[Note: Presentation to the 2003 Spring Conference, “Beyond the Storm,” hosted by Sage Capital Management, Inc., Houston, Texas, March 12, 2003. The views expressed are mine alone, and not those of Sage Capital.]

Good afternoon. I’m delighted to be here today. It’s an honor to speak to a gathering of smart and successful people. And it’s a privilege to share a podium with some of the best living minds in economics. I’d like to thank my friend Tony Deden for inviting me to take part.

Tony has asked me to share some of my views on gold. He tells me his accounts have gold in their portfolios. Now, unless you’ve somehow managed to shut the financial media out of your life, you may wonder what it’s doing there. How does a volatile commodity square with a sober emphasis on capital preservation?

The Three Propositions

Allow me to present what might be called the three articles of the gold bug creed:

First, gold is money. It always has been. It’s the clear choice of free markets throughout recorded history.

Second, what we call money today is not money at all. It’s just a rash experiment in credit expansion that has spun totally out of control. Like all such experiments before it, this one will end in tears.

Third, following the failure of the current monetary system, gold will once again play its historic role as the anchor of a successor system. The market will demand it, and the authorities will have no choice but to let the market have its way.

The presence of gold in your portfolios signifies that you will emerge from the collapse of this experiment with your capital intact. Indeed, you may clean up in a radically altered landscape. Kind of the ultimate good news/ bad news scenario.

Now with your indulgence, I’ll take you on a little historical excursion as I provide some support for these wild assertions.

In Search of Money

Why is gold money? Several years ago, at a dinner party in New York, I was discussing this very topic with a smart and senior portfolio manager at Salomon Brothers. At one point, he grabbed an empty beer bottle, held it up and asked me why gold was money, any more than that bottle. This pretty well captured the mainstream skepticism toward gold. So it seems like a pretty good starting point.

[Source: www.danhyde.com]

Permanent, Natural Money

So why is gold money? The short answer is because the market says so. Over the course of thousands of years of trial and error, consenting adults engaging in commercial acts settled on it to perform the function of money. Why did people choose gold? Because, Menger observed, over time it was identified as having the greatest liquidity – the lowest bid-offer spread – of all possible contenders. A person bringing a relatively illiquid item to market could swap it for gold, secure in the knowledge that he could later use that gold to get whatever he wanted.2

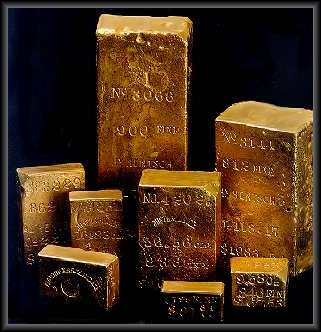

[Source: www.vosper4coins.co.uk]

Rarity. Gold constitutes only about 5 parts per billion of the earth’s crust. It is also difficult, dangerous and expensive to extract. Anyone who’s actually been down a mineshaft, as Tony and I have, knows just how precious a metal it is.

Indestructibility. Gold doesn’t tarnish or decay.

Density. Gold doesn’t take up much space. All the gold mined in human history amounts to about 130 thousand metric tons, an amount which would only fill about a 100 foot cube if gathered in one place.

Malleability and divisibility. You can stretch it, pound it thin, and divide it into multiple tiny amounts.

Controlled expansion. This is the most important quality, as we’ll see. Gold can only be produced in limited quantities, currently at a peak rate of about 2,500 metric tons, or roughly 2%, each year. No matter what wars or social programs urgently need funding.

So the answer to my friend’s question is that gold is money, over brown glass and anything else he might have brandished, because people have sensibly chosen to use it as such over a very long period of time.

The Gold Standard

Gold as money reached its fullest flowering under the gold standard of the 19th century. Off and on over a period of about 100 years, the leading countries of the West plus many others operated under this remarkable international monetary system.

