SecondAffidavitExhibits

LIST OF EXHIBITS TO PLAINTIFF'S SECOND AFFIDAVIT A. Updating Data from Official Sources Exhibit 1A: Tables 3.12 and 3.13 from January 2001 Federal Reserve Bulletin

Exhibit 1B: Tables 3.12 and 3.13 from February 2001 Federal Reserve Bulletin

Exhibit 1C: Tables 3.12 and 3.13 from March 2001 Federal Reserve Bulletin (not online)Exhibit 2A: Status Report of U.S. Treasury Owned Gold for May 31, 2001

Exhibit 2B: Status Report of U.S. Treasury Owned Gold for July 31, 2001Exhibit 3A: Table ESF-2 for 1st fiscal quarter of FY 2000

Exhibit 3B: Table ESF-2 for 1st fiscal quarter of FY 2001

Exhibit 3C: Table ESF-1 for 1st fiscal quarter of FY 2001B. Relevant Additional Evidence

1. Gold Price ManipulationExhibit 4: Pages 17-19 from the transcript of Federal Open Market Committee meeting on March 26, 1991, containing reference to "swap puts" on U.S. gold by former Federal Reserve Board governor Wayne Angell

Exhibit 5A: Letter dated June 25, 2001, from Alan Greenspan to Senator Jim Bunning

Exhibit 5B: Memorandum dated June 8, 2001, from J.Virgil Mattingly, Esq., to Alan Greenspan

Exhibit 5C: Federal Open Market Committee's explanation of procedures used in preparing transcripts of its meetingsExhibit 6: Part IV.1 (gold transactions) from "Statistical Treatment of Eurosystem's International Reserves" published by European Central Bank

Exhibit 7: Article by Lawrence H. Summers et al., "Gibson's Paradox and the Gold Standard," Journal of Political Economy (vol. 96, June 1988, pp. 528-550)

Exhibit 8: Plaintiff's commentary "Gibson's Paradox Revisited: Professor Summers Analyzes Gold Prices," published August 13, 2001, at The Golden Sextant

Exhibit 9: Chart entitled "Real Rates & Gold"

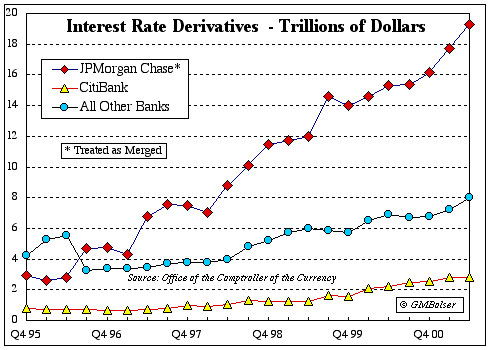

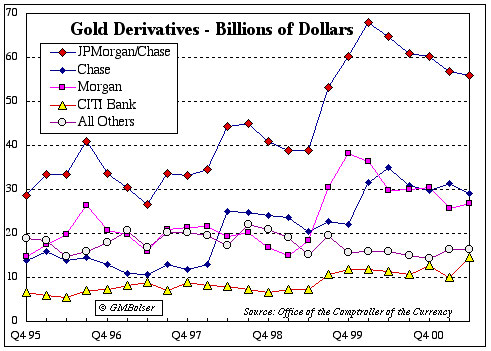

Exhibit 10: Stacked charts drawn from OCC reports on interest rate and gold derivatives

Exhibit 11: Article by John Hathaway, "Gold as Theatre," August 23, 2001

2. Bank for International Settlements Exhibit 12: Article by A. Kueppers, "Minority of Mannesmann Holders Continue Resistance to Vodafone," The Wall Street Journal (August 27, 2001, p. A10)

Exhibit 13: Article by Adrienne Robert, "BIS banker speaks on gold," Financial Times (London) (August 31, 2001, p. 42)

Exhibit 14: Letter dated August 17, 2001, from plaintiff to BIS Arbitral Tribunal

