November 27, 2002. Arbitration Tribunal Awards Additional Compensation to Former BIS Shareholders

The Bank for International Settlements may have dodged justice at the hands of the U.S. federal courts in New York and Boston, but it did not escape altogether. In a decision released November 22, 2002 (www.pca-cpa.org/PDF/BIS%20Award%20final%202.pdf), the Arbitration Tribunal established at the Hague to hear disputes involving the BIS ruled that the Bank employed an improper valuation methodology in connection with its compulsory withdrawal in January 2001 of all privately held shares of its American, Belgian and French issues. At that time, the Bank paid SwF16,000 per share (approx. US$9280 at the then exchange rate) based on a valuation prepared by J.P. Morgan and a supporting fairness opinion by Arthur Andersen.

In rejecting the Bank’s valuation, the Tribunal ruled (at paragraph 209) that the former private shareholders should receive “a proportionate share of the Net Asset Value of the Bank, discounted by 30%,” and that for this purpose, the Bank’s NAV is SwF33,820 (or US$19,034 at the exchange rate used in the decision), plus the appraised value of the Bank’s real estate. In adopting the 30% discount rate rather than the discount rate in excess of 50% employed by J.P. Morgan, the Tribunal stated (at paragraph 201): “[T]he most telling evidence in favor of a discount of 30% is the consistent use of it by the Bank in pricing shares issued to new central banks.”

The Tribunal has retained jurisdiction to determine the valuation of the Bank’s real estate, the exact per share amount remaining due to former shareholders (including interest thereon), the final allocation of costs of the arbitration, and certain other minor issues. Accordingly, if the former shareholders’ proportionate share of the Bank’s real estate is sufficient to cover the costs of the arbitration, they should receive an additional payment of over SwF7674 per share (well in excess of US$5000 at recent exchange rates). Indeed, given the rise in gold prices, it may be open to the claimants to argue for an even higher valuation based on the Swiss gold franc, the Bank’s official unit of account in which it has always priced new shares issued to central banks.

The three claimants in the arbitration were Dr. Horst Reineccius, of Germany, Mr. Pierre Mathieu and la Société Hippique de La Châtre, of France, and First Eagle SoGen Funds, Inc., of the United States, represented by Debevoise & Plympton (John H. Hall and Donald Francis Donovan). First Eagle’s gold fund, managed by Jean-Marie Eveillard, was the largest private shareholder in the Bank. In connection with the arbitration, the Bank stipulated that it would pay to all former private shareholders any additional per share amount awarded to the named claimants, and has confirmed this undertaking in its press release (www.bis.org/press/p021125.htm) on the Tribunal’s decision. All former shareholders, I expect, are as grateful as I for the good work of the named claimants and their counsel.

September 6, 2002. Randy Randite OutLaw: Another Perspective on Alan Greenspan

Stickler that he is for accuracy, my colleague Bob Landis is troubled by some recent analogies equating Alan Greenspan to John Law. In a new essay posted today, Alan Greenspan Is No John Law, Bob marshals considerable scholarly support for his position that such comparisons can be overdrawn and frequently do an injustice to Law. As one of his targeted offenders, I must confess that his point appears well-taken. Indeed, comparing Greenspan to Law seems rather like calling a mouse a rat. But mouse though he may be from the perspective of world monetary history, in the present monetary environment, Chairman Greenspan may well prove — albeit unintentionally as Bob suggests — a mouse that roared.

Actually, I have never regarded John Law’s Mississippi bubble as the most apt historical analogy to the present monetary situation, which strikes me as much closer in its most salient characteristics to the experiment in paper money that attended the French Revolution some sixty years after Law’s bubble. The period of the French assignats is perhaps best described in Andrew Dickson White’s classic essay, Fiat Money Inflation in France, first publicly read to an audience of senators and members of the House of Representatives from both political parties on April 12, 1876, in Washington, D.C. In 1912, at the request of a Canadian businessman, White revised and enlarged the essay for private publication, and since then it has been republished several times, including a 1980 edition available from the Cato Institute (www.cato.org).

