April 29, 2005. Gold and Deflation Revisited

One of the heartiest weeds in the garden of contemporary gold commentary is the inflation hedge theory of gold. Bob Landis takes aim at the latest sighting in his new essay, Gold and Deflation: A Dissenting Dissection.

December 7, 2004. New Essay by Reg Howe

To serious students of our paper-based monetary system, discerning both its future -- a collapse -- and its past -- the gold standard -- are relatively straightforward. Plotting our present position in this unfolding Greek tragedy is a far more difficult matter. The central banks charged with administering the global monetary system have done their best to obscure its parlous state, and to penetrate the wall of official deceit is a daunting task.

Unearthing new data and reassessing old data, Reg Howe shows in Déjà Vu: Central Banks at the Abyss that the stewards of our monetary system, by systematically betraying their trust, have brought us to the end of the line. The parallels with the collapse of Bretton Woods a generation ago are striking, down to the emergence of a counterpart for Jacques Rueff, this time in the unlikely form of a Russian central banker.

But as Reg notes, the pending collapse of the dollar standard presents an opportunity, not just a crisis. Somewhere along the way -- we would argue 1913, but others might choose 1934 or 1971 -- the United States strayed from the path charted by the Founding Fathers. Now the republic has morphed into an empire, the very antithesis of what they envisioned. The end of the current monetary system will present us with the challenge and the opportunity of finding our way home.

August 23, 2004. New Essay by Bob Landis and a Note on Argentina

New Essay. In the process of founding the deeply flawed body of economic thought that carries his name, Lord Keynes delivered more than a few perceptive and prescient observations on economic phenomena. Among the more well-known is this passage from The Economic Consequences of the Peace (1919), ch. 6:

Lenin was right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

No authoritative census of U.S. gold bugs exists, but if it did, it would almost certainly include a rather large roster of Keynes's "one man in a million." Today these are the folks who truly understand how the U.S. Federal Reserve System operates and why that system, particularly as it has developed since President Nixon closed the gold window in August 1971, poses a clear and present danger to the nation's future. Those aspiring to membership in this exclusive club may find useful insights in a new essay by Bob Landis, Fiat's Reprieve: Saving the System, 1979-1987.

This essay addresses questions gold bugs seldom ask. Why were the gold bugs of a generation ago so wrong in their predictions, detailed at length in the Report of the U.S. Gold Commission, of an imminent monetary crisis unless their sound money recommendations were adopted? Could today's gold bugs be just as wrong? Can the existing dollar-based international monetary system continue to muddle along, as it has now for more than thirty years, or is it merely enjoying a reprieve stemming from unique factors and circumstances? Bob's essay concludes:

With respect to the form the denouement will take, much has been written within the gold community on the subject of whether we face hyperinflation or deflationary depression as the prelude to monetary collapse. Both sides of the debate appear to accept the premise that whatever may transpire will bear a linear relationship to what now exists. The disagreement centers on the direction the line will go. But today's markets are fully linked by derivatives and technology, and they are patrolled by wolf packs of large, leveraged speculators not noted for their patient outlook. So it seems likely that the terminal monetary crisis will unfold on virtually an instantaneous and discontinuous basis, once the fog of statistical deceit and false market cues begins to lift and a clear trend either way becomes evident. We are not likely to enjoy the luxury of observing either a deflation or an inflation unfold in the fullness of time, but rather, just as Mises foretold, a final and total catastrophe of our fiat monetary system. All we can hope is that once the curtain falls on the current system, the wisdom in the gold bugs' submissions to the Gold Commission will finally find a receptive audience.

Who's Crying Now, Argentina? Argentina, once the poster country for dollar-based currency boards in the brave new post-Bretton Woods monetary world (see National Gold and Forex Reserves: Use and Misuse (11/1/99)), has recently experienced just the sort of "final and total catastrophe" of which Mises spoke. So the announcement last week that Argentina had added 42 tonnes of gold to its official reserves during the first six months of this year should command more than passing interest. See E. Conway, Argentina ensures gold hits record, The Telegraph (London) (August 20, 2004). After all, apparently under pressure from the gold price fixing cabal, this same nation just a few years ago sold the last of its then remaining gold reserves.