Tab 15: Reserved for future responses to Exhibit 14

***** EXHIBIT 9 - Chart

***** EXHIBIT 10 - Interest Rate and Gold Derivatives

***** EXHIBIT 12 - Letter to BIS Arbitral Tribunal Reginald H. Howe

49 Tyler Road

Belmont, Massachusetts 02478-2022

tel. & fax: (617) 484-0029

e-mail: row@ix.netcom.comAugust 17, 2001

Phyllis Hamilton, Secretary to the BIS Arbitral Tribunal

Dane Ratliff, Assistant Counsel

Permanent Court for Arbitration

Peace Palace

2517 KJ The Hague

The NetherlandsDear Ms. Hamilton and Mr. Ratliff:

Unfortunately my e-mail communication of July 25, 2001, to the Permanent Court for Arbitration (the "PCA") with reference to the BIS Arbitral Tribunal (the "Tribunal") failed to elicit the information sought, except that I infer from Mr. Blackman's letter dated August 2 that: (1) a preliminary conference is indeed scheduled for September 7; and (2) as of August 2, no former private shareholder other than Dr. Reineccius had filed a notice of arbitration and/or statement of claim.

Since the BIS objects to my participation in the September 7 conference unless I first file a formal notice or claim, which I am neither in a position nor required to do prior to that date, I have not made any plans to attend. The purpose of this letter is to request advice, clarification or information from the Tribunal on specific matters that I must consider prior to filing any notice of arbitration relating to the Bank's freeze-out of its private shareholders. In addition, I am taking this opportunity to indicate certain issues of tension or conflict between any arbitration that the Tribunal may hold relating to the freeze-out and my pending lawsuit, Reginald H. Howe v. Bank for International Settlements, et al., United States District Court for the District of Massachusetts, Civil Action No. 00-CV-12485-RCL, relating to the same event. (Copies of all the plaintiff's important filings are available at my website, www.goldensextant.com, in HTML format. These same materials are available in PDF format at www.zealllc.com, as are copies of all the important filings of all defendants.)

Secretary to the BIS Arbitral Tribunal, August 20, 2001, page 2 Challenges to Jurisdiction and Arbitrability. My positions with respect to relevant aspects of the Tribunal's existence, jurisdiction and procedures as well as the arbitrability of the various issues in dispute between me and the Bank, including its involvement in suppressing gold prices over the past few years and thereby reducing the value of its shares, are set forth in Plaintiff's Consolidated Opposition to All Motions to Dismiss and Plaintiff's Affidavit filed in that action. Nothing in this letter should be taken to waive any of these positions or arguments, and they are all expressly reserved.

The lawsuit was filed on December 7, 2000, thereby effecting notice to the BIS of my objections to the freeze-out more than a month in advance of its vote thereon. Notwithstanding that Article XV of the treaty referenced in Article 54 of the Bank's statutes calls for a permanently sitting arbitration tribunal composed of five members appointed for five-year terms, no such body was in existence at the time of this filing, or at any subsequent time while I remained a shareholder, or indeed, so far as I can determine, at any time since the Second World War.

Article 54 provides for arbitration of disputes "between the Bank and its shareholders, with regard to the interpretation or application of the Statutes of the Bank." Contrary to the first sentence of the PCA's information notice, there is no provision for arbitration of disputes involving "treaties ... of the BIS" as well as its statutes. Nor does Article 54 provide for arbitration of disputes between the Bank and its former shareholders, as would be expected if the Bank possessed authority to freeze-out its private shareholders and the Tribunal were the intended forum for resolving controversies arising therefrom. In any event, no reasonable reading of Article 54 can encompass a dispute that could not have been submitted to the Tribunal by a former shareholder while he was a shareholder, especially when his loss of shareholder status resulted entirely from unilateral action by the Bank.

For these reasons and as set forth in my U.S. federal court action, any notice of arbitration or statement of claim that might in future be submitted by me will include challenges to the jurisdiction of the Tribunal and to the arbitrability of the dispute. Accordingly, should the Tribunal consider these or related issues -- either sua sponte or at the request of a party -- in any arbitration proceeding relating to the freeze-out, I request prior notice and an opportunity to present argument. Conversely, these same issues are pending before the court in my case, and its

Secretary to the BIS Arbitral Tribunal, August 20, 2001, page 3 decision thereon could affect the validity of any arbitration proceeding relating to the freeze-out.

