (left) of the curve is not shown. The total universe of probabilities is equal to 1 (the total area under both halves of the bell-shaped-curve). The further one goes to the right, the smaller the remaining area and therefore the smaller the probability. Note how the standard deviation increases further out to the right. In very low probability events, one is limited to a tiny portion of the area under the bell-shaped cure. For example, a 1.0% probability means that 99% of the available chances (or in the case of preemptive selling, dates) are excluded.

The June 1996 preemptive selling event was a truly remarkable occurrence. According to chance, the Gaussian formula (inset in figure 4) reveals it would have been expected to happen only once in 18,450 months of trading or only once in 1,538 years of COMEX trading. The fact that this event happened within a cluster of other high standard deviation preemptive selling events further reduces, in a substantial manner, the already vanishing probability that the epoch 2 group of preemptive selling episodes is a natural phenomenon that just somehow happened "out of the blue." This is the basis of my original conclusion that these gold-negative, preemptive selling events could not have been the result of random market forces.

Michael Bolser

2215 Summit View Drive

Valrico, Florida 33594May 2, 2002

The writer wishes to thank Bill Murphy, the Gold Anti-Trust Action Committee, Don Lindley and Reg Howe for their kind assistance.

June 18, 2001. Guest Article: Mike Bolser Updates His Study of Gold Manipulation on the COMEX

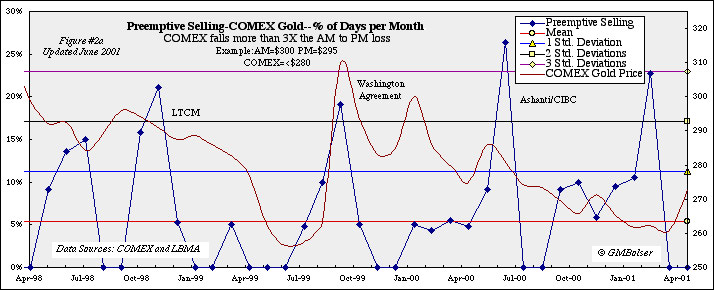

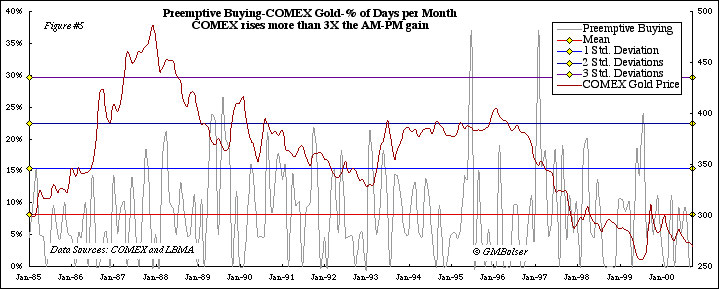

Preemptive Selling in COMEX Gold: An Update By Michael Bolser This article updates an earlier study, Anomalous Selling in COMEX Gold 1985 to November 2000, which I published in late 2000. It validated Dr. Harry Clawar's earlier findings of consistent, predictable COMEX selling against a rising overseas market component. Dr. Clawar has since published updated conclusions, which reveal that in four out of five trading days over a one-year period the COMEX closed lower than the London AM fix. My earlier study utilized the concept of preemptive selling, a condition that occurs when the dominant forces on the COMEX sell gold three times lower than the same day's decline on London market.

The World Gold Markets

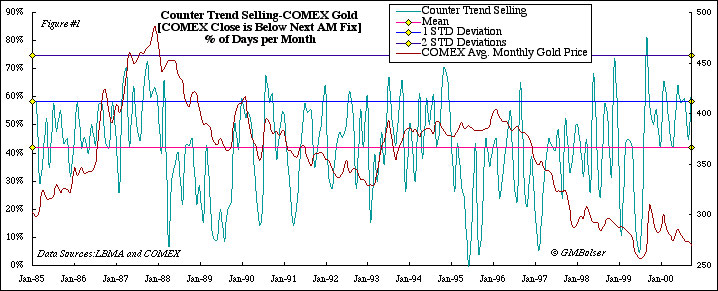

Counter Trend Selling Updated Dr. Clawar's counter trend COMEX selling tests the hypothesis that the COMEX gold market can be predicted to close below the next morning's London AM fix. Predictable market behavior such as this represents abnormal and biased operations. Figure #1 below shows the updated series from 1985 through May 2001. Note that for over a year counter trend selling has stayed above the mean, indicating a sustained selling effort by the dominant forces on the COMEX. This selling continues to be predictable and runs counter to the activity in the overseas component of the gold markets.