It emerged by accident, as a result of the choices of individuals engaged in commerce, not as the result of government decree. In the words of a modern scoffer, “Nobody invented [it], no grand plan was ever devised, no one ever wrote a rule book on the necessary codes of behavior.”3

[Source: http://www.uh.edu]

The discipline of the gold standard brought about the closest approximation to the ideal of the limited state that we have ever known. The late economist Melchior Palyi put it thus:

It protected the individual against arbitrary measures of the government by offering a convenient hedge against confiscatory’ taxation, as well as against the depreciation or devaluation of the currency. It was an instrument of mobility’ within and beyond national borders. Above all, it raised a mighty barrier against authoritarian interferences with the economic process.5

Ludwig Von Mises, the towering genius of the Austrian school, called it “the world standard of the age of capitalism, increasing welfare, liberty, and democracy, both political and economic.”6 The gold standard, he said, “is certainly not a perfect or ideal standard. There is no such thing as perfection in human things. But nobody is in a position to tell us how something more satisfactory could be put in place of the gold standard.”7

So what happened to it?

Spoils of War

The big picture answer is that it was a casualty of World War I. In addition to destroying the lives of millions of individuals through incredible stupidity, butchery and waste, the war destroyed the entire international economic, legal and monetary order.

[Source: www.ku.edu]

When peace was finally restored some four years later, an evil genie had been let out of the bottle. The gold standard was now seen as just another manipulable institution. It had been set aside in furtherance of war; why not set it aside in furtherance of peacetime prosperity?

The war had brought about a change in people’s perceptions of the proper role of the state. After the years of sacrifice and empty promises, they wanted a better life, and looked to the state to provide it. In the monetary sphere, this took the form of what Palyi called “an emotional and utopian attitude toward money and credit,” the open embrace of inflationism.8 Politicians chose inflation over liquidation of uneconomic productive capacity that had sprouted up to feed the war effort. Rather than return to the gold standard, the leading nations adopted an inflationary compromise, a so-called gold exchange standard that preserved the old form but gutted its substance.

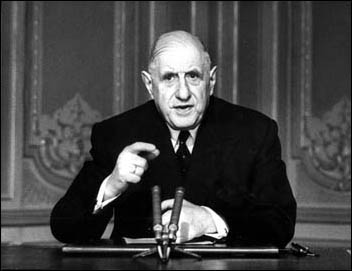

Rogues Gallery

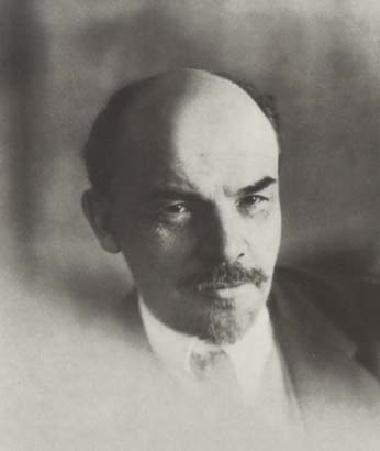

But that’s just the big picture answer. Individual human actors make history, just as they make markets. And in the case of the gold standard, I believe its death is better understood as murder at the hand of an assassin, namely, one John Maynard Keynes.

That’s Keynes on the left, in an early mugshot.

[Sources: www.radford.edu; www.sadcom.com]

Lord Keynes, along with Vladimir Lenin, pictured at right, ranks among the most destructive forces unleashed by World War I. Keynes was a Fabian socialist who provided intellectual cover for inflationism. He was more subtle than Lenin, more a termite than a thug. He’s best known for authoring bogus economic theories that turned classical economics on its head, undermined Western values and philosophy, and enslave us to this day. But he was also a devastatingly effective participant in the monetary debates that followed the Armistice. It was Keynes who famously called the gold standard a “barbarous relic.” In the words of a biographer, Keynes “killed it almost singlehanded.”9

Brown Glass and Green Paper

So much for the first proposition, that gold is money. The second is that our money is not. How can I say that, and what do I mean?

Let’s go back to my friend with his beer bottle. So far I’ve only addressed the explicit part of his question. But there was also an implicit part, which was: what is to keep us from deciding nevertheless to use brown glass as money? Where does it say we have to be rational? Why can’t we override the market’s choice and write a law saying brown glass is money, and prohibit anyone other than a council of wizards from making brown glass? Why not, indeed. This is in fact what our government has done, except it picked green paper — or rather digital entries symbolizing green paper — instead of brown glass.