Representative Nature of the Proceeding. Mr. Blackman's letter of August 2 states in part:

The Bank has also announced, in order to avoid repetitive arbitral proceedings, that it will voluntary pay all former shareholders any additional compensation that the Tribunal may deem to be appropriate, without the necessity of their filing a claim. However, this does not mean, that a former shareholder who files a claim "represents" anyone besides himself, and no former shareholder, whether he chooses to file or not, is legally bound by the actions of any other former shareholders.

Whether or not one chooses to characterize the proceeding thus described as a class action (a form of action that exists in Canada as well as the United States), it presents many of the same problems, including but not limited to the following:

First, if there are multiple claimants and proceedings, the evidence and contentions presented in each case may vary, as may the awards (assuming that the Tribunal is not biased in later cases by the presentations in prior ones). In the event of multiple awards, which -- the highest, the lowest, the first or some other -- will set the amount of the Bank's payment to former shareholders who do not file claims?

Second, there is no provision in the Tribunal's rules (or otherwise) for the recovery of legal expenses and costs of arbitration by a shareholder whose efforts effectively secure a higher per share valuation for all shareholders. For example, I held six shares of the American issue, which means that at net asset value (and setting aside the issue of mandatory payment in Swiss gold francs), my additional recovery would be around $57,000, an amount that could easily be exceeded by my legal expenses and costs. However, at net asset value, the additional payments to all former shareholders would amount to some $700 million. In the event that former shareholders who undertake the expenses and risks of an arbitration are successful, what is the Tribunal's position with regard to allowing them to recover their legal expenses and costs as a charge against the enhanced payments to all?

Secretary to the BIS Arbitral Tribunal, August 20, 2001, page 4 Also, will the Tribunal allow them or their lawyers to receive a bonus payment or contingency fee out of these same funds?

Third, the Tribunal's own rules make no provision for the equitable allocation of costs in an arbitration involving the BIS on one side and its shareholders in more or less common cause on the other. Rule 1 of Annex XII provides in relevant part: "[E]ach Party shall pay its own expenses and an equal share of those of the Tribunal." Under this provision, the greater the number of shareholders who appear as parties in a combined proceeding, the greater their proportionate share of the costs of the Tribunal. If Dr. Reineccius and I were the only two claimants, we would have to pay two-thirds of those costs. If there were a third, the claimants would pay three-quarters. If all private shareholders joined in a single proceeding, they would pay virtually the full costs of the Tribunal. On the other hand, if each claimant's case is conducted separately, the total costs of all the proceedings is likely to far exceed those of a combined proceeding. Can the Tribunal provide any further guidance with respect to the handling of its costs?

Fourth, under Article 33 of the Tribunal's rules effective March 23, 2001, for arbitrations between the BIS and private parties, the Tribunal's costs are defined to include: the fees of the Tribunal as fixed by it, the Tribunal's travel and other expenses, the cost of experts or other assistance engaged by the Tribunal, and the fees and expenses of the PCA. Under Article 34, each party is required to deposit an advance on its share of the costs, and additional advances may be required during the course of the arbitration. Failure to make advances as required can result in termination of the proceedings. These provisions, which give the Tribunal an unlimited call on the resources of the parties, appear designed for arbitrations involving disputes between governments and the BIS, which are in fact the only disputes contemplated in Article XV of the relevant treaty. However, these provisions are wholly inappropriate and unfair when applied to an arbitration between the Bank and a private shareholder, and especially so in a proceeding involving the forced taking of privately held shares. Reserving this objection, I request that the Tribunal provide me with as complete an estimate as possible of the likely costs of an arbitration proceeding between the Bank and a former shareholder over the freeze-out, including a complete schedule of the hourly or other rates or charges by the members of the Tribunal and any other staff members or assistants.

