MPEG COMMENTARY - Page 11

May 15, 2000. The Fed: Up to its Earmarks in Gold Price Manipulation?

Testifying before Congress in mid-1998 on the subject of over-the-counter derivatives, Fed Chairman Alan Greenspan set off a minor fire storm in the gold community when he observed: "Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise."

In a letter dated January 19, 2000, to Senator Lieberman (Dem., Conn.) responding to questions posed by GATA, Mr. Greenspan affirmed that the Fed owns no gold and does not intervene in the gold market. Emphasizing this point, he wrote: "Most importantly, the Federal Reserve is in complete agreement with the proposition that any such transactions on our part, aimed at manipulating the price of gold or otherwise interfering in the free trade of gold, would be wholly inappropriate." Further explaining his prior statement to Congress, Mr. Greenspan added: "The observation simply describes the limited capacity of private parties to influence the gold market by restricting the supply of gold, given the observed willingness of some foreign central banks -- not the Federal Reserve -- to lease gold in response to price increases."

Subsequently, on March 29, 2000, Mr. Greenspan wrote to Congressman Ron Paul: "I don't know if I will be able to end speculation about U.S. involvement in the gold market, but I can say unequivocally that the Federal Reserve Bank of New York has not intervened in the gold market in an attempt to manipulate the price of gold on its own behalf or for the U.S. Treasury or anyone else."

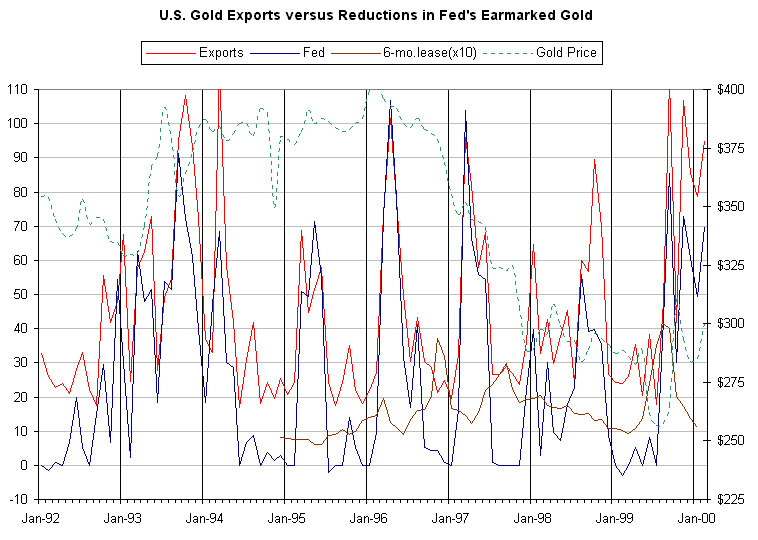

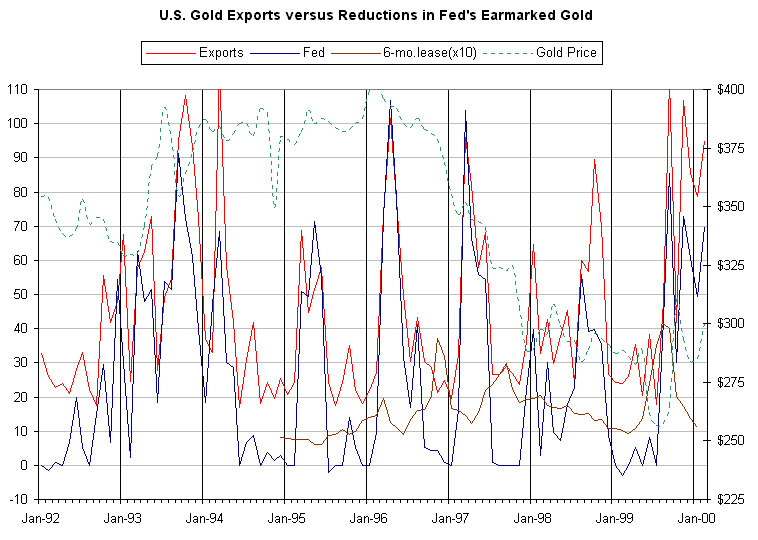

Mr. Greenspan, meet Elwood, or more specifically, Elwood's charts. Like many in the gold community, including myself and many who e-mailed me on the subject, Elwood was perplexed by the export figures for nonmonetary gold released monthly by the U.S. Department of Commerce. Determined to get to the bottom of the matter, he decided to chart on a monthly basis both the Commerce Department's export and import figures for nonmonetary gold and the figures given in the Federal Reserve Bulletin for reductions in "earmarked" gold held for foreign official agencies, primarily foreign central banks. Although he did not really need it, Elwood sought my assistance. As a result, not only did I come to have great confidence in the accuracy of his work, but also he agreed to custom-tailor for this commentary two special versions of the chart referenced at the end of my prior commentary. So, with special thanks to Elwood for all his work, here is the first chart:

What is immediately apparent from this chart is that disbursements of gold from the earmarked accounts of foreign central banks and other foreign official agencies at the N.Y. Fed, shown in blue, are included in exports of nonmonetary gold as reported by the Commerce Department, shown in red. Plainly there is no realistic sense in which these withdrawals of foreign official gold from the Fed are U.S. exports. Possibly they are reported this way by mistake, perhaps reflecting the fact that nonmonetary gold cannot be distinguished from monetary gold at the points where exports are measured. Intentionally or not, the effect is to gild the export numbers, making the trade balance appear better than it is.