Our monetary system is not based on money at all. It’s based on credit. What we call a dollar is not even a dollar, but a Federal Reserve Note, a promissory note issued by our central bank, promising to pay us, not a dollar, but another note. Look at the legend on the bills in your wallet. You won’t see anything that makes any sense. That’s because our currency is just a circular liability that can never be liquidated or redeemed. It costs virtually nothing to produce Federal Reserve Notes, and there is no limit on their production. From the standpoint of the government, this green paper is even better than brown glass.

How do I know the system will fail? Because that’s what history teaches. There’s nothing new about a monetary system in which a government overrides the market and substitutes something easier to produce than real money. Such a system has a name — “fiat” — and it’s been adopted on many occasions within the last 300 years. Each and every time it has failed. It’s from this dismal record that I conclude ours too will fail.

Know Your Fiats

There are four main historical examples of fiat money among the major nations.

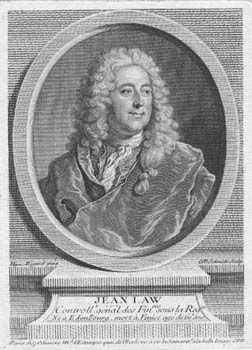

The first was the Mississippi System. This was the strangest, and the most original. Following the death of the free-spending Louis XIV in 1715, France was broke. [That’s Freedomland, for any government employees out there.] A Scottish gambler and amateur economist named John Law gained the confidence of the Regent, who was the man in charge following the transfer of the crown to a minor.

[Source: www.mapforum.com]

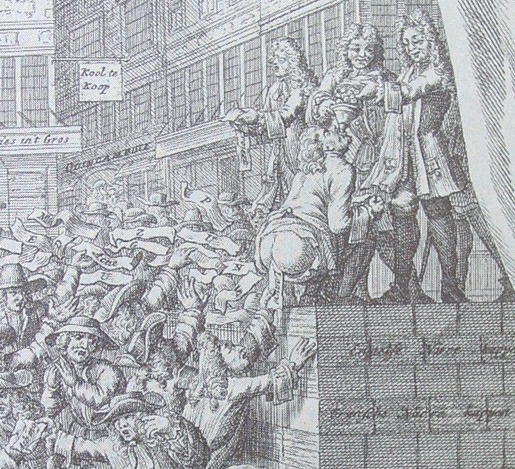

His newly created Banque Royale issued 2.7 billion livres in banknotes in the space of two years. His newly created Mississippi Company achieved a market capitalization of 5 billion livres over the same period. This resulted in a massive stock market bubble. Following a parabolic blowoff, the bubble collapsed, the bank failed and Law fled the country, leaving destitution in his wake.10

[Source: Frontispiece of Arlequin Actionist (Amsterdam, 1720), reprinted in Antoine Murphy, John Law (Oxford, 1997)]

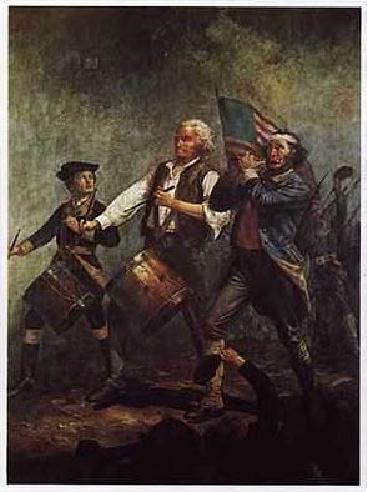

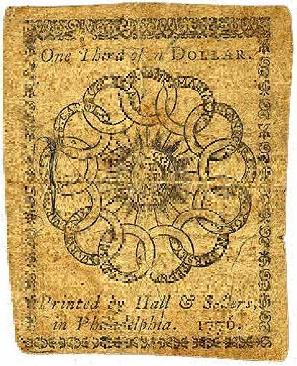

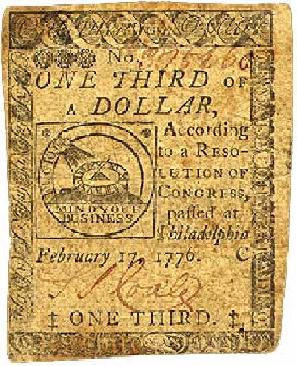

The second episode was the case of the Continental Congress. This is the most sympathetic of the four. Meeting in May 1775 following the outbreak of hostilities at Lexington and Concord, Congress had a war to finance and no clear way to do so.