An authority on the French Revolution, White not only founded and became the first president of Cornell University but also served in several important diplomatic posts. In 1876, he wrote with a purpose: to bring the hard lessons of France’s disastrous experience with paper money to bear on the debate about returning the United States to the gold standard after the Civil War. Historical analogies are never perfect, but as Santayana’s dictum warns: “Those who cannot remember the past are condemned to repeat it.” Each of the three chapters in White’s extraordinary essay makes a point worth pondering today even if much of the damage has already been done.

From chapter 1, “How It Came:”

But the current toward paper money had become irresistible. It was constantly urged, and with a great show of force, that if any nation could safely issue it, France was now that nation; that she was fully warned by her severe experiences under John Law; that she was now a constitutional government, controlled by an enlightened, patriotic people — not, as in the days of the former issues of paper money, an absolute monarchy controlled by politicians and adventurers; that she was able to secure every livre of her paper money by a virtual mortgage on a landed domain vastly greater in value than the entire issue; that, with men like Bailly, Mirabeau, and Necker at her head, she could not commit the financial mistakes and crimes from which France had suffered under John Law, the Regent Duke of Orleans, and Cardinal Dubois.

From chapter 2, “What It Brought:”

All this vast chapter in financial folly is sometimes referred to as if it resulted from the direct action of men utterly unskilled in finance. This is a grave error. That wild schemers and dreamers took a leading part in setting the fiat money system going is true; that speculators and interested financiers made it worse is also true; but the men who had charge of French finance during the Reign of Terror and who made these experiments, which seem to us so monstrous, in order to rescue themselves and their country from the flood which was sweeping everything to financial ruin were universally recognized as among the most skillful and honest financiers in Europe. Cambon, especially, ranked then and ranks now as among the most expert in any period. The disastrous results of all this courage and ability in the attempt to stand against the deluge of paper money show how powerless are the most skillful masters of finance to stem the tide of fiat money calamity when once it is fairly under headway; and how useless are all enactments which they can devise against the underlying laws of nature.

From chapter 3, “How It Ended:”

Just as dependent on the law of cause and effect was the moral development. Out of the inflation of prices grew a speculating class; and, in the complete uncertainty as to the future, all business became a game of chance, and all businessmen, gamblers. In city centers came a quick growth of stockjobbers and speculators; and these set a debasing fashion in business which spread to the remotest parts of the country. Instead of satisfaction with legitimate profits, came a passion for inordinate gains. Then, too, as values became more and more uncertain, there was no longer any motive for care or economy, but every motive for immediate expenditure and present enjoyment. So came upon the nation the obliteration of thrift. In this mania for yielding to present enjoyment rather than providing for future comfort were the seeds of new growths of wretchedness: luxury, senseless and extravagant, set in. This, too, spread as a fashion. To feed it, there came cheatery in the nation at large and corruption among officials and persons holding trusts. …

Thus was the history of France logically developed in obedience to natural laws; such has, to a greater or less degree, always been the result of irredeemable paper, created according to the whim or interest of legislative assemblies rather than based upon standards of value permanent in their nature and agreed upon throughout the entire world. Such, we may fairly expect, will always be the result of them until the fiat of the Almighty shall evolve laws in the universe radically different from those which at present obtain.

And also from chapter 3, in summary:

And, finally, as to the general development of the theory and practice which all this history records: my subject has been Fiat Money Inflation in France: how it came; what it brought; and how it ended.

It came by seeking a remedy for a comparatively small evil in an evil infinitely more dangerous. To cure a disease temporary in its character, a corrosive poison was administered, which ate out the vitals of French prosperity.

It progressed according to a law in social physics which we may call the “law of accelerating issue and depreciation.” It was comparatively easy to refrain from the first issue; it was exceedingly difficult to refrain from the second; to refrain from the third and those following was practically impossible.