At the end of World War II, the vast bulk of official world gold reserves were stored in the United States. By 1974, following the breakdown of the Bretton Woods international monetary system, approximately 12,500 tonnes ($17 billion @ $42.22/oz.) of foreign official gold remained in earmarked accounts at the N.Y. Fed. This number declined gradually in subsequent years, to about 9860 tonnes ($13.4 billion @ $42.22/oz.) in 1990. Since 1992, the pace of withdrawals has picked up, both absolutely and in percentage terms as shown in the following table:

Total Fed Reduction Reduction Official Date Earmarked in Year* in Year Sales** of Gold* ($millions) (tonnes) (tonnes) Sales** 1990 13387 69 51 1991 13303 84 62 1992 13118 185 136 202 (Bel.) Q2 1993 12327 791 583 400 (Neth.) Q4/92 Q1 1994 12033 294 217 1995 11702 331 244 175 (Bel.) Q1 1996 11197 505 372 203 (Bel.) Q1 1997 10763 434 320 300 (Neth.) Q1 167 (Austral.) Q2/3 125 (Arg.) Q1/2 1998 10343 420 309 299 (Bel.) Q1 1999 9933 410 302 75 (Brit.) Q3/4 30 (Neth.) Q4 * In $millions valued at $42.22/oz. **Major sales as reported by World Gold Council, GOS, 7/1998, 4/2000Total Fed outflows in the 1995-1998 period were 1245 tonnes. Well-publicized large official sales over the same period were 1269 tonnes. In 1995-1997, large sales at the beginning of the year roughly correspond to the big spikes in Fed outflows in the same years. So one relatively benign explanation for these Fed outflows is that they reflect official sales decided upon by foreign central banks with no coordinated design to influence gold prices. But is that the only plausible explanation, or has Mr. Greenspan suggested another?

In prior commentaries, I have hypothesized that any coordinated, large-scale official scheme to cap the gold price probably began in 1995 with the severe worsening of the Japanese economic crisis, continued through 1998 with the support of the major industrial nations, and then ran into European resistance after the successful launch of the euro in 1999. See generally Two Bills: Scandal and Opportunity in Gold. With the Europeans stepping back from further participation and plans for gold sales by the IMF going awry, the remaining gold price manipulators under American leadership were forced to resort in desperation to British gold sales, provoking European retaliation in the form of the Washington Agreement.

Reductions in gold in the foreign earmarked accounts at the Fed could just as easily represent leased gold as outright official sales. Indeed, leased gold exported from the U.S. by the private bullion banks who leased it might be more easily mistaken for nonmonetary gold exports than official gold sales, which often go directly to other official agencies. The volume of Fed outflows, around 1250 tonnes in the 1995-1998 period, is as consistent with leasing as with sales. This amount is about the same as the proposed Swiss gold sales, which in a prior commentary I suggested might be aimed at covering a roughly equivalent amount of gold previously leased by European central banks.

Obviously it is impossible to tell from the Fed's numbers whether the gold outflows from its foreign earmarked accounts represented gold for lease, outright sale or some combination of the two. But, taking Mr. Greenspan at his word, as of mid-1998 foreign central banks had in the past and stood ready in the future to lease gold into rising prices. This reason for leasing, of course, is not that ordinarily given by central banks, who claim that it is principally a means to earn income on an otherwise sterile asset. Looking at the chart, which shows lease rates in brown, there does not appear to be any significant correlation between lease rates and Fed outflows.

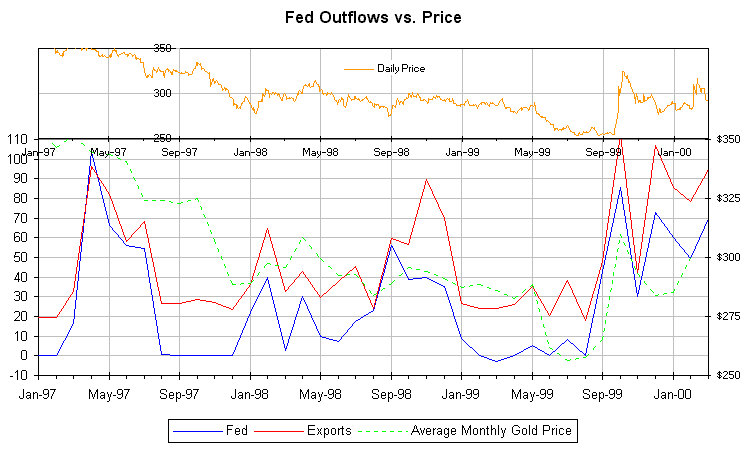

Mr. Greenspan did not reveal the source of his knowledge about the "observed willingness" of foreign central banks to engage in leasing for the purpose of controlling the gold price. Nor did he say why it was "appropriate" for them to do so but not the Fed. In any event, his knowledge of their activities could well have come to him as he watched foreign earmarked gold flow out of the N.Y. Fed. Particularly since 1995, spikes in these outflows appear to correlate quite closely with both gold price rallies and periods of international financial distress. In order to facilitate analysis of this relationship over the critical past three years, Elwood has obliged with a second chart:

In this chart, Fed outflows for each month are spotted at the end of the month, as are U.S. exports of nonmonetary gold. For technical reasons, average monthly gold prices, which ought to be spotted mid-month, must be put at the beginning of the month. However, to provide accurate reference to gold prices, they are plotted daily in the top section of the chart.

When the Asian financial crisis first broke in early 1997, Fed outflows initially surged into relatively high and strong gold prices. As it became apparent that the Asian crisis would not only dampen demand for gold in an important market but also precipitate some distress selling, gold prices began a sustained decline into the beginning of 1998. Fed outflows also declined and ceased. With the recovery of gold prices in early 1998, Fed outflows again picked up, showing small spikes with each rally. In 1995 and 1996, a similar pattern of otherwise quiescent Fed outflows spiking upward with gold price rallies is shown on the first chart.

When the Russian default and Long Term Capital Management fiasco struck in the fall of 1998, gold prices and Fed outflows again surged together. But then something strange happened. As gold prices continued their upward advance, Fed outflows fell back. But total U.S. gold exports, in amounts far in excess of ordinary monthly levels of around 25 tonnes, still spiked into the rising gold prices. Where did this gold, emanating from the U.S. but not from foreign earmarked accounts at the Fed, come from?