Argentina is not only in default on its international debt, including interest payments, but also effectively refuses to accede to the International Monetary Fund's terms and conditions for a stabilization plan as a condition for a financial rescue package. Rather than apply its available forex reserves to meeting its international obligations, Argentina has instead bought gold in defiance of the cabal, and what is more, apparently without eliciting any penalty or sanction from either the IMF or the United States, not to mention the country's other creditors.

An August 19, 2004, Reuters report (reproduced the same day in the Midas commentary at LeMetropoleCafe) quoted an unnamed official of Argentina's central bank: "We were positive about gold. ... We thought that in this international context with a war going on and the price of oil going up, we were relatively positive in relation to gold." According to the same official, the central bank had not yet decided whether to buy more gold. "We are in this precise moment deciding the benchmark of the administration of reserves," he said.

Notwithstanding the independent tenor of these remarks, it remains possible that Argentina's gold purchases are subject to unannounced terms or conditions for the protection of its creditors arranged by or at the behest of the IMF, which must have known about the purchases since changes in all members gold reserves are reported to it monthly.

But if what presently appears is substantially the full story, these purchases have the look of an implicit threat aimed right at the heart of today's dollar-based international monetary order, a system now so disordered that it cannot mount an effective response. In that event, Argentina seems to be saying: "Push us too hard and we will bring the system down." And no one is pushing back, suggesting that Argentina may have engineered what amounts to a Mexican standoff over gold's place in the heavily indebted paper dollar world, and in the process advanced the hands on the clock to monetary Armageddon.

June 28, 2004 (RHH). Hard Money Markets: Climbing a Chinese Wall of Worry

« La Chine est un géant qui sommeille. Laissez-le dormir, car lorsqu'il se réveillera, il étonnera le monde. » « Quand la Chine s'éveillera, le monde tremblera. » Whether Napoleon truly spoke these lines two centuries ago is open to doubt, but their prescience has made them almost trite today. With respect to silver and gold, the Chinese giant can perhaps best be thought of as well into the REM stage of its slumber, entertaining dreams and gathering strength to shake the markets for the monetary metals to their core, and thereby to trigger fundamental change in the existing dollar-based world financial system.

Gold Derivatives Update. Since the posting of Gold Derivatives: Hitting the Iceberg (12/20/2003), another six months of data has become available, further underscoring a basic point of that commentary: producer hedging accounts for only a small proportion of total gold derivatives, which are primarily driven by transactions among certain central banks and major bullion banks for the purpose of suppressing gold prices.

On May 14, 2004, the Bank for International Settlements released its regular semi-annual report on the OTC derivatives of major banks and dealers in the G-10 countries for the period ending December 31, 2003 (www.bis.org/publ/otc_hy0405.htm). The total notional value of all gold derivatives rose to $344 billion from $304 billion as of June 30, 2003. Translated into estimated tonnes, these figures are shown in the chart below by Mike Bolser, together with the breakdown between forwards and swaps ($154 billion versus $134 billion at June 30) and options ($190 billion versus $169 billion at June 30) as reported in table 22A of the June issue of the BIS Quarterly Review (www.bis.org/press/p040614.htm).

Also shown in tonnes are the gold derivatives held by U.S. commercial banks as reported through March 31, 2004, by the Office of the Comptroller of the Currency (www.occ.treas.gov/deriv/deriv.htm). Held almost entirely by J.P. Morgan Chase, HSBC Bank USA and Citibank (see second chart below), the total notional value of these gold derivatives has held fairly steady at around $80 billion for the past three quarters while HSBC has moved solidly into the number two position behind JPM and ahead of Citi.

As explained in Gold Derivatives: Moving towards Checkmate (12/04/2002), updated in Not Your Father's Gold Market (6/15/2003), a pretty good proxy for the total net short physical position in gold is the total notional value of forwards and swaps as reported by the BIS and converted into tonnes, which as of year-end stood at 12,687 tonnes according to Mike's calculation, an amount equal to almost half of total official gold reserves as reported by the International Monetary Fund.