[Source: www.americanrevolution.org]

A loan was also out of the question, since a lender would have been crazy to take the risk of funding a ragtag band of colonial rebels at the outset of their rebellion. So Congress did what it had to do, and printed up the money.

Lots of it.

[Source: www.frbsf.org]

Over the next five years, until they stopped the presses in 1780, Congress issued about $241 million face amount of irredeemable, non-convertible paper bills known as “Continentals.”11 The bills served their purpose, keeping the armies in the field, but how they functioned in practice is described in the following passage12:

A barber wallpapered his shop with Continentals. An old soldier, wounded in the leg, used a bundle of his pay as a bandage, and coined the word “shinplaster,” which was later used to describe any sort of money that could not be redeemed. A ship’s crew discharged in Boston, and paid off in now worthless currency, found a way of making suits out of the paper bills and paraded through the streets. “For two or three years we constantly saw and were informed of creditors running away from their debtors, and the debtors pursuing them in triumph, and paying them without mercy,” wrote [a contemporary observer].

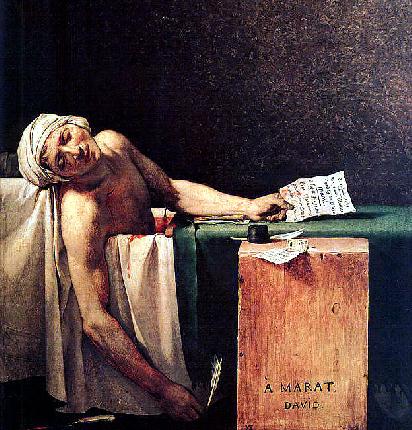

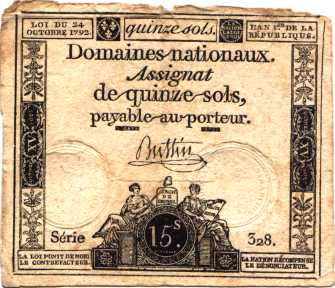

The third episode was the fiat money of Revolutionary France. This was the most chilling of the four, intertwined as it was with the Reign of Terror. In 1789, France was broke once again, with a heavy debt and a serious deficit. With the memory of John Law still fresh, the Jacobins set about their experiment with great caution and solemnity. They promised themselves they would limit the emission of paper, called assignats, to 400 million, come what may. They over-collateralized the paper with the extensive and valuable lands of the church that had been seized in the name of the people. They put bells and whistles on the paper to distinguish it from the plain paper used in Law’s Bubble, and to signify that it was tightly controlled. They persuaded themselves that the evils of the earlier debacle stemmed from the fact that Law’s paper was the issue of a corrupt monarchy operating in secret. This time would be different; after all, it was now the virtuous people operating in the open. Wrong.

By the morning of February 18, 1796, when all the machinery, plates and paper for printing the hated paper money were finally broken and burned in the Place Vendome, a total of 45 billion had been issued.13 Here we see one of the revolutionary kingpins, Marat, as depicted shortly after his assassination by Charlotte Corday.

[Source: www.bc.edu]

Note the assignat on the table by his bathtub.

[Source: www.joelscoins.com]

The fourth episode was the German inflation following the defeat of Imperial Germany in World War I. This is probably the most famous of the four. Everyone’s heard stories of wheelbarrows filled with paper money needed to buy a loaf of bread, wage payments made twice daily to keep up with the inflation, etc. It started with Germany’s defeat in the war. Germany was an economic basketcase. It had counted on winning, and paying for the war with booty. It had bled its population white and stuffed its central bank with government paper. To make matters worse, the victors imposed heavy reparations through the infamous Treaty of Versailles.