One obvious suspect is the Exchange Stabilization Fund, which also has a gold account at the N.Y. Fed and thus, assuming it had the gold, could have released it into the market through substantially the same channels as previously utilized for foreign earmarked gold. The ESF may also have had an additional motivation at this time. Impeachment proceedings were moving into full gear, and any serious financial disturbance might easily have been fatal to the Clinton presidency.

Where might the ESF have obtained some gold. When the Asian financial crisis hit Korea in late 1997, there was speculation that the Exchange Stabilization Fund might intervene with some sort of support package, although whether it did so has never been confirmed. Korea's own "Save the Nation" campaign took in about 200 tonnes of gold volunteered by its citizens. Accordingly, it is possible that the ESF bought or otherwise obtained some or all of this gold as part of a rescue package, and thus had it available in the U.S. in 1998.

Two other points bear on this theory: (1) most of the Korean gold must have been scrap, and therefore in need of some recycling, which could have been done in private U.S. refineries and/or through the government's own gold recycling program; and (2) this sort of activity could also explain the one time entry for commissions that appeared on the ESF's third quarter 1999 financial statements.

Wherever the gold came from in the fall of 1998, by the end of the year gold prices were comfortably under control well-below the $300/oz. level. Here they rested until April 1999, when increasing doubts surfaced regarding the ability of the IMF to secure the required approvals for its proposed gold sales. Gold prices began to rally, closing near $290 on May 6, and threatening the $300 level. At the same time there was just the tiniest blip upward in outflows of foreign earmarked gold from the Fed and total U.S. gold exports. Apparently these sources, including the mysterious gold that appeared during the previous fall, were tapped out.

Then, on May 7, 1999, Her Majesty's Treasury intervened with its yet to be explained and totally unexpected announcement of gold sales. British gold reserves are under the jurisdiction of the British Treasury's Exchange Equalisation Account, which was the paradigm for the ESF. Out of gold, either from its own account or from foreign earmarked accounts, the ESF may simply have executed a hand-off of the gold control ball to the EEA. The British announcement sent gold prices into a steep slide, but the European central banks were far from supportive.

On September 26, 1999, they announced the Washington Agreement. In the gold panic that followed, some foreign official gold was obtained from accounts at the N.Y. Fed. This gold, apparently unavailable in May, was thrown at spiking gold prices. Whatever extra gold that could be found in the U.S. was tossed into total U.S. exports. But these supplies were far from sufficient to meet the demand from panicked shorts, and the newest form of alchemy was pressed into service without restraint: paper gold, a/k/a gold derivatives.

In the last half of 1999, Citibank, former Treasury Secretary Rubin's new firm, increased the total notional amount of its gold derivatives by over 60%, from $7.2 billion to $11.8 billion. But among U.S. commercial banks, Citibank is a distant number three in this business. It could not fill the burgeoning demand. So the ESF and the Fed were forced to go where the Treasury used to go before the Fed succeeded J. Pierpont Morgan in 1913 as the last resort in a U.S. financial crisis.

Spouting gold derivatives in abundance, the House of Morgan spooked the longs and gained a reprieve for the shorts. Time was when a true Morgan rescue with real money marked a turning in the financial tide, and Morgan remained on the scene to guide the recovery. But as John Hathaway notes in his new essay, JP Morgan To The Rescue, www.tocqueville.com/brainstorms/brainstorm0065.shtml (alternate link: http://groups.yahoo.com/group/gata/message/453), at the end of 1999 Morgan shutdown its New York gold trading operations and moved them to London, conveniently close to the British Treasury and further from the view of U.S. regulators.

Whatever Mr. Greenspan may have intended to convey about the risks of gold derivatives and the knowledge or participation of the Fed in any scheme to control gold prices, he has not painted a very accurate picture of the true situation. Indeed, the notion that central banks possess a general power through leasing to control gold prices over the longer term is not just mistaken but dangerous. It is a prescription for a gold banking crisis. This subject will be addressed in my next commentary, together with the possible connection of the Swiss gold sales to the activities hypothesized in this commentary and dramatized so well by Elwood's charts, for which I again express my sincerest thanks.

May 3, 2000. House of Morgan: From Gold Bugs to Paper Hangers

No bank is more intertwined in the great events of U.S. financial history than the House of Morgan. More than once, J. Pierpont Morgan rode almost single-handedly to the rescue of the U.S. financial system. Never were the stakes higher, nor the outcome more uncertain, than on February 5, 1895. The U.S. Treasury faced imminent default on its gold obligations. In Morgan's view, widely shared on Wall Street and in London, default threatened a complete collapse of the national credit and the dollar. In a last minute effort to avert catastrophe, the great financier met with President Cleveland to try to salvage a plan for the issue of government gold bonds through a syndicate led by his bank. Based on an obscure Civil War statute, Morgan's plan faced heavy political opposition. But in a tense White House meeting, Morgan carried the day. Not until the deal was done did the President notice that the cigar which Morgan had pulled from his pocket upon arrival lay in brown dust on his lap. It would be more than century before another cigar played as famous a role in a White House rendezvous.

No one fought harder for restoration and maintenance of the gold standard after the Civil War than J. Pierpont Morgan. "Gold is money," he thundered. "That's it." Today the House of Morgan appears considerably more ambivalent on the subject. Its participation in GoldAvenue.com suggests some optimism about gold. On the other hand, the derivatives business of Morgan Guaranty Trust Co. of New York (hereinafter "Morgan"), a wholly-owned subsidiary of J. P. Morgan & Co., gives quite another picture.

Recent figures from the Office of the Comptroller of the Currency on the off balance sheet derivatives contracts of U.S. commercial banks show that Morgan continues to play an outsized role on the U.S. financial scene, particularly as regards gold. But there is a difference. When a Morgan ran Morgan, the dollar was as good as gold and the bank aimed to keep it that way. Today's managers at Morgan seem to have placed a huge bet against gold and on the paper dollar.