With respect to producer hedging, GFMS continues to report declines in total delta-adjusted producer hedge books, which as of March 31, 2004, stood at 67.6 million ounces (2103 tonnes), of which 51.2 million ounces (1593 tonnes) were forwards. See GFMS Limited, Global Gold Hedge Book Analysis - Q1 2004 (May 2004). On these numbers, of the total forwards and swaps reported by the BIS, producer hedging would account for less than 13%.

WAG the French. On March 8, 2004, the European Central Bank together with 14 other European central banks but not the Bank of England issued a Joint Statement on Gold that effectively renews for another five years the Washington Agreement on Gold that expires in September. Two points about the joint statement merit emphasis.

First, only a relatively small part of the new sales quota -- 2500 tonnes at the rate of 500 tonnes per year -- has been assigned to or spoken for by the participating central banks, which together claim some 14,000 tonnes in total gold reserves. See World Gold Council, World Official Gold Holdings (March 2004). As of the date of the statement, the principal identified sellers were the Bundesbank, which had previously indicated a desire to sell 600 tonnes, and the Dutch central bank, which expected to have 65 tonnes unsold from its allowance under the WAG. See GFMS Limited, The New Central Bank Gold Agreement (March 2004).

Indeed, to reach the full quota it appears that, as GFMS noted, "France (3,025 tonnes) and Italy (2,452 tonnes) would have to change policy and initiate gold sales programmes." In his instant "Precious Thought" on the "New Deal," Mitsui's Andy Smith penciled in France and Italy for 600 tonnes each. Not surprisingly then, at a press conference in early June, Christian Noyer, current governor of the Banque de France, announced that it may sell "possibly up 500-600 tonnes" assuming "appropriate" gold prices.

Second, under numbered point 3 of the joint statement, the participants commit: "that the total amount of their gold leasings and the total amount of their use of gold futures and options will not exceed the amounts prevailing at the date of the signature of the previous agreement" (emphasis supplied). Like the WAG, this provision omits any mention of deposits or swaps. See J. Turk, 8 Reasons to Ignore the New Central Bank Gold Agreement, The Freemarket Gold & Money Report (March 18, 2004).

The key point here is that given an accounting regime that allows central bank gold reserves to be stated as a single line item, including both vault gold and gold receivables arising from lending or derivatives activities, gold sales may not represent additional physical supply to the market but rather a public acknowledgement that gold which long ago left the vault through leases, deposits or swaps must now for whatever reason be declared gone. Conversely, with the Banque de France currently contemplating gold sales, the possibility exists that this gold may already be entering the market through deposits or swaps since they are outside the WAG.

Since its founding under Napoleon and as recently as France's last great saviour, Charles de Gaulle, the Banque de France has been regarded as perhaps the world's most aggressively pro-gold central bank. It is a tradition that continued under its last governor, Jean-Claude Trichet, who now heads the ECB. Only time will tell whether the Banque de France is truly planning gold sales or just aiding its former governor with propaganda to salve for a bit longer the gold derivatives banking crisis that the central banks have created for themselves. In either event, the underlying message is the same: the central banks are coming close to exhausting their practicably deliverable supplies of physical gold.

Stressing Out. The apparent U-turn in long-standing French gold policy is not the only sign of truly extraordinary stress in the gold market. By a press release issued April 14, 2004, N M Rothschild & Sons Limited announced its withdrawal from commodities trading, including gold and London gold price fixing which it had chaired ever since the adoption of this strange ritual during World War I. However, the release added: "Rothschild will continue to provide advice, project finance, corporate banking and other services to its Natural Resources and Mining clients around the world." In explaining that commodities trading no longer fit within the firm's strategic plan, its current chairman, David de Rothschild, noted: "Our income from commodities trading in London, including gold, has fallen as percentage of our total income in each of the past five years."

Rothschild's announcement was followed on May 28, 2004, by the withdrawal of AIG International Limited from its position as a LBMA market maker in gold and silver. According to silver analyst Ted Butler, until recently AIG "had been the most active dealer in COMEX silver deliveries," and he opines that the LBMA, generally regarded as the largest market for physical silver, has lost "perhaps its largest silver market maker." See T. Butler, All Systems Go (June 1, 2004).

