(RHH Commentary, August 13, 2001)

Due in no small measure to articles he wrote as a young economist, especially his 1966 essay “Gold and Economic Freedom” (reprinted in A. Rand, Capitalism: The Unknown Ideal, available online at www.gold-eagle.com/greenspan041998.html), Fed chairman Alan Greenspan is widely recognized as quite an authority on gold. Far less widely known are professional articles on gold by another young economist who also went on to serve until quite recently in some of the nation’s top economic policy positions.

Not long before joining the new Clinton administration as undersecretary of the treasury for international affairs, Harvard president and former treasury secretary Lawrence H. Summers, then Nathaniel Ropes professor of political economy at Harvard, co-authored with Robert B. Barsky an article entitled “Gibson’s Paradox and the Gold Standard” published in the Journal of Political Economy (vol. 96, June 1988, pp. 528-550), available online at www.gata.org/gibson.pdf. The article, which appears to draw heavily on a 1985 working paper of the same title by the same authors, is an excellent technical piece, revealing a high level of expertise regarding gold, gold mining, and the interconnections among gold prices, interest rates, and inflation.

Indeed, for any administration concerned that the bond vigilantes on Wall Street might thwart its economic policies by pushing up long-term rates at inopportune times, the article is must reading and qualifies its authors as attractive candidates for government service. Of even more interest looking at the Clinton administration retrospectively, the article provides strong theoretical evidence that since 1995 gold prices have not acted as would normally be expected in a genuine free market, but instead have behaved as if subject to what the authors describe as “government pegging operations.”

Lord Keynes gave the name “Gibson’s paradox” to the correlation between interest rates and the general price level observed during the period of the classical gold standard. It was, he said, “one of the most completely established empirical facts in the whole field of quantitative economics.” J.M. Keynes, A Treatise on Money (Macmillan, 1930), vol. 2, p.198. And it was a paradox because contemporary monetary theory, largely associated with Irving Fisher, suggested that interest rates should move with the rate of change in prices, i.e., the inflation rate or expected inflation rate, rather than the price level itself. Yet when Keynes wrote, data for the prior two centuries showed that the yield on British consols (government securities issued at a fixed rate of interest but with no redemption date) had moved in close correlation with wholesale prices but almost no correlation to the inflation rate.

Economists have long tried to find a theoretical explanation for Gibson’s paradox. Professors Summers and Barsky provide the following executive summary of their contribution to this debate (at 528):

A shock that raises the underlying real rate of return in the economy reduces the equilibrium relative price of gold and, with the nominal price of gold pegged by the authorities, must raise the price level. The mechanism involves the allocation of gold between monetary and nonmonetary uses. Our explanation helps to resolve some important anomalies in previous work and is supported by empirical evidence along a number of dimensions.

They begin their article with an examination (at 530-539) of the data supporting the existence of Gibson’s paradox, concluding that it was “primarily a gold standard phenomenon” (at 530) that applies to real rates of return. Regression analysis of the classical gold standard period, 1821-1913, shows a close correlation between long-term interest rates and the general price level. The correlation is not as strong for the pre-Napoleonic era, 1730-1796, when Britain effectively adhered to the gold standard but many other nations did not, and “completely breaks down during the Napoleonic war period of 1797-1820, when the gold standard was abandoned” (at 534).

Nor is the evidence of Gibson’s paradox as strong for the period of the interwar gold exchange standard, 1921-1938, which was marked by active central bank management and restrictions on gold convertibility. Following World War II, the correlation weakened substantially under the Bretton Woods system, and “[t]he complete disappearance of Gibson’s paradox by the early 1970s coincides with the final break with gold at that time” (at 535).

With the nominal price of gold fixed, Barsky and Summers note (at 529) that “the general price level is the reciprocal of the price of gold in terms of goods. Determination of the general price level then amounts to the microeconomic problem of determining the relative price of gold.” For this, they develop a simple model (at 539-543) that assumes full convertibility between gold and dollars at a fixed parity, fully flexible prices for goods and services, and fixed exchange rates.