The following table is taken from the quarterly OCC Bank Derivatives Reports, which can be accessed at www.occ.treas.gov/deriv/deriv.htm. Since these reports cover only commercial banks, investment firms like Goldman Sachs and Merrill Lynch are not included. Neither, of course, are foreign banks. Data on individual banks is reported only for the seven banks having the largest total notional amounts of off balance sheet derivatives. Of these seven, only Morgan, Chase Manhattan Bank and Citibank NA reported any gold derivatives at the end of 1999. The table gives the total notional amounts of all gold derivatives for all reporting banks in US$ billions from March 31, 1995, together with Morgan's share in both dollars and percent from June 30, 1998.

Maturity Tonnes @ Gold* Tonnes @ Quarter <1 yr 1-5 yrs >5 yrs Total Gold Pr. Price $327/oz.** 1999/4 46.5 27.8 13.3 87.6 9388 290 8333 Morgan 20.9 11.3 5.8 38.1 4082 3623 % 45% 41% 44% 43% 1999/3 52.3 22.4 8.7 83.4 8676 299 7933 Morgan 21.0 7.6 1.8 30.5 3171 2899 % 40% 34% 21% 37% 1999/2 36.9 20.9 3.6 61.4 7317 261 Morgan 13.8 3.8 0.8 18.4 2188 % 37% 18% 21% 30% 1999/1 34.8 21.5 8.5 64.8 7213 279 Morgan 10.7 3.8 0.6 15.1 1677 % 31% 17% 7% 23% 1998/4 36.0 23.2 9.2 68.4 7392 288 Morgan 10.4 5.3 1.1 16.8 1811 % 29% 23% 12% 25% 1998/3 40.6 24.3 9.2 74.1 7844 294 Morgan 13.5 5.8 0.9 20.3 2148 % 33% 24% 10% 27% 1998/2 37.0 23.5 9.1 69.6 7306 296 Morgan 13.4 4.9 0.9 19.3 2026 % 36% 21% 10% 28% 1998/1 39.7 17.7 4.9 62.3 6438 301 1997/4 42.6 15.4 4.2 62.2 6667 290 1997/3 44.1 13.6 3.1 60.8 5694 332 1997/2 35.0 14.3 2.5 51.8 4816 335 1997/1 34.2 22.9 2.4 59.5 5317 348 1996/4 39.4 17.4 2.0 58.8 4953 369 1996/3 46.8 15.6 1.7 64.1 5261 379 1996/2 36.5 15.6 1.7 53.8 4381 382 1996/1 38.8 16.4 2.4 57.6 4520 396 1995/4 35.9 16.1 1.9 53.9 4335 387 1995/3 28.4 10.6 1.3 40.3 3264 384 1995/2 22.8 9.5 1.4 33.7 2708 387 1995/1 20.4 9.4 1.2 31.0 2515 383 * End of period, London, IMF International Financial Statistics. ** Average of Barrick's strike prices: $319 in 2000; $335 in 2001.This table shows a pattern of generally rising gold derivatives against generally falling gold prices. At the beginning of 1995, the total notional amount of gold derivatives converted to tonnes at market prices equaled just slightly more than annual new mine production of around 2275 tonnes. Currently new mine production is running at about 2500 tonnes, but total gold derivatives have increased to considerably more than 3 times this amount whether converted at market prices or the average price of Barrick's calls. Morgan's position alone equals some one and one-half years of total world gold production. Coincidentally or not, the total position now exceeds total official U.S. gold reserves of around 8140 tonnes.

Especially striking are the increases in the last half of 1999, and particularly in the last quarter. The British gold sales were announced on May 7, 1999, and the Washington Agreement on September 26, 1999. Both events, one presumably bearish for gold and the other bullish, were followed by large increases in total gold derivatives. In the third quarter, these increases were most pronounced in the under one year maturities. However, in the fourth there were large increases in the longer maturities, with the over five years category rising by more than 50%.

But even more extraordinary than the increases in total gold derivatives in the last half of 1999 were their increasing concentration in one bank: Morgan. Prior to 1999, Morgan had never held more than about $20 billion in total gold derivatives, nor more than 28% of the total outstanding for all banks. But beginning in the second quarter of 1999, Morgan took on a much larger role in the under one year maturities, possibly presaging the the British gold sales. Then, during the last half of 1999, Morgan more than doubled its total gold derivatives, taking them from $18.4 billion to $38.1 billion, amounting to 43% of the total for all banks. What is more, Morgan's over 40% dominance stretched across all maturities. In the fourth quarter alone, it increased its gold derivatives with maturities over one year by more than 80% to $17.1 billion from $9.4 billion, which may well answer the question of who sold Barrick the calls.

Typically financial rescue operations carried out by banks involve a sharing of the load and risk more or less in proportion to exposure. Indeed, normally banks strongly object to taking on more than their fair share of a problem, or to giving another bank -- not to mention a major rival -- a free ride. Until Morgan passed it in the third quarter of 1999, Chase was the largest provider of gold derivatives. Its total gold derivatives were $23.7 billion on March 31, 1999, falling to $20.5 billion by June 30. Thereafter they rose just slightly to $22.6 billion on September 30, falling back to $22.1 billion at the end of the year. This huge change in the relative positions of Morgan and Chase during a period of extreme turbulence in the gold market seems quite unusual unless Morgan acted with some sort of official approbation.

Notional amounts are generally the underlying contractual amounts from which derivative payments are determined. They are not typically the amounts at risk. Assessment of risk requires assumptions or estimates about the magnitude, timing and volatility of underlying price movements, the liquidity of the relevant markets, especially as regards the availability of appropriate hedge positions, and the creditworthiness of counterparties. Particularly for over-the-counter derivatives, which constitute over 90% of the total, risk assessment also requires knowledge of the details of the relevant contracts.

For example, Barrick's calls on 6.8 million ounces (211.5 tonnes) of gold at an average price of $327/oz. have a notional value of around $2.2 billion. However, this amount could not really be deemed at risk unless one assumed a doubling of the gold price to $654 before any of the calls expired and with no opportunity to put protective hedges in place. What is more, a provision making the calls dischargeable in dollars rather than bullion would further affect the risk calculation under certain conditions.