As shown in the charts below, the volume of daily trading in both gold and silver on the LBMA has been on a downward trend for several years. Thus Rothschild should probably be taken at its word that commodities trading, at least in gold and silver on the LBMA, has not been generating satisfactory returns. But this fact may not be the sole or even principal reason for its withdrawal, which would make eminent good sense assuming that Rothschild is well-informed about the manipulation of gold prices but not itself a direct participant in the gold price fixing scheme.

In that event, not only would its reputation likely suffer along with that of the LBMA when the scheme meets its inevitable demise, but also until then its trading activities would be at a distinct disadvantage to those of the participants, both as regards market knowledge and risk exposure. In this connection, it is interesting to note that Rothschild has not exited from mining finance, presumably including gold loans and forward sales. These types of transactions carry acceptable levels of business risk, at least when done with well-operated mining companies possessing adequate reserves. However, transactions involving the gold carry trade or other speculative activities requiring the use of gold derivatives carry levels of risk that in most cases, when properly analyzed, would seem unacceptable absent explicit or implicit official support.

Another possible reason for Rothschild's withdrawal is a conviction that the better risk/reward ratio is found in buying gold and silver for vault storage than in trading them on the LBMA. In this event, and especially with respect to silver for which anecdotal evidence of scarce physical supplies abounds, the firm may have found itself in a potential conflict of interest situation with some of its own clients also searching for physical silver.

An earlier version of the above chart on average daily LBMA silver volume appeared in Targeting the Gold Cabal with Silver Bullets (2/17/2004) in connection with discussion of a theory advanced by Professor Maurice Obstfeld that identifies T* as the date when a price fixing scheme may be expected to collapse, usually after a speculative attack by private market participants attempting to acquire all of the remaining stock available at the artificially depressed prices.

The prior chart ended with the January 2004 spike to over 143 million ounces from December's 110 million ounces. In February, March and April, daily volume ran at 121.5, 128.7 and 133.8 million ounces, respectively. But in May it dropped sharply to 94.7 million ounces. While the R^2 value of the long-term declining trend line has fallen marginally from .737 to .726, the short-term divergence from trend remains the widest since 1998.

The May decline suggests that markedly increased investment buying of physical metal in the preceding several months may now be meeting serious supply constraints and that T* for the silver market may soon arrive. Few would be in a better position to sense the premonitory tremors of such a seismic market event than Rothschild and AIG, and none who did would remain at ground zero if they could escape it.

Silver Update. Recent reports indicate that the bullish case for silver remains as strong as ever. In 2004, with fabrication demand exceeding new mine production and scrap recovery by an estimated 72 million ounces, silver recorded its 15th annual structural deficit. See GFMS Limited, World Silver Survey 2004 (discussed in May 13, 2004, press release by The Silver Institute and in Silver Fundamentals -- 2003 (May 17, 2004) by Pan American Silver). See also CPM Group, Silver Survey 2004 (May 7, 2004). China supplied 57 million ounces or 69% of the 82.6 million ounces in net sales from government stocks according to GFMS, which after raising its estimate of Chinese inventories last year now questions "whether China's silver trove is unlimited."

What is more, the bullish case for silver has received additional support -- even if unintentional -- from an unlikely source: the Commodity Futures Trading Commission itself. On May 14, 2004, responding to the letter writing campaign by supporters of Ted Butler and the Gold Anti-Trust Action Committee alleging manipulation of silver prices on the COMEX, the CFTC issued a nine page open letter to silver investors. While claiming that it could find no evidence supporting the allegations of manipulation, the CFTC largely adopted the fundamental facts, including the structural deficit and declining world inventories, which underpin the bullish case. See T. Butler, A Silver Buy and the CFTC's Response (May 17, 2004) (includes a detailed rebuttal of several key points in the CFTC's letter).

During the week preceding release of the CFTC's open letter, Ross Beaty, CEO of Pan American Silver and a past president of The Silver Institute, engaged in an informative public exchange of letters with GATA's Ed Steer and Chris Powell. Of particular interest, Mr. Beaty noted: "[T]here exist now well over 300 million ounces of silver sold forward to bullion banks by base metal mining companies in long-term hedge contracts (going out as much as five years)." This disclosure prompted Ted Butler to comment: "[This] figure reinforces my speculation that there may be more than 1 billion ounces of silver involved in forward selling/leasing." T. Butler, The Great Mystery (May 10, 2004).