It brought, as we have seen, commerce and manufactures, the mercantile interest, the agricultural interest, to ruin. It brought on these the same destruction which would come to a Hollander opening the dikes of the sea to irrigate his garden in a dry summer.

It ended in the complete financial, moral, and political prostration of France — a prostration from which only a Napoleon could raise it.

August 9, 2002. Barton Biggs: Weekend Gold Worm

Barton M. Biggs, Morgan Stanley’s well-known global investment strategist, put out a research note on July 16, 2002, making an investment case for gold. See T. Wood, Morgan Stanley “name” backs gold, The Miningweb (July 18, 2002). Under the heading “The True Believer,” Biggs admits: “[A] horse I have never believed in is gold, for all the conventional reasons, but now I am changing what’s left of my mind.” He continues: “I think there is a plausible case that a professionally managed portfolio consisting of the metal itself and gold shares could realize returns of 15% real per annum in the difficult environment ahead. Here is the story.”

The story, as it turns out, is that Biggs has an old friend, Peter F. Palmedo of Sun Valley Gold, who is a “true believer” in gold. Biggs’ research note is essentially a summary of Palmedo’s recent report: “Gold 2002: Can the Investment Consensus Be Wrong?” This report is available online from links provided at the bottom of T. Wood, The seminal gold analysis is in, The Miningweb (July 19, 2002).

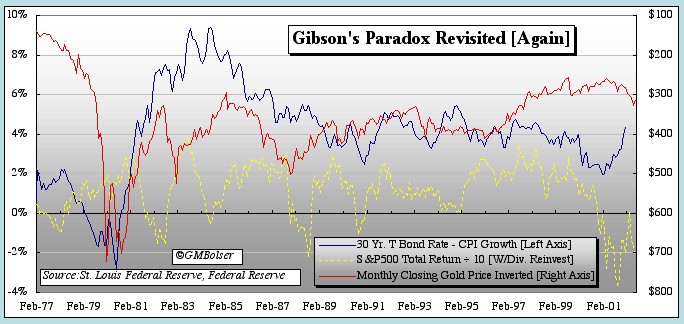

Palmedo builds on the 1988 article co-authored by future U.S. treasury secretary and then Harvard economics professor Lawrence H. Summers and Robert B. Barsky, “Gibson’s Paradox and the Gold Standard,” Journal of Political Economy (vol. 96, June 1988, pp. 528-550) (available online at www.gata.org/gibson.pdf), and discussed at length in my prior commentary Gibson’s Paradox Revisited: Professor Summers Analyzes Gold Prices.

Palmedo is nothing if not a good salesman. Biggs, describing the Summers-Barsky paper as “too dense a thicket for me,” accepted Palmedo’s interpretation unquestioningly. The Miningweb’s Tim Wood gushed:

[M]oney manager cum braniac Peter Palmedo will be lionized for making gold the most respectable subject in daily institutional investment conferences.

We’re away from retread explanations of gold as a one-dimensional safe haven from terror, plague and famine, the more hysterical chants about dark conspiratorial manipulation in the vaults of the NY Fed are receding, and the deflationary-Fed drumbeat of supply-side doyen Jude Wanniski is less impressive.

Written in a calm tone reflecting rock-ribbed confidence, Palmedo’s analysis starts with the famously infamous “Summers-Barsky Gold Thesis” published in the Journal of Political Economy (June 1988). The research by Lawrence Summers, former Clinton Treasury Secretary and current Harvard President, attracted a lot of attention as one of the key exhibits in Reg Howe’s impudent effort to sue Alan Greenspan and other luminaries from the finance-treasury complex for cooking the gold price.

Where Howe and his supporters at the Gold Anti-Trust Action Committee saw the thesis as a blueprint for a cabal to rig markets and the dollar in a devilishly clever way, Palmedo saw fine scholarship.