Total notional amounts of all off balance sheet derivatives for all reporting banks at the end of 1999 were $34.5 trillion, of which Chase accounted for $12.7 trillion and Morgan for $8.7 trillion. Approximately 80% of the total represents interest rate contracts, 17% foreign exchange, and 3% equities, commodities and credit derivatives.

Obviously gold derivatives are a tiny proportion of the total, about 0.25%. However, not only do they exceed annual new gold production by well over 3 times, but also they are of significant size relative to bank capital. At the end of 1999, Morgan reported total risk-based capital of $12.1 billion, or $12.9 billion for parent J. P. Morgan & Co. as a whole. The parent's total market capitalization is around $22 billion (at $135/share); total stockholders' equity at year end was $11.4 billion. Against these numbers, Morgan's total gold derivatives of over $38 billion, equivalent to roughly 3600 to 4000 tonnes of gold, are scarcely trivial.

How dangerous are these gold derivatives? Apart from dwarfing annual new mine production, they must also be viewed against: (1) reasonable estimates of a current equilibrium gold price on a commodity basis of $500 to $600/oz.; (2) a total net short gold derivatives position estimated at anywhere between 7000 and 14,000 tonnes; and (3) the possibility of a surge in western investment demand for gold caused by stock market declines or other outside events. In these circumstances, a swift upmove to $600/oz., with little or no retracement, cannot be discounted. Assuming that Morgan's book is equally divided between longs and shorts, a move of this size could well create actual liabilities equal to around 50% of the notional value of its gold derivatives. Failure of 20% of its counterparties to perform would imply losses to Morgan equal to approximately 10% of the notional value or $3.8 billion, which is nearly one-third of its total capital.

Of course, the actual situation could be much worse. To the extent Morgan or its counterparties had to deliver physical bullion, it might not be available at all, or only at much higher prices. The known facts already point to a real possibility that in the wake of the Washington Agreement, Morgan may have served to warehouse short gold positions of others, thereby keeping those who wanted or needed to cover out of the physical market and cutting short a potentially huge rally toward equilibrium prices. In this event, Morgan's book is likely far more short than long, and difficulties in securing physical bullion have already manifested themselves. But as dangerous as Morgan's gold derivatives may appear, it is very unlikely that Morgan took on this position without the full knowledge of the Fed.

Why did Morgan do so? What was the Fed's involvement? Is there any connection between the gold derivatives positions of the big U.S. banks and the Swiss gold sales? What are the possible end games for Morgan and the other U.S. banks? Before tackling these intriguing questions, it is first necessary to look at U.S. gold exports and reductions in foreign earmarked gold at the N.Y. Fed. This interesting subject will be addressed in my next commentary. In the meantime, I recommend study of the chart found at the following link: http://www.geocities.com/goldtango/analysis1.htm.

April 24, 2000. The Golden Ostrich: Misruling the Roost in Gold Mining

Nothing better represents the executive echelons of the gold mining industry than the legend of the ostrich: the world's largest bird reputed to respond to danger by burying its head in the sand. The legend is untrue. Brooding ostriches lower their long necks to avoid detection. Messing with them invites savage attack.

But the legend is apt for another species: the golden ostrich. Without apparent flight or navigational skills in the real world of gold and money, these birds climb to the top perches in the gold mining industry, where they sit secure in golden parachutes, singing for stock options and pecking at shareholder equity. Pull their feathers, eat their lunch, starve their young, they remain docile, accepting misfortune as their fate. Crumbs from the sovereign's table, doled out in miserly servings by his bullion bankers, are their diet and the apparent limits of their ambition. C'est la vie pour l'autruche d'or.

Where better to look for a real John Galt, hero of Ayn Rand's Atlas Shrugged, than at the head a major gold mining company, leading the fight for honest money? On peut l'y chercher; on ne le trouvera pas. Today those positions are largely filled by a bunch of Mr. Thompsons, men with mining, management and accounting skills, but as deserving as the original of John Galt's scorn:

Thinking is man's only basic virtue, from which all others proceed. And his basic vice, the source of all his evils, is that nameless act which all of you practice, but struggle never to admit: the act of blanking out, the willful suspension of one's consciousness, the refusal to think -- not blindness, but the refusal to see; not ignorance, but the refusal to know. It is the act of unfocusing your mind and inducing an inner fog to escape the responsibility of judgment -- on the unstated premise that a thing will not exist if only you refuse to identify it, that A will not be A so long as you do not pronounce the verdict "It is." Non-thinking is an act of annihilation, a wish to negate existence, an attempt to wipe out reality. But existence exists; reality is not wiped out, it will merely wipe out the wiper. By refusing to say "It is," you are refusing to say "I am." By suspending your judgment, you are negating your person. When a man declares: "Who am I to know?" -- he is declaring: "Who am I to live?"

Underground miners who do the hard, dirty, dangerous work of digging gold ore know that existence exists. Theirs is one of those activities where to forget this basic principle is to court an early and painful demise. But neither rockbursts nor cave-ins patrol the executive suite or the boardroom.

Gold bugs, the gold mining companies' largest natural constituency, may sometimes appear almost overzealous in their search for the truth about gold and money. If they sometimes see things that may not exist, it is not for want of sincere desire to know the truth but because they have already known too many official lies and deceptions. They are among the small band of paranoiacs who have good reason for their affliction. Burdened with much deeper knowledge of gold than the mining executives who produce it, gold bugs receive mostly brickbats from the industry in which they are the principal investors.

Running a gold mining company is not easy. Too diligent a search for the truth about official policies relating to gold and money can quickly lead to conflict and confrontation with powerful political interests, some of whom may wield influence over the company's bullion banks or the official permitting authorities with which it must deal. Then too, with gold money now relegated to the academic and political fringe, wearing the gold bug label too brazenly may bring a certain degree of social chill into previously warm relationships.

There is never a shortage of reasons for going along to get along. The real question is whether the leaders of the gold mining industry are prepared to change their ways and join the fight for gold in its most important use -- as permanent, natural money. If not, shareholders should wipe them out before they wipe out their companies and the industry.