Before turning to a detailed examination of what little publicly available information on silver derivatives exists, several statements contained in all this open correspondence deserve mention.

The most egregious comes from the CFTC (letter, p. 5):

The allegation of a long-standing manipulation also fails to offer a plausible motive. The purpose of any manipulation is to make a profit. The allegation is that, over a long period, the commercial shorts have continued to sell at what they know to be artificially low prices. This defies rational explanation. Sellers in a short manipulation could make manipulative profits only if they later bought back their positions at prices lower than those at which they sold them, and yet the allegation is that for 20 years the commercial shorts have continued to sell at artificially low prices without ever taking profits. Further, by knowingly selling something for less than it was worth, they would put themselves at grave risk since they could never know when the market price might correct. [Emphasis supplied.]

Private manipulations may have profit as their purpose. Officially supported ones normally have other objectives, such as the London Gold Pool, which in the 1960's tried to save the Bretton Woods system by maintaining free market gold prices at $35 per ounce. Does the CFTC really believe that today's foreign exchange markets operate without significant official intervention, or that George Soros did not really make $1 billion betting against manipulation of the British pound by the Bank of England? As discussed in The Golden Sextant, gold and silver prices properly understood are simply exchange rates between paper currencies and real money.

Focusing on the question of risk as related to the large commercial shorts in silver, the CFTC reported (letter, pp. 7-8):

The CFTC has substantially more information than it is permitted under the Commodity Exchange Act to make public. The Commission routinely obtains detailed information on large silver futures positions -- long and short. Both the CFTC and the NYMEX have had discussions with the largest traders in the market and, in some instances, have looked beyond their NYMEX silver positions to obtain written documentation of their positions in various other silver markets and silver derivatives. We have used this information to evaluate the overall exposure, market power, and trading incentives that a trader's complete "book" of positions would present. Based on the information that we have, we are satisfied that what may appear to be large net short futures exposures are often offset by other market positions, including physical silver inventories, forward positions, positions in other derivative products, and positions in non-U.S. markets. We believe that the characterization of the largest commercial short positions as "naked" short positions is simply not correct.

Although he does not credit allegations of price manipulation in silver, Mr. Beaty is not quite as blind to the manipulation of gold prices as the CFTC. He wrote to Mr. Steer:

Please also note that my silver views do NOT extend into the gold arena, where the opportunity for government manipulation is much greater due to the large holdings of gold by governments and the obvious bias of central bankers to hold gold prices down. In fact, I think a very good case can be made for at least some market manipulation by central bankers in the gold market.

But then in a follow-up letter to Mr. Powell, after noting that the silver market is "about 10% of the size of the gold market" and cannot support very many large dealers, Mr. Beaty continued:

Don't forget too (and Butler seems to ignore this) that there is no such thing as a market that is net short. Every short position on COMEX is offset by a long position. ...

* * * * * It so happens that the silver market has seen many speculators taking long positions against the bullion banks because of the general view that silver is underpriced -- and I absolutely share that view. And the bullion banks have often made large losses going against this view -- for example, those caught truly short when the market went from $4.80 to $8.50 or so in the last six months.

This action of the bullion banks is simply core business for them, not conspiracies to manipulate the silver price. I just don't buy that because I can explain the world without resorting to that unproven fantasy, and because it is illegal and because I have a higher opinion of the integrity of the banks than Butler does. [Emphasis supplied.]

As with gold, the key issue with respect to the manipulation of silver prices is the size of the total net short physical position, which at any point in time is the total amount of physical silver that the shorts stand obligated to deliver but can neither cover with offsetting contracts, as in the case of unhedged positions or the failure of a counterparty to a hedge, nor obtain except through market purchases, as would be typical with uncovered written calls or silver loans or leases to non-producers.

Of course, as Mr. Beaty says, there is a buyer for every seller on the COMEX and similar exchanges. But while prudent sellers of futures and writers of options normally delta hedge their exposures, they can go naked initially or in certain instances be forced by market volatility or lack of market liquidity to allow previously hedged positions to become partially naked.