In fact, Palmedo saw quite a bit that wasn’t there, starting with his basic assertion: “These two highly regarded researchers conclude, based on two hundred years of empirical data, that the relative price of gold is driven by (and is the reciprocal of) the real return from capital markets” [emphasis in original]. Lord Keynes gave the name “Gibson’s paradox” to the close correlation between interest rates on British consols and the general price level observed during the gold standard era. Studying the period from 1973 to 1984, Summers and Barsky conclude (at 548):

The price level under the gold standard behaved in a fashion very similar to the way the reciprocal of the relative price of gold evolves today. Data from recent years indicate that changes in long-term real interest rates are indeed associated with movements in the relative price of gold in the opposite direction and that this effect is a dominant feature of gold price fluctuations.

Thus, according to Barsky and Summers, Gibson’s paradox is not solely a gold standard phenomenon, but also manifests itself in a free market for gold, where gold prices will move inversely to real long-term interest rates, falling when rates rise and rising when they fall. To the extent that Summers and Barsky looked at equities, they used “stock yield data … [to] argue that Gibson’s paradox involved the underlying real rate of return, and not merely the nominal yield on nominal assets” (at 530). Thus they “examine[d] both earnings/price and dividend/price ratios [because] [b]oth should be proxies for long-term required real returns” (at 537).

Neither Gibson’s paradox nor Summers and Barsky posit any relationship between gold prices and total returns on equities, whether real or nominal, especially where capital gains rather than earnings or dividends are the principal measure of return. Nevertheless, Palmedo asserts: “This relationship [of gold prices] to the capital market real return (and particularly to the movement of the stock market) has proven stunningly consistent since [the Summers and Barsky] paper was written.”

As the following chart by Mike Bolser demonstrates, there is no observable long-term correlation between the annualized total return for the S&P 500 calculated on a monthly basis and either inverted gold prices or real long-term interest rates. For this purpose, Mike has calculated the return on the S&P 500 each month by taking the absolute change in the index over the prior twelve months, positive or negative, adding cumulative dividends over the same period, then dividing by the starting value of the index, and finally dividing by ten in order to plot on the same scale as interest rates. Thus a 20% positive return on the S&P is plotted the same as a 2% real interest rate. The return on the S&P 500 has not been adjusted for inflation, which in any event would have had relatively little impact on the rate of return given its wide swings often exceeding plus or minus 20%.

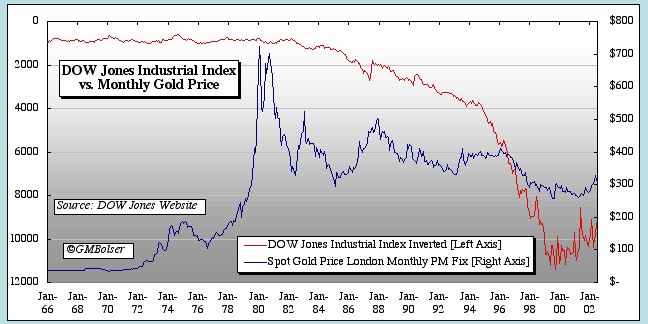

Of course, the “movement of the stock market” is not precisely equivalent to the monthly annualized return on stocks. Biggs includes as Exhibit 1 in his research note a chart headed “Gold and the Dow – A Natural Aversion” depicting “Weekly Gold Spot vs. Inverted Dow Jones Index” from 1996 to 2002. At my request, Mike Bolser has created essentially the same chart but covering the period from 1966 to 2002. Because of the different time spans, the scales for the both gold prices and the Dow cover a greater range in Mike’s chart, where the Dow starts at around 1000 versus 5500 in Biggs’ chart and gold reaches from $35 to over $700 versus a range of $240 to $420 for Biggs. Yet it is easy to see from Mike’s chart that taking the period from 1996 to 2002 and adjusting the scale would yield a pretty close correlation between gold and the inverted Dow, just as Biggs’ chart showed. The problem is that the same cannot be said for the period prior to 1996.