Two recent statements by high-ranking gold mining executives illustrate the problem. One suggested that either a lower gold supply or increased consumption is necessary to raise gold prices. What? Annual demand now exceeds new mine production by some 60%, but this executive has yet to absorb the most basic fact about gold: it is the only commodity produced by man for accumulation rather than consumption.

Another asserted that there is no credible evidence of gold price manipulation by governments or bullion bankers over the past year, a view confirmed by a third as that generally held in the industry. But ask any of them why the British and the Swiss are selling half their gold reserves, and at best you will get a blank stare. They cannot tell you because neither they nor the World Gold Council has made any judgment on the true reasons for these sales notwithstanding the complete failure of either the British or Swiss governments to put forward any genuinely plausible ones of their own.

Nowhere is this suspension of judgment more obvious than in the WGC's own publications. The April issue of the WGC's Gold in the Official Sector (www.gold.org/Gra/Gios/11/Contents.htm) contains articles on the Swiss, British and Dutch gold sales. The main point of the first is that Swiss do not yet have any clear idea of what to do with proceeds. A child would ask -- but not the WGC -- why the Swiss are in a rush to sell gold at multi-year lows if they have no current use for the proceeds.

The main point of the other two is to contrast Dutch "deftness" with British "daftness" in implementing their respective gold sales. Not much sophistication is required to ask -- although the WGC does not -- whether the British are really as daft as they appear, or whether perhaps there is a method to their madness, not to mention whether there could be some relationship between all these sales and the enormous net short gold derivative positions that have built up in the paper markets. Confidence has been defined as suspicion asleep; the WGC and the industry it represents are intelligence asleep.

Will they wake, or resting in their collective coma will they be carried off? Two recent statements by Miss Haruko Fukuda, CEO of the WGC, could represent cause for hope. Speaking in January on Gold in the 21st Century (www.gold.org/Gra/Speeches/Hf000127.htm) to the Zurich Business Club, Miss Fukuda observed: "The scenario of prolonged weakness in the gold price is to the detriment of all, except those who want to see the absolute supremacy of the dollar." Last week, speaking at the annual meeting of the Gold Institute, Miss Fukuda revealed that some third world nations are now negotiating with the IMF about scrapping its prohibition on currencies linked to gold. This subject, including the IMF's anti-gold policy adopted in 1978 at American behest, is discussed in a prior commentary as well as The Golden Sextant.

Although not popular with the IMF, currency boards can be a reasonably effective solution to the problem of crummy, unreliable paper currencies in developing countries. But a country prepared to accept the discipline of a currency board is also ready to accept the discipline of gold. What is more, by linking to gold, a nation takes the interest rates associated with gold rather than those of another country whose currency is administered by its central bank according to the particular requirements of its own economy.

Here is a cause -- the freedom to choose gold money -- in which the WGC could and should be a leader, not merely to expand the use of gold, but to support many peoples whose yearning for economic development and democratic government cannot be satisfied without first giving them sound money. Gold is where you find it, and many mining companies have found it in the world's less developed countries. Mining gold that serves to increase the monetary base for their own expanding economies is likely in the long run to be far more attractive to these countries than mining gold to be exported for use as jewelry elsewhere.

Indeed, failure to appreciate gold's monetary importance can lead to political problems for gold mining companies even in the developed world. In a recent polemic, Gold at What Price (April 5, 2000, www.mineralpolicy.org/index.php3?whatshot=3), a U.S. environmental group argues that it is ridiculous to despoil beautiful countryside mining gold for jewelry, dental fillings and other minor purposes when gold enough to last for years sits unused in the vaults of central banks. And the truth is, if gold is not money, the point is well-taken.

By first raising the spectre of gold as competition for the dollar, and then the possibility of gold-linked currencies for developing countries, the intrepid Miss Fukuda has edged dangerously close to what has heretofore been forbidden terrain in the mostly macho male world of gold mining. Klondike Jessie herself must be smiling at the thought of this woman giving the boys some lessons in the ways of the world. And if that's her plan, she deserves support from all shareholders of gold mining companies.

But either way, the season of annual meetings is underway, and shareholders should speak out against managements that almost to a man refuse: (1) to promote gold as money, its natural, highest and best use; or (2) to act on the ever growing body of circumstantial evidence suggesting massive official suppression of gold prices carried out through leading bullion banks. In this event, it is not just the profits of gold mining companies that are affected. Other critical aspects of their businesses -- calculations of ore reserves, long term planning, not to mention hedging -- are almost certainly based on flawed assumptions about the probable course of future prices. Cambior and Ashanti are dramatic testimony to the perils of putting gold mining companies in the hands of managers too reliant on advice from bullion banks and too unaware of gold's role as an international monetary reserve.

Time is past due for the golden ostriches to be knocked from their comfortable roosts. If they cannot or will not fly in the real world of gold and money, of international monetary politics and much needed reform, they should be grounded before they crash their companies and their industry. In short, what gold mining needs in its boardrooms as well as underground are some real John Galts. C'est vrai.

April 16, 2000. Gold: Unchained by the Swiss; Ready to Rock!

Barring the unexpected filing of a referendum petition by April 20, Swiss gold sales should begin in May. Gold's foes will hail the disappearance of the last legal barrier to the Swiss sales as another bearish event. In fact, it is likely just the opposite. My guess is that almost none of these sales will result in added physical supply reaching the market. Rather, I expect this gold will mostly replace that previously leased into the market by Euro Area central banks, allowing them to bring their physical gold stocks to the same levels as their officially stated gold reserves.

By assuring sufficient physical gold to cover outstanding gold loans on the books of EA central banks, to whom it can be directly channeled through the BIS, the Swiss sales obviate the risk of embarrassing defaults that a rising gold price would otherwise bring, particularly in a gold market that is net short by two to four years of annual production. And by removing this risk, the Swiss sales leave the EA central banks, collectively the world's largest holders of monetary gold, with many reasons to cheer -- and no strong reason to oppose -- rising gold prices.