Of more general relevance, however, is the ability of counterparties to meet their commitments. In stating its belief that "the characterization of the largest commercial short positions as 'naked' short positions is simply not correct," the CFTC is effectively vouching an opinion that these positions are adequately hedged with reliable counterparties outside of the COMEX. The validity of that opinion depends in large measure on the size of the total net short physical position in silver.

Turning to the question of motive, the principal bullion banks dealing in silver also deal in gold. They include subsidiaries of the three largest international financial services companies (Citigroup, HSBC Group, and J.P Morgan Chase) as well as Europe's largest bank (Deutsche Bank). While all four are also among the largest holders of derivatives, their total exposure to precious metals derivatives, including gold, is a relative pittance.

The core businesses of these giant financial institutions are banking and other financial services involving unlimited paper money and enjoying symbiotic relationships with governments and central banks. Far from being a core business, gold and silver -- real money -- represent a mortal threat to their comfortable existence, not to mention that of their friends in high political office.

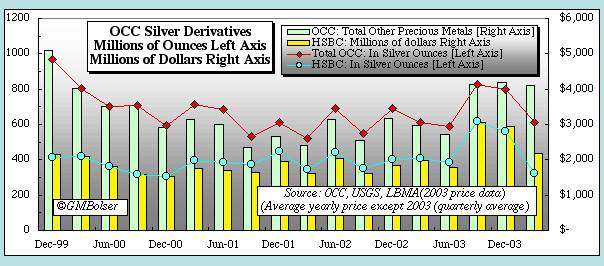

Silver Derivatives. Calculating a total net short physical position for silver is even more problematic than for gold. Neither the BIS nor the OCC report figures on silver derivatives per se. However, they do report combined figures for "other precious metals" excluding gold, i.e., silver and the platinum group metals, principally platinum and palladium. These figures are summarized in the two charts below by Mike Bolser. The first gives total notional values as reported in U.S. dollars. The second converts the dollar figures to millions of ounces of silver as if the dollar amounts related only to silver and did not include any platinum or palladium.

Although the assumption on which the second chart is based is not literally correct, silver derivatives most likely represent the bulk of other precious metals derivatives, especially with regard to forwards and swaps where the nature of the transactions generally assumes delivery for sale into the market of an equal amount of physical metal. But at over 4 billion ounces, if just half of the forwards and swaps in fact relate to silver, they double Ted Butler's estimate.

Over the past couple of years high lease rates resulting from scarce supplies have put platinum into backwardation, eliminating any incentive for forward selling by producers. See Johnson Matthey, Platinum 2004, Prices and Futures Markets. See also The Golden Sextant (improbability of backwardation in the monetary metals, especially gold). In palladium, where lease rates still permit a very modest contango, one producer has ceased hedging through the bullion banks and entered into a sales contract with an automotive manufacturer assuring a floor price of $325/oz. for all of its delivered palladium through mid-2005. See North American Palladium Ltd., 2003 Annual Report (March 31, 2004), p. 7.

Not only are the price differentials between silver and the platinum group precious metals large, but also at least until quite recently prices for platinum and palladium have shown greater volatility than for silver. Both factors likely contribute to the volatility in the dollar figures reported by the BIS for other precious metals options. This volatility further suggests that the platinum group metals play a relatively larger role with respect to options than to the more stable forwards and swaps, and that the similarly stable OCC figures are also heavily weighted toward forwards and swaps.

Because the BIS reports exchange-traded derivatives as a separate memorandum item, the dollar amounts in the first chart do not include open interest on the NYMEX or TOCOM, the principal exchanges on which platinum and palladium futures and options are traded. The OCC does include exchange-traded derivatives in its figures, but its reports cover only U.S. commercial banks, which for historical and legal reasons are generally confined to dealing in the two monetary metals and in any event are not members of the TOCOM.

As shown in the following chart, the two largest U.S. commercial bank holders of gold derivatives also hold virtually all the silver derivatives, but here HSBC Bank USA ($2.2 billion at 3/31/04) is the leader with J.P. Morgan Chase($1.6 billion) in second place. Given the pivotal role that Chinese stocks play in the silver market, the leading role of HSBC is hardly surprising. What is more, as explained in the following section, the OCC's figures for JPM cover its worldwide operations whereas the figures for HSBC cover only the U.S. operations the HSBC Group, which in all likelihood holds additional silver derivatives in its operating units in other countries.