[Source: http://www.geh.org]

After handing over its merchant marine, its rolling stock, its flocks and herds, as well as a large portion of its gold reserves, Germany turned to printing new marks and selling them in the foreign exchange market for whatever they would bring.14

[Source: Golden Sextant archives]

Before the War, the mark had an exchange value of about 24 cents. When postwar trade started up in the summer of 1919, the mark fetched 8 cents.15 Four and a half years later the currency was replaced by a new rentenmark, which had a value of about 24 cents. The conversion rate was 1 trillion old marks for each rentenmark.

Fiats Past and Present

| Unit | Context | Duration | Severity |

|---|---|---|---|

| Banque Royale Notes | Regency of Louis XV | 1716-1720 | one livre to zero |

| Continental Bills | American Revolution | 1775-1780 | 1/specie dollar to 40/specie dollar |

| Assignats | French Revolution | 1790-1797 | 1/gold franc to 600/gold franc |

| Reichsmarks | Weimar Germany | 1919-1924 | .08/US$ to 4.2 trillion/US$ |

| Federal Reserve Notes | Cold War | 1971-20?? | to be determined |

Now, despite their obvious differences, these episodes had several important features in common. To begin with, it’s worth noting that in each case the fateful errors were made by talented and well-educated people. They were their countries’ best and brightest financial minds. This includes John Law, by the way, who’s gotten very bad, and I think, unfair, press ever since. These men did not take the road to ruin frivolously, but rather as a measured response to a set of exigent circumstances. The point is that governments are simply incapable of managing a money supply. The pressures and temptations always prove too great.

Economically, each episode began with good intentions and admirable restraint. Business picked up. Soon, however, the cost-free money began to act like a drug. More and more was demanded, more and more was supplied. Ultimately, the authorities completely lost control over the quantities of fiat money they produced. Each episode ended in what Von Mises called a “crack-up boom.” This is the manic phase in which a tipping point is reached in popular perception. People finally realize that the paper money is no good, and they move out of it, as quickly as they can, into something more durable. While business is feverishly brisk, the turnover actually signifies that commercial activity has become a giant game of Old Maid. The boom ends in a sudden collapse, and the final repudiation of the currency. At the end of the day, as Voltaire observed back in 1729, “Paper money eventually goes down to its intrinsic value — zero.” In each case, gold and sometimes silver made a quiet return as the only thing people were willing to accept as money. In the case of the French and American episodes, this involved a return to a familiar form of hard money. In the case of Germany, it involved the introduction of a brand new gold- backed currency under the provisions of the Dawes Plan of 1924.

Politically, each episode featured several common elements. Fiat currency is, after all, a political phenomenon — people with political power decide to compel other people to accept their paper as a medium of exchange. As Lenin famously observed, all politics boils down to the question, “kto kovo”; “who whom.” Somebody wins, somebody loses. The winners are the clever fellows who figure out how to scam the system, go with the flow. Speculators and debtors win big, at least until the music stops. Ordinary folks, that is, people without political connections, take the hit. In the case of Revolutionary France, the working class was the primary victim, as wages were held constant throughout the horrific inflation. The misery and distress this occasioned provided plenty of cannon fodder for the Revolutionary armies. In the case of Weimar Germany, the middle class was basically wiped out at the expense of the big industrialists. This was not a healthy development, as subsequent events would show.

Socially, each episode had a poisonous effect. The essence of capitalism is an orientation toward the future. People work and save today so that they may live better tomorrow. Fiat money inflation makes this a mug’s game. It results in what Andrew Dickson White, the founder of Cornell University and the author of a brilliant analysis of the experience in Revolutionary France, called the “obliteration of thrift.”16 Savers are chumps. The smart guys are those who spend it all and go into debt to consume, the more conspicuously the better. Moreover, fiat money always results in massive corruption. The new pools of paper-based wealth are never shy about buying protection for their privileges.

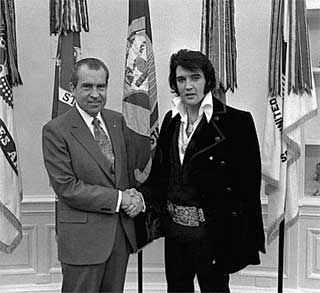

Back to the Future

[Source: http://politicalhumor.about.com]

He did this by suspending the convertibility of the dollar into gold as required under a set of postwar monetary agreements known as Bretton Woods. A little background is in order for those of us who don’t read monetary history for fun.