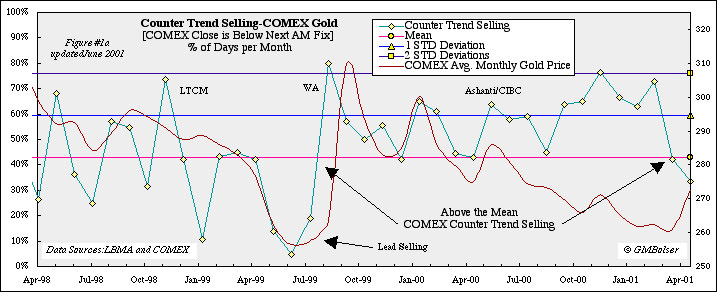

Figure #1 Figure #1a below presents an expanded resolution timeline. Note the drop in counter trend activity just prior to the Washington Agreement (WA) in September 1999. During that period gold exhibited horizontal pricing. Perhaps the implied intervention was no longer necessary. Then, late in September 1999, the rally in gold prices triggered by the WA called forth a far more aggressive intervention, resulting in a large spike in counter trend activity, which has persisted at high levels almost to the present.

Figure #1a Preemptive Selling Updated By testing a relative condition between the COMEX and the London Bullion Market, preemptive selling is more sensitive at detecting trading patterns and their degree than a simple yes/no test. Figure #2 below is an updated and annotated chart from Anomalous Selling in COMEX Gold 1985 to November 2000. The series has been divided into two falling gold price epochs in order to highlight one of that study's several control mechanisms. The temporal resolution units are months. In a freely traded market, selling events in one price declining epoch should be similar to selling events in other price declining epochs. The original conclusion of clustered, anomalous selling behavior stands.

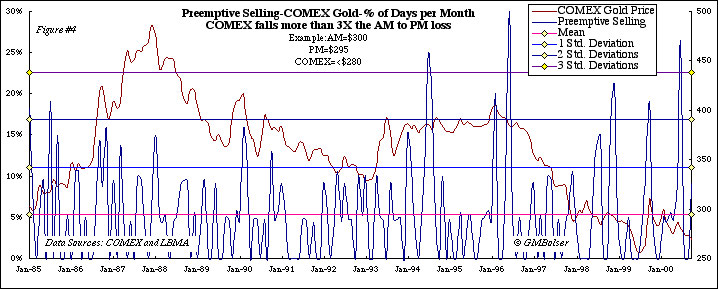

Figure #2 Figure #2 shows that extreme selling events have continued into the present year. The March 2001 event touches the three standard deviation ceiling. These three standard deviation selling events would be expected to happen only once in 83 years of COMEX trading (1,000 periods). In Epoch 1, there are no selling events which exceed two standard deviations. Epoch 2 contains seven such events. Event B, a four standard deviation selling event, would be expected to happen at random only once in 833 years of COMEX activity (10,000 periods). The implications of such an event are ominous. These extreme selling events started during the Clinton Administration. Perhaps not coincidentally, Event A occurred right around the time that the Federal Reserve, after a lapse of 64 years, assumed the two American seats on the board of the Bank of International Settlements. This aggressive selling effort nevertheless only affected the price of gold in a minimal way. Event B was necessary to break the resilience of the gold market, which thereafter fell into a major multi-year decline.

Figure #2a Figure #2a above gives an expanded time line from April 1998 to today, including annotations relating the over two standard deviation preemptive selling events to related market events. As yet there are no obvious market events to associate with the March 2001 spike. However, at least until very recently, counter trend selling has remained remarkably high around this March preemptive selling event. Perhaps more effort has been required to suppress the price of gold than in prior periods.

Conclusion These updated figures show a continuation of the abnormal COMEX gold trading pattern that began in 1994, including another in a series of high standard deviation selling events. These extreme selling episodes did not happen prior to 1994. The updated figures also validate for the first part of 2001 Dr. Clawar's observation that the COMEX gold market follows a predictable pattern of selling against a rising overseas price component. Such a market trading pattern cannot be regarded as random. The recent slight reduction in counter trend selling below the mean should be watched. It could indicate the beginning of a significant change in trend.

G. Michael Bolser

Valrico, Florida

June 15, 2001The author wishes to thank the Gold Anti-Trust Action Committee, Bill Murphy, Reg Howe and Don Lindley for their kind assistance.

© Copyright November 2000 No reproduction of this material is allowed without written permission from the author.

December 6, 2000. Guest Article: Evidence of Gold Manipulation on the COMEX

Mike Bolser was introduced to readers of The Golden Sextant in a prior commentary on October 8, 2000, Charting the Gold Markets: Regressing to ?. He is the analyst who has been working with the proprietor to produce the special section containing regression charts on certain parts of the gold market. Now he has outdone himself with the following article that should be of great interest to anyone with an interest the gold market.

Anomalous Selling in COMEX Gold, 1985 to November 2000 By Michael Bolser