Taking Mike’s two charts together, the period since about 1995 is characterized by a breakdown in the long-term correlation described by Gibson’s paradox while at the same time the Dow and gold prices are moving in a close inverse relationship that is unusual. Gibson’s paradox operates in a free market for gold just as it did under the classical gold standard because both regimes are free market mechanisms. What will defeat Gibson’s paradox under either regime, as Summers and Barsky point out, is government interference, whether with the free flow of gold under the gold standard or with its the free market price since the demise of the Bretton Woods system.

According to Palmedo: “Statistically speaking, the stock market explains 72% of the monthly price movement of gold over the past 14 years and 88% of the weekly price movement over the last eight years.” Even assuming that his statistics are sound, there is nothing in Gibson’s paradox to support the causal relationship that he asserts. The argument that Gibson’s paradox does support is that beginning around 1995, government interference with free market gold prices permitted real long-term interest rates to fall to artificially low levels, and these low rates contributed to the stock market boom — or, more accurately, bubble — that is now unwinding. Correct as his bottom line investment advice may be, Palmedo’s analysis has validity only to the extent that it is the Dow/Gold ratio in drag. See The Dow/Gold Ratio and the International Monetary Order.

What is more, just as The Miningweb consigns them to near irrelevance, “the vaults of the NY Fed” have produced an interesting development that bears close watching over the next couple of months. Paragraphs 2 and 3 of Plaintiff’s Second Affidavit in the gold price fixing case summarize the outflows of foreign earmarked gold from the N.Y. Fed through June 2001 as reported monthly in table 3.13 of the Federal Reserve Bulletin. As shown in the following chart by Don Lindley, the pattern of steady outflows in excess of 50 tonnes per month that started in September 2000 ended in June 2001. From then through March 2002 there was virtually no change in the amount of foreign earmarked gold at the N.Y. Fed. However, in both April and May, the most recent months for which there is data (Federal Reserve Bulletin, July 2002, table 3.13), the outflow resumed at a rate of 5 tonnes each month, barely enough to register on Don’s chart. Whether these new outflows represent a last few drops that can be squeezed from increasingly reluctant central banks or the start of new, more significant monthly outflows to come remains to be seen. Meanwhile, those who believe that what happens in the vaults of the N.Y. Fed has little to with gold prices might consider why in recent years gold prices have tended to rise whenever these outflows have turned flat.

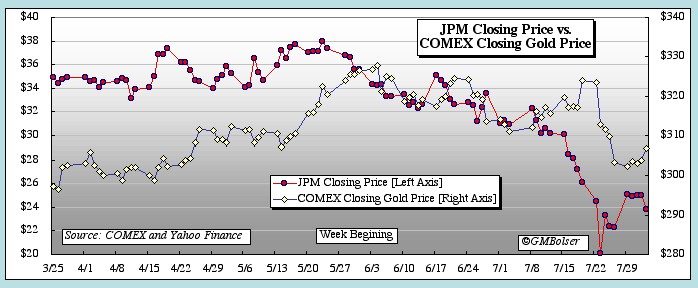

As a gold bug, Biggs never progressed beyond the larval stage. On Monday, July 22, less than a week after issuing his panegyric to Palmedo, Biggs went on CNBC to aver that he really knew nothing about gold and to imply that his favorable comments about it the previous week should be disregarded. It’s a safe bet that his employer didn’t like them either. Near the end of June, I learned from a quite reliable source, later confirmed by a second, that Morgan Stanley had emerged as “the new sheriff in town that keeps a lid on the gold market” in New York. (Note: Because Morgan Stanley is an investment bank, its gold and other derivatives do not appear in the OCC’s reports, and unlike Goldman Sachs, it had not previously been visibly active in suppressing gold prices on the COMEX. Thus, although aware of information suggesting that it was member of the cabal, I did not have sufficient grounds to name Morgan Stanley as a defendant in the gold price fixing case.)