Bretton Woods had been adopted toward the end of the Second World War. Its main architect was our old friend, the economist from hell, John Maynard Keynes. See if you can spot him here. Bretton Woods was another gold exchange standard, similar to the one adopted after World War I, except this time the dollar was the sole reserve currency. The pound, also a reserve currency under the old system, was now toast. Bretton Woods was a great deal for the United States.

[Source: National Archives]

It enabled us, alone among the nations, to have our cake and eat it too. It conferred on us what critics, mainly French [some things never change] correctly called an “exorbitant privilege.” It licensed us literally to print up the world’s reserve currency. The only catch was we had to agree to redeem dollars for gold at a set price, $35 per ounce. But not just any dollars. Only dollars presented for redemption by foreign central banks. American citizens were still barred by law from owning gold under an earlier decree of President Roosevelt.

The Bretton Woods system worked for a while. But around the time of the Cuban Missile Crisis in 1961, the market began to act up.

[Source: www.gwu.edu]

It so happened that the market clearing price for gold was at that time actually somewhat north of $35. Now, the monetary authorities had three choices. They could tighten monetary policy, to make the dollar more valuable relative to gold. They could devalue the dollar against gold. Or, they could engage in a costly and futile attempt to hold down the dollar price of gold through market intervention.

Everybody out of the Pool

So what do you think they did? That’s right, they did what they always do in such circumstances: they intervened. Massively. They organized something known as the London Gold Pool, which operated from November 1961 to March 1968. The Gold Pool was a price suppression scheme operated by the Bank of England at the behest of the United States. It fed gold supplied by the US and seven European countries into the London bullion market. The seven became six after France pulled out in 1967 and moved conspicuously to the buy side.

[Source: www.canoe.ca]

The market ultimately forced the authorities to establish a two-tier system under which gold had both an official price, $35, and a market price, which was generally in the $40 range. By August 1971, when President Nixon finally pulled the plug, we were suffering a hemorrhage of gold. We had been pursuing a guns and butter policy for a long time, fighting a costly war in Viet Nam and enacting a number of expensive domestic entitlement programs. We had a substantial amount of inflation in the system, which the French and others had duly noted. The official price of $35 per ounce was absurd and couldn’t last.

You Have to Give Us Credit

Thirty years on, there are a number of striking similarities between our own adventure in fiat money, and its historical antecedents. For the most part, they’re obvious, and I won’t dwell on them: the winners and losers, the rise of the speculators, the rise of the debtors, the obliteration of thrift, the corruption. Read any newspaper, and you see that the nature of the excesses and distortions is pretty much the same.

But the scope and scale are on a different plane altogether. Our scope is global. Each of the prior examples was limited to a particular nation state. Our fiat money is the whole world’s problem. US dollar assets still account for about 75% of the monetary reserves of the world’s central banks.

And our scale beggars the imagination.

Sorry to interrupt your right brain reverie.

This chart shows graphically how even modern governments can’t manage a money supply.

It begins in 1959, just before the London Gold Pool got started. It ends at yearend 2002. Things have not improved since. The chart tracks the growth in our money supply, and our debt limits, on the right hand scale. Those are trillions of dollars. The light blue line is M3, the yellow is M2, the greenish blue line at the bottom is M1. The debt limit ceiling is shown in the blue stairstep line.

The technical term for this explosion in monetary aggregates is “nightmare.” The really sobering aspect of this is that it actually understates the money supply. The authorities have literally lost track of what money is. In Congressional testimony on February 17, 2000, Fed Chairman Alan Greenspan had a revealing exchange with Representative Ron Paul. See Definitions of Money in Congress: Webster vs. Greenspan. Mr. Paul asked Chairman Greenspan what he considered the best tool to measure the money supply. The Chairman admitted that he was at a loss to pick such a tool. Mr. Paul asked him:

“So it’s hard to manage something you can’t define?” And the Chairman answered:

“It is not possible to manage something you can’t define.”

As our chart shows, the Chairman wasn’t kidding.