Next, they examine the response of the model to changes in the available real rate of return. In this connection, they observe (at 539): “Gold is a highly durable asset, and thus … it is the demand for the existing stock, as opposed to the new flow, that must be modeled. The willingness to hold the stock of gold depends on the rate of return available on alternative assets.” With respect to the gold stock, the model distinguishes between bank reserves (monetary gold under the gold standard) and nonmonetary gold, principally jewelry.

Summarizing the mathematical formulas of the model, Barsky and Summers make two key points. The first (at 540):

The price level may rise or fall over time depending on how the stock of gold, the dividend function [formulaic abbreviation omitted] and the demand for money [formulaic abbreviation omitted] evolve over time. Secular increases in the demand for monetary and nonmonetary gold caused by rising income levels tend to create an upward drift in the real price of gold, that is secular deflation. Tending to offset this effect would be gold discoveries and technological innovations in mining such as the cyanide process.

And the second (at 542):

The economic mechanism is clear. Increases in real interest rates raise the carrying cost of nonmonetary gold, reducing the demand for it. They also reduce the demand for monetary gold as long as money demand is interest elastic. The resulting reduction in the real price of gold is equivalent to an increase in the general price level.

Because the model is “essentially a theory of the relative price of gold,” Barsky and Summers postulate (at 543) that “an important test of the model is to see how well it accounts for movements in the relative price of gold (and other metals) outside the context of the gold standard.” They continue (id.):

The properties of the inverse relative prices of metals today ought to be similar to the properties of the general price level during the gold standard years. We focus on the period from 1973 to the present, after the gold market was sufficiently free from government pegging operations and from limitations on private trading for there to be a genuine “market” price of gold.

And they conclude (at 548):

The price level under the gold standard behaved in a fashion very similar to the way the reciprocal of the relative price of gold evolves today. Data from recent years indicate that changes in long-term real interest rates are indeed associated with movements in the relative price of gold in the opposite direction and that this effect is a dominant feature of gold price fluctuations.

In other words, the bottom line of their analysis is that gold prices in a free market should move inversely to real interest rates. Under the gold standard, higher prices meant that an ounce of gold purchased fewer goods, i.e., the relative price of gold fell. Since under the Gibson paradox long-term interest rates moved with the general price level, the relative price of gold moved inversely to long-term rates. Assuming, as Barsky and Summers assert, that the Gibson paradox operates in a truly free gold market as it did under the gold standard, gold prices will move inversely to real long-term rates, falling when rates rise and rising when they fall.

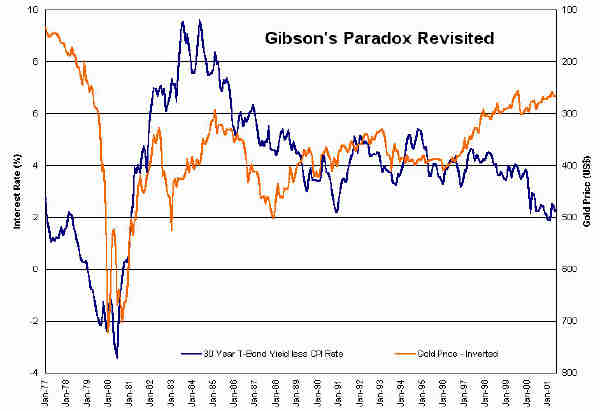

To test this proposition, particularly for the period after 1984 not covered by Barsky and Summers in their 1988 article, Nick Laird has constructed the following chart at my request. Nick is the proprietor of www.sharelynx.net, which offers an excellent collection of charts relating to gold and financial matters, and I am most grateful for his assistance. The chart plots average monthly gold prices on the inverted right scale, i.e., higher prices at the bottom. Real long-term rates are plotted on the left scale. They are defined as the 30-year U.S. Treasury bond yield minus the annualized increase in the Consumer Price Index (calculated as the sum of the monthly CPI increases for the preceding twelve months).