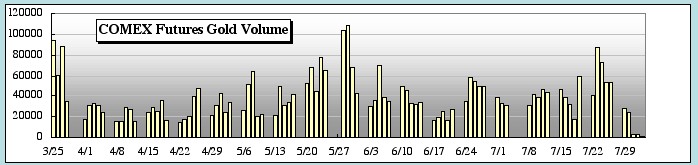

Working overtime for this commentary, Mike Bolser has provided a chart of the daily closing spot gold prices on the COMEX since Judge Lindsay’s decision dismissing the gold price fixing case, together with a related bar chart of COMEX daily gold futures volumes over the same period. The price chart also plots the daily closing prices of J.P. Morgan Chase (NYSE: JPM), which as can be seen in the Plaintiff’s Second Affidavit is the American Goliath of gold and interest rate derivatives. As the price chart shows, gold prices climbed steadily from just under $300/oz. on March 26, the date of the decision, to almost $330 by the beginning of June. Since then, in both mid-June and mid-July, gold made two more runs at the $330 barrier, only to be beaten back on heavy volume and amid reports of official selling.

Prior to this past June, the last time gold made a serious run at $330 was during the sharp rally in gold prices triggered by the Washington Agreement in the fall of 1999, all as recounted at paragraph 55 of the Complaint in the gold price fixing case filed in December 2000:

The fifth wave of preemptive selling in excess of two standard deviations occurred in response to this rally as the Fed, the Bank of England and the BIS struggled to halt and reverse it. According to reliable reports received by the plaintiff, this effort was later described by Edward A. J. George, Governor of the Bank of England and a director of the BIS, to Nicholas J. Morrell, Chief Executive of Lonmin Plc:

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The U.S. Fed was very active in getting the gold price down. So was the U.K.

What the market seems to be saying now is what Eddie George was saying then: gold prices over $330 will collapse the heavily exposed bullion banks, starting with J.P. Morgan Chase. See M. Goldstein, Bank Derivatives Back on Radar, TheStreet.com (August 2, 2002). Indeed, given their enormous absolute and relative size, the gold and interest rate derivatives of J.P. Morgan Chase cannot be reasonably explained except as a Fed-endorsed operation carried out through its traditional bank. See W. Greider, Secrets of the Temple (Simon & Schuster, 1989), p.269.

In this context, Barton Biggs’ July 16 clarion call to investors to consider the merits of gold could not have come at a worse time for the gold price fixing cabal. Gold prices were rising again toward $330 while JPM’s stock price was falling into the mid-20’s from the high 30’s as recently as late May. Royal Bank of Canada, one of that country’s leading financial institutions, was still wiping golden egg from its face after publicly disassociating itself from an improvidently published internal report by one its senior officials endorsing point-by-point the principal evidentiary allegations of the gold price fixing case. See “‘Conspiracy Theory’ Gains New Credibility at www.nationalinvestor.com/leaked_gold_report_reveals_troub.htm; see also http://groups.yahoo.com/group/gata/message/1149; http://groups.yahoo.com/group/gata/message/1153.

Stories on this contretemps dated June 22 to 25, 2002, from The Globe and Mail (Toronto) and South China Morning Post are reprinted at: http://groups.yahoo.com/group/gata/message/1154; http://groups.yahoo.com/group/gata/message/1157; and http://groups.yahoo.com/group/gata/message/1158.

During the week that began with Biggs aborting his gold call, gold prices were hammered back to near $300 even as JPM’s stock price fell to around $20 before recovering slightly at week’s end. Palmedo’s “seminal analysis” may give comfort to those investors in gold who crave respectability over truth; it does little to explain the fierce battle whenever gold prices approach $330. Real gold bugs can handle the truth and will sting for it. “Impudent” is among the milder adjectives typically applied to them, as any member of the GATA army can readily attest. Pseudo gold bugs might bite a little, but not enough seriously to offend the powers that be. And gold worms, well, they just roll over.