The chart also tracks the gold price on the left hand scale. You can see how it started off at $35 back in 1971 in the last days of Bretton Woods. Gold had a fine romp in the late 70’s. You can also see there in the mid 90’s the footprint of the so-called “strong dollar policy,” or “weak gold policy,” as gold bugs put it. This policy featured covert intervention, a sort of “son of London Gold Pool,” that once again held down the gold price as our financial asset bubbles grew unchecked. But that’s a topic for another day.

Bad Moon Rising

Now, we don’t know exactly when the collapse will occur. This episode has already lasted a lot longer than it should have, much longer than any of its fellows. There are a number of reasons for this. One is the unique position of the United States as protector of the West during the Cold War. Another has been the absence of a plausible alternative reserve currency. Another is the massive and continuing interventions by a state that is more powerful than any that has come before. Another is China, which has supported the dollar in order to increase its exports. Still another is the fact that our biggest creditors have had a huge stake in postponing a collapse. With total debt of some $31 trillion on a GDP of $10 trillion, and combined annual deficits approaching $1 trillion, we may be too broke to go on as we are, but we’re also too big to fail.

However, signs of terminal stress abound.

Recent comments by Fed officials suggest we may be about to launch into crack-up overdrive. Fed Chairman Greenspan assured Congress back in November that deflation is not a risk. Quoth the Chairman: “There is virtually no meaningful limit to what we could inject were that necessary.”

This comment was famously echoed by Fed governor Ben S. Bernanke, a good Princeton man, about a week later. Addressing the National Economists Club in Washington in November of last year, he said (“Deflation: Making Sure ‘It’ Doesn’t Happen Here“):

Like gold, US dollars have value only to the extent that they are strictly limited in supply. [Note the irony.] But the US government has a technology, called a printing press (or today, its electronic equivalent) that allows it to produce as many US dollars as it wishes at essentially no cost. By increasing the number of US dollars in circulation, or even by credibly threatening to do so, the US government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Indeed.

When it comes, the final collapse will be a sudden breakdown, what we call today a non-linear event. It will also, in all likelihood, take everything else down with it.

After the Storm

[Source: www.posterphoto.com]

There. Back to the right brain. The third and final proposition is that gold will rise again. That seems a stretch, doesn’t it?

Even if I’m right and our fiat system does fail, why won’t it just be replaced by some other fiat system? Because the market won’t allow it. When the system collapses, the monetary authorities will be on the defensive. Having lost the confidence of the market, they won’t be able to get it back with more of the same. They will have to do what everyone in their position has done before them. They will have to show us the money. Real money. Money that’s an asset, not a promise. It will be at least another generation or two before a government can get away with another monetary swindle.

Now, I grant you that it seems incredible, sitting here today, that a population that has been systematically miseducated to despise precious metals will demand that they return to the center of financial life. But when the confidence goes, history teaches that’s just what will happen. We will relearn some very hard lessons. Gold will return to its historic role as the anchor for the Western monetary system, not because officials welcome it, but because the market will force their hand.

And that, I submit, is why it belongs in your portfolios.

Thanks for your attention.

Notes

1. Carl Menger, The Origin of Money (Monograph, Committee for Monetary Research & Education, Inc., 1984).

3. Peter L. Bernstein, The Power of Gold (John Wiley & Sons, 2000), p. 244.

4. Robert Mundell, The Wall Street Journal (op-ed page, 12/10/99, cited in Bernstein, p. 243).

5. Melchior Palyi, The Twilight of Gold (Henry Regnery, 1972), p. 5.

6. Ludwig von Mises, Human Action (Fox & Wilkes, 4th rev. ed., 1996), p. 472.

10. See Antoine Murphy, John Law (Oxford, 1997), passim.

11. Jason Goodwin, Greenback (Henry Holt & Co., 2003), p. 72.

12. William G. Anderson, The Price of Liberty (University Press of Virginia, 1983), p. 3.

13. Andrew Dickson White, Fiat Money Inflation in France (Foundation for Economic Freedom, 1959), p. 93.

14. Benjamin M. Anderson, Economics and the Public Welfare (LibertyPress, 2nd ed., 1979), p. 106.

17. Anthony C. Sutton, The War on Gold (‘76 Press, 1978), p. 111.