Note: In preparing the foregoing chart, $9,502 million of other precious metals silver derivatives shown for Bank of America in the OCC's report for the quarter ending September 30, 2001, have been eliminated. That figure is shown in the total column for all maturities but only a total of $6 million is shown for this bank in the separate columns for different maturities. In the first quarter of 2000, Bank of America sharply cut its other precious metals derivatives from $1,116 million at year-end 1999 to $387 million. At year-end 2000, they were down to $61 million; at mid-year 2001, they were $16 million; since year-end 2001, they have never exceeded $4 million; and since mid-year 2002, they have been at zero.

Chinese Orphan. The Hongkong and Shanghai Banking Corporation Limited, founded in Hong Kong in 1865, is the oldest member of the HSBC Group, which has its corporate headquarters in London and is generally regarded as the world's second largest financial services concern after Citigroup. HSBC Bank USA acquired Marine Midland Bank, N.A., in 1980 and Republic New York Corporation in 1999.

As discussed in several prior commentaries, the system under which the BIS collects and reports data on derivatives generally requires that the home office of each reporting financial institution submit figures on its worldwide operations to the proper regulatory authority in its home country, which then transmits to the BIS the data necessary for the preparation of its reports. Thus, for example, after Deutsche Bank acquired Bankers Trust in 1999, the data on its derivatives ceased to appear in the OCC's reports, but presumably continued to flow to the BIS through the appropriate reporting channel for the worldwide operations of German banks. See Deutsche Bank: Sabotaging the Washington Agreement? (5/20/2000).

Accordingly, the inclusion of HSBC Bank USA in the OCC's reports appears aberrant. No obvious reason presents itself to explain why HSBC Bank USA is not reporting through British or possibly Chinese channels given that both The People's Bank of China and the Hong Kong Monetary Authority are BIS members. However, the most likely explanation is that for whatever reason HSBC Bank USA remains under the primary supervision of U.S. banking authorities.

The system for reporting derivatives is integral to implementing the risk capital adequacy standards mandated by the Basle Capital Accord, which generally places principal regulatory authority and responsibility for financial institutions on the central banks or other supervisory authorities in their home countries. However, particularly in the case of complex international banking groups, cross-border supervision has raised a number of difficult issues regarding the respective roles of home- and host- country supervisory authorities, and these in certain situations may have called for special arrangements.

In any event, the appearance of derivatives data for HSBC Bank USA in the OCC's reports suggests that should this bank ever find itself in severe difficulty due to derivatives or any other problem, the U.S. Federal Reserve -- not the British or the Chinese -- will perforce be its lender of last resort.

Golden Yellow Peril. Even Ted Butler cannot quite bring himself to link the manipulation of silver prices to that of gold prices, or to recognize that the prices of both monetary metals are being suppressed as part of a broader effort to sustain the existing world financial system based on the unlimited U.S. paper dollar. Nevertheless, he offers some interesting conjecture in his May 17 rebuttal to the CFTC:

It is interesting to note that the CFTC confirms that it is dumping by the Red Chinese government that is primarily responsible for filing the current deficit. Official government dumping from treasury holdings, below the marginal cost of production, is not a free market hallmark. It would not surprise me, at all, if the Chinese government is behind the current manipulation in silver, and are using the commercials as surrogates.

Dollar balances generated by large trade surpluses with the United States reflect exports that are the driving force in the economies of many of its trading partners, making them reluctant to convert these balances into local currencies and risk choking off their own export-led prosperity with strengthening exchange rates. See Richard Duncan, The Dollar Crisis (John Wiley & Sons (Asia), 2003), esp. pp. 90-119. Nowhere is this phenomenon more obvious, or more important to the strength of the dollar, than in the accumulation of huge dollar balances by China and Japan.