As the chart shows, Gibson’s paradox continued to operate for another decade after the period covered by Barsky and Summers. But sometime around 1995, real long-term interest rates and inverted gold prices began a period of sharp and increasing divergence that has continued to the present time. During this period, as real rates have declined from the 4% level to near 2%, gold prices have fallen from $400/oz. to around $270 rather than rising toward the $500 level as Gibson’s paradox and the model of it constructed by Barsky and Summers indicates they should have.

The historical evidence adduced by Barsky and Summers leaves but one explanation for this breakdown in the operation of Gibson’s paradox: what they call “government pegging operations” working on the price of gold. What is more, this same evidence also demonstrates that absent this governmental interference in the free market for gold, falling real rates would have led to rising gold prices which, in today’s world of unlimited fiat money, would have been taken as a warning of future inflation and likely triggered an early reversal of the decline in real long-term rates.

Other analysts have noted the inverse relationship between real rates and gold prices. An interesting and informative recent article along these lines is Adam Hamilton’s Real Rates and Gold, which makes reference to a 1993 Federal Reserve study containing the following statement: “The Fed’s attempts to stimulate the economy during the 1970s through what amounted to a policy of extremely low real interest rates led to steadily rising inflation that was finally checked at great cost during the 1980s.”

The low real long-term interest rates of the past few years may have been engineered with far more sophistication than those of a generation ago, including the coordinated and heavy use of both gold and interest rate derivatives. By demonstrating that falling real long-term rates will lead to rising gold prices absent government interference in the gold market, Barsky and Summers underscore the futility of trying to control the former without also controlling the latter. But they do not provide a model for successful long-term suppression of gold prices in the face of continued low real rates.

What they do indicate (at 548), however, is that their model of Gibson’s paradox accords only a “minimal role [to] new gold discoveries” and fails to account fully for shifts between monetary and nonmonetary gold. As they note (at 546-548), the fraction of the total gold stock held in nonmonetary form during the gold standard era was substantial, perhaps exceeding one-half, and the fraction varied over time. Also (at 548), “the post-1896 rise in prices, after more than two decades of deflation, is usually attributed to gold discoveries in combination with the development of the cyanide process for extraction.”

Accordingly, they conclude (at 548-549) that their “proposed resolution of the Gibson paradox cannot be the whole answer” and that determination of “the quantitative importance of the mechanism in this paper would require better methods for proxying movements in the stocks of monetary and nonmonetary gold, and this might be an appropriate topic for further research.” The unusual and sharp divergence of real long-term interest rates from inverted gold prices that began in 1995 suggests that Mr. Summers found an opportunity to do some further applied research on these matters during his tenure at the Treasury.

Both the heavy use of forward selling by mining companies and the World Gold Council’s obsession with promoting gold as jewelry to the near exclusion of its historic monetary role appear designed to exploit the conceded points of vulnerability in the operation of the model. Viewed in this light, these two novel and distinguishing features of the post-1995 gold market appear less accidental and more as the handmaidens of the government price-fixing operations that the model reveals.

At the time of his appointment, Professor Summers was the youngest tenured professor in Harvard’s modern history. On Friday, October 12, 2001, in outdoor ceremonies in Tercentenary Theatre, he will be formally installed as its 27th president, entrusted with the job of leading the nation’s oldest university — where “Veritas” is the motto — into the new millennium. Three days earlier, in Courtroom No. 11 of the new U.S. Courthouse on Boston Harbor, the search for the truth about his interim service in the highest positions at the U.S. Treasury will resume.

Judge Lindsay has scheduled a hearing on the defendants’ motions to dismiss for Tuesday, October 9, at 3:30 p.m. The underlying issue in that proceeding is whether the Constitution and laws of the United States may be enforced in a federal court action challenging the authority of Mr. Summers and other American officials, working at least in part through the Bank for International Settlements, to conduct the surreptitious and illegal gold price-fixing operations exposed even by his own academic research.