With respect to this commentary, the April issue of the World Gold Council's Gold in the Official Sector (www.gold.org/Gra/Gios/11/Contents.htm) contains some useful background information, including articles on the Swiss sales (p.1), the BIS and gold (p.2), and the BIS's smooth handling of the recent Dutch sales (p.4). The WGC, and the mining industry that supports it, deserve criticism for their self-defeating aversion to speaking out for gold as money or in protest against official manipulation of gold prices. Nevertheless, the WGC puts out a lot of good information, even if its interpretation of some of that information is often at variance with mine, as is partially the case with the Swiss sales.

Two prior commentaries may also be helpful: Two Bills: Scandal and Opportunity in Gold, giving details about the genesis of the Washington Agreement, and It's the Dollar, Stupid, especially the table showing official gold reserves as reported to the IMF. These figures include leased gold as well as physical gold stocks, a fact underscored by Kuwait's reported gold reserves of 79 tonnes notwithstanding that nearly all of it is admittedly on loan through the Bank of England.

On April 7, the Swiss National Bank released its 92nd Annual Report 1999, which can be found at the English language version of the SNB's website (www.snb.ch/e/aktuelles/index.html), but the report itself is available only in French or German. The critical information on the SNB's gold loan activities is contained in section 1.4 and notes 20 and 21.

As of year-end 1999, the SNB' total gold reserves were 2590.2 metric tonnes, the same figure as reported to the IMF, consisting of 2274.5 tonnes of physical gold stocks (in various places both in and outside Switzerland) and 315.7 tonnes of gold on lease. Total leased gold increased by 128.9 tonnes (or 69%) over 1998. In a new twist, 73.3 tonnes (or 23%) of this gold, having a market value of SwF1102.6 million, were secured by collateral with a market value of SwF1089.5 million. The average maturity of the gold loans outstanding was 7.25 months, and the average annual rate of return on gold loans in 1999 was 1.6%. The new practice of requiring collateral on certain gold loans was instituted during the year to reduce credit risk even though it also produced a lower rate of return.

The report also confirms the SNB's "intention to begin as rapidly as possible to sell the 1300 tonnes of gold no longer necessary for monetary purposes." These sales, as the report notes, were included within, and are planned to be carried out pursuant to, the Washington Agreement of September 26, 1999, regarding future sales and leasing of monetary gold. Under the agreement, the participants (SNB, European Central Bank, 11 central banks of the Euro Area, Bank of Sweden, and BOE for the British Treasury) are limited to selling no more than 2000 tonnes, at a rate of about 400 tonnes per year, in a coordinated program to extend for five years from the date of the agreement. During this period, the same banks also agreed not to expand their gold leasing or their use of futures and options.

The 2000 tonnes are allocated as follows: Switzerland, 1300 tonnes; Britain, 365 tonnes to carry out the remainder of the sales program of 415 tonnes announced May 7, 1999; Netherlands, 300 tonnes announced in October 1999; and Austria, 90 tonnes announced at the beginning of April. Altogether these announced sales total 2055 tonnes, so someone will have to cut back a little to stay within the limit of 2000 tonnes.

Since the date of the agreement, Britain has sold 75 tonnes and plans to sell another 75 tonnes in 3 auctions prior to October (May 23, July 12, and an unspecified date in Sept.); the Dutch have already sold their first year quota of 100 tonnes; and Austria has sold 30 tonnes. Thus, of the 400 tonnes permitted in the first year, at least 280 tonnes have been sold or are in process to be sold, leaving no more than 120 tonnes to be sold by the Swiss before October.

Setting aside the British sales and disregarding the 55 extra tonnes implied by the Austrian announcement, Switzerland and the EA are allowed sales of 1635 tonnes: 1300 by Switzerland and 335 by the EA countries, mostly the Dutch. The planned sales by the EA countries approximate quite closely the SNB's gold loans outstanding, which are about 12% of its total gold reserves as reported to the IMF. In the absence of specific figures on gold loans for the EA countries, it seems fair to assume that collectively their total gold loans are about the same percentage of total reserves as the Swiss.

At the end of 1999, the EA countries as a group reported total gold reserves of 12,457 tonnes to the IMF, or 11,710 tonnes excluding the gold held by the ECB itself. Putting their total outstanding gold loans in a range of 10% to 12% gives estimates of 1250 to 1500 tonnes on the full total, or 1170 to 1400 tonnes on the total excluding the ECB. If these estimates are reasonably accurate, their total gold loans are about equal to the planned Swiss sales, just as total EA sales are about equal to Swiss gold loans.

In these circumstances, final approval for the Swiss gold sales could put the last block in place for a workout of all or most outstanding gold loans on the books of both the EA central banks and the SNB. The essence of the plan would be to allow the leased gold on the balance sheets of the EA central banks to be replaced by gold purchased from the Swiss, and leased gold on the SNB's balance sheet to be replaced by gold purchased from the Dutch and Austrians.

Because the ECB reports total gold reserves for the EA in aggregate, including its own and those of the member central banks, gold sales between EA central banks would wash out in consolidation. To retire gold loans without drawing down its combined gold stocks, the EA must have the ability to purchase gold from an outside country such as Switzerland. And for Switzerland, with by far the highest per capita gold reserves of any nation, the logical quid pro quo is assurance of effective inclusion in the EA while remaining formally outside it in accordance with the currently expressed preference of a majority of its citizens.

The precise wording of the SNB's statement about "its intention to begin as rapidly as possible" its gold sales may also be significant. It says nothing about completion of the sales. A previous commentary queried the need for speed, so vigorously championed by SNB Vice President Jean-Pierre Roth. But haste in securing legal authority to start a program is quite different from quick completion of the program. Rising pressures in the gold market, described in more detail later, would make anyone party to a plan relying on Swiss sales anxious to complete all legal requirements as quickly as possible.

A plan of this nature would: (1) recognize that leased gold -- already sold into the market -- cannot be replaced without forcing many borrowers into the market, driving gold prices much higher, and increasing the risk of defaults; (2) avoid any physical defaults on outstanding gold loans of the EA central banks and the SNB by covering all of them with interbank gold sales; and (3) put reported official gold reserves of all these central banks after the sales at the same levels as their remaining physical gold stocks.