What is more, the reinvestment of large amounts of these dollars in U.S. government securities supports the Fed's low interest rate policy without requiring it to engage in the level of open market purchases that would otherwise be necessary. See J. Grant, "Outsourcing the Fed," Grant's Interest Rate Observer (April 9, 2004). Displaying his customary flair for felicitous expression, the editor of that always stimulating publication concludes (at p. 4):

The pell-mell purchase of dollars for yen, renminbi and other Asian currencies constitutes the largest exchange rate manipulation in the history of the world. A recent Martin Wolf column in the Financial Times called attention to this this fact and cited a new paper by a trio of economists under the auspices of the National Bureau of Economic Research. "We are experiencing an official sector effort to reverse global private sector capital flows on a scale that we have never seen," write Michael P. Dooley, David Folkerts-Landau and Peter Garber, "even at the end of the Bretton Woods system."

* * * * * The authors title their essay, "The Revived Bretton Woods System...." To us, however, the new "system" bears not even a faint resemblance to the old one. The system now prevailing is a system to push almost inconceivable volumes of Asian currency into circulation to the end of propping up the value of the dollar. Whatever comes of this transpacific fandango, we believe, it will continue to enrich patient holders of gold and silver.

As discussed in Targeting the Gold Cabal with Silver Bullets (2/17/2004), any effort to support the dollar by suppressing gold prices would also seem to require a parallel suppression of silver prices. With its own reasons for wanting a strong dollar, China had an obvious motive for mobilizing its silver stocks to assist in the scheme, and all the evidence suggests that its role became increasingly vital with each annual decline in other world inventories. A more interesting question, however, is presented by the data indicating that the Chinese have supplied large quantities of physical metal through leasing or swaps rather than outright sales.

In the case of gold, leases or swaps offer the central banks several advantages. Given the accounting conventions approved by the IMF, central banks can report leased or swapped gold as if it were still in their vaults, preserving the illusion that collectively they remain a powerful force in the gold market. They also avoid having to make the public explanations that sales require, not to mention waging battles with politicians over control of the proceeds.

None of these advantages has any relevance in the case of official Chinese silver. However, selling silver at historically low prices, whether measured in dollars or by the silver/gold ratio, is not an attractive option, especially if large amounts of physical silver can be moved into the market by other means to accomplish its purpose. On the other hand, leasing silver to non-producers during periods of low prices involves significant risk of default should silver prices later move sharply higher.

One solution that might well have appealed to the both the Chinese and Western central banks is silver/gold swaps. They would also explain why the BIS is reporting total silver forwards and swaps apparently far in excess of a billion ounces when only 300 million ounces of producer forward sales have been authoritatively identified.

Although swaps of this nature might take place directly between government instrumentalities, they could also be effected using the bullion banks as intermediaries, and thus show up in the figures on OTC gold and other precious metals derivatives reported by the BIS. In that event, an intriguing question arises as to whether and how the procedures used by the BIS to avoid double counting would operate, and it is possible that the full amount of the same swap might appear in the figures for both gold derivatives and those for other precious metals.

In negotiating the precise terms of any such swaps, the parties would have faced an array of issues. The Chinese would have required custody arrangements for the gold that assured physical delivery to them on any failure to unwind a swap. They also would have sought provisions allowing them to benefit from any favorable movement (reduction) in the silver/gold ratio.

Assuming that what James Grant has labeled the "transpacific fandango" involves gold and silver as well as paper currencies, any Chinese move toward revaluing the yuan has more profound implications for the monetary metals than even he suggests. Noting evidence of recent reductions in their dollar holdings, at least one respected analyst expects a Chinese revaluation prior to the the U.S. presidential election. See J. Turk, The Coming Revaluation of the Yuan, Gold Money Alert (June 13, 2004).

What is more, there is always the danger that China might use its financial muscle in the foreign exchange and precious metals markets to support strategic objectives that are not largely economic, e.g., reunification with Taiwan. See, e.g., US feels heat of dragon's breath, Asia Times Online (June 22, 2004). But whatever the challenges to U.S. power presented by China today, the racially insensitive phrase applied to earlier threats from across the Pacific does not suffice.

For if America is vulnerable to high stakes economic and financial blackmail, the true peril is not of a pale oriental hue, but the rich golden yellow reflected by the two monetary metals fused to their common and historic purpose. And remembering that the Chinese invented paper money brings into play another golden rule of financial survival: "Never try to hustle a hustler."