The plan would also carry two other important features. First, little or no new physical gold would enter or leave the market. Borrowers on outstanding gold loans would be allowed to settle in paper, effectively paying for the gold purchased from another central bank. All transactions would be channeled through the BIS, generally at market prices, but leaving it in full control of the destiny of the gold. Second, in the event of much higher gold prices threatening the solvency of a bullion bank that is also an important commercial bank, the plan would allow a rescue through paper instruments without fear of defaults on the bullion bank's gold obligations per se.

The WGC has applauded the BIS's deft handling recent Dutch gold sales, noting that 100 tonnes were fed into the market over 12 weeks from December through February without any apparent affect on gold prices. At the end of December, the SNB had secured gold loans of just over 73 tonnes. The market value of the collateral closely approximated the market value of the loans, suggesting that the security might really be serving in lieu of payment until physical gold could be found to retire the loans. Not to take anything away from the BIS, but a pre-arranged waiting market for the Dutch sales could also explain the benign market reaction.

Whether such a plan exists, of course, is speculation. But if so, three conclusions follow: (1) for a total cost of some 1600 tonnes of gold, the EA and Switzerland -- the old gold bloc -- have bought sufficient time to launch the euro successfully in relative monetary calm; (2) a net short position of over 1600 tonnes will be accorded tolerable terms of surrender, resulting in less upward pressure on gold prices from this particular source than might otherwise be the case; and (3) the EA central banks and the SNB, no longer facing the prospect of defaults on their outstanding gold loans, are in position to let the gold market truly run free. What is more, they have some incentive to do so.

The EA and Switzerland are by far the world's largest holders of official gold. With the EA already marking its gold reserves to market on a quarterly basis, rising gold prices are in its interest. Recent rumors of French gold sales to fund state pension obligations were quickly denied by the Bank of France, and anyway would not be permitted under the Washington Agreement for more than four years. But as noted in an earlier commentary, ultimately much higher gold prices may represent a partial solution to acutely underfunded pension programs in many EA countries. In this connection, while the Swiss have not yet decided what to do with the proceeds of their gold sales, dedicating them to the pension system currently appears to have the most support.

In any event, whether or not the Swiss gold sales form part of a wider plan, gold's future looks bright.

In Gold Watch (March 22, 2000, www.gold-eagle.com/gold_digest_00/veneroso032200.html), Veneroso Associates analyses recent data from both Gold Fields Minerals Services and the World Gold Council, and concludes that in all probability "there was absolutely huge undisclosed official selling in 1999." Indeed, looking at the fourth quarter of 1999 for which only about 100 metric tonnes of official selling was announced, Veneroso Associates now estimates that there must have been undisclosed official selling of as much as 1000 tonnes or possibly more. Because the official sector can and often does meet demand for physical gold through leasing rather than outright sales, what the Veneroso study labels "undisclosed official selling" would include leasing that ordinarily is not disclosed in IMF figures.

The Veneroso study attempts to track physical gold flows, i.e., gold demand for jewelry, bar hoarding and official coin. By comparing these flows to new mine production of around 2500 tonnes annually, estimates can be made of official or other dishoarding needed to meet annual new physical demand, now thought to run in excess of 4000 tonnes. Because new mine supply has failed to meet physical demand for several years, knowledgeable estimates of the current net short gold position run anywhere from about 4000 tonnes to well over 10,000 tonnes. Even with 1600 tonnes removed, there is plenty of fuel for a vicious short squeeze.

Following the Washington Agreement, lease rates spiked to around 8% from already high levels of 3% to 4%. But since November they have returned to more normal levels of 1% to 2% and remained there despite the size of the net short position. As discussed in a prior commentary, when fundamental factors such as gross undervaluation of gold give rise to a gold banking panic, both gold loan activity and lease rates are likely to remain depressed until gold is revalued to a more realistic level. Current lease rates are consistent with this pattern. What is more, despite a more normal contango, gold mining companies continue in general to cut back on their hedging.

Activity and open interest in the paper markets has shown varying levels of decline, particularly on the LBMA and TOCOM, but to some extent on the COMEX as well. One analyst has produced some studies suggesting a repeating pattern of small gold price increases in overseas markets being met by larger decreases in New York. H. Clawar, Making Money with Manipulators (April 3, 2000, www.gold-eagle.com/editorials_00/clawar040300.html), and prior articles cited. Another has noted a huge increase in gold derivatives during the last quarter of 1999 as reported by the major U.S. money center banks to the Comptroller of the Currency. U.S. Doran, Is It Just a Simple Bear Raid? (April 4, 2000, www.gold-eagle.com/editorials_00/doran040400.html). At the same time, unusual physical gold disposals such as Kuwait's underscore the increasing difficulty of obtaining physical gold.

All these straws in the wind point toward an ever tightening physical market pushing to break free from the bonds imposed by the paper and derivatives markets. Any manipulation by the Exchange Stabilization Fund and its prototype, the Exchange Equalisation Account in the British Treasury, the actual seller of the British gold, ultimately will be broken by market forces if not by exposure. Whatever they have done to cap the price has only further compressed the coiled spring that gold has become.

While current conditions in the gold market itself are sufficient to propel prices much higher, external events could detonate a price explosion. Gold is typically a contrarian and counter-cyclical investment. Collapses in other markets -- equities, bonds, the dollar -- could quickly lead to new investment interest in gold on top of already strong physical demand. If these collapses mark the end not just of an ordinary business cycle, but also, as I suspect they will, of the whole the dollar-based post-Bretton Woods international monetary system, gold will reclaim the monetary throne.

The gold shorts and their friends in high places will propagandize the Swiss sales as another nail in gold's monetary coffin. But the Swiss are not bugling the death knell for gold. What they may be sounding, however, is taps for the U.S. dollar. Perhaps that is the tune that triggered Alan Greenspan's sudden nostalgia for the gold standard last Friday while stock markets were in full retreat.