Secretary to the BIS Arbitral Tribunal, August 20, 2001, page 5 Fifth, no adequate provisions are in place for keeping former shareholders of the BIS properly informed about the status of the arbitration proceedings in which they have an interest. Both the PCA and the BIS operate websites which have obvious capabilities in this regard. Accordingly, I request that copies of all important pleadings, briefs, rulings, opinions and other important filings be posted online, together with notices of the dates and location of hearings and other significant developments.

Issues Relating to Price Fixing and Share Valuation. My U.S. federal court action alleges that since 1995 the BIS has been a key participant in a scheme to suppress gold prices orchestrated by top U.S. and British officials, including those who are directors of the Bank. Further new evidence in support of these allegations is detailed in recent commentaries at my website. Because the BIS holds large gold reserves for its own account and keeps its own books in Swiss gold francs, gold prices necessarily play an important role in any valuation of its shares. Accordingly, the Tribunal will be unable to determine a correct freeze-out price for the Bank's shares without also addressing and investigating its involvement and that of certain of its directors, specifically including Alan Greenspan, William J. McDonough, and Edward George, in the alleged price fixing scheme which, if proven, constitutes a serious violation of the U.S. Sherman Act.

In this connection, the share valuation report relied upon by the BIS in setting the freeze-out price was prepared by a wholly-owned subsidiary of J. P. Morgan Chase, which is also a defendant in my federal court action and an alleged principal participant in the scheme to manipulate gold prices.

Under these circumstances, and also with an eye to reducing its costs, the Tribunal might want to consider whether it is the most appropriate forum in which to address the price fixing issues, and if not, whether to stay any arbitration proceedings relating to the freeze-out until after the U.S. courts have finally determined the Sherman Act and related constitutional claims in my case.

Issues Relating to the Appointment and Impartiality of the Tribunal. As previously noted, after more than a half century of desuetude, the Tribunal has been specially recreated to hear disputes relating to the freeze-out. Article XV of the treaty under which the Tribunal claims its authority calls for a permanently sitting

Secretary to the BIS Arbitral Tribunal, August 20, 2001, page 6 body, not one put together when, as and if required to deal with a specific dispute. In the present case, it appears that the BIS -- without any input from its private shareholders -- contacted the signatory governments specified in Article XV to request them to appoint the Tribunal. The central banks of all these governments are members of the BIS, and two, the central banks of France and Belgium, had placed portions of their respective issues in private hands. Another, the Bank of England, has played a key role in the manipulation of gold prices, all as set forth in more detail in my federal court action. All these central banks and governments share substantial common interests with each other and with the BIS that are in direct opposition to the interests of the Bank's former private shareholders.

Accordingly, and in order to consider the possible need for challenges under Article 5 of the Tribunal's recent rules, I request that each member of the Tribunal provide: (1) copies of all correspondence and other communications, or notes pertaining thereto, with any official of any signatory government or of the Bank relating to his appointment to the Tribunal; (2) copies any contract, memorandum or other writing describing the terms and conditions of his appointment to the Tribunal, including but not limited to arrangements for compensation and any indemnity agreements; (3) a brief summary of any consulting or other work that he has done within the past five years for any of the signatory governments or for any central bank that is a member of the BIS or has representatives on its board. In addition, I request that the Tribunal direct the BIS to provide copies of all its correspondence and other communications, or notes pertaining thereto, with any official of any signatory government at any time relating in any way to the existence or functions of the Tribunal or the appointment of its members.

This letter is not intended as a complete review of all the issues or concerns that might be raised at a preliminary conference. It does, however, address several on which I believe it is reasonable for a private shareholder to request further information from the Tribunal before making a decision on whether to file a notice of arbitration, and I look forward to the Tribunal's reply.

Sincerely yours, Reginald H. Howe *****

BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM WASHINGTON, D.C. 20551 ALAN GREENSPAN CHAIRMAN June 25, 2001 The Honorable Jim Bunning

United States Senate

Washington, D.C. 20510Dear Senator:

Thank you for your recent letter requesting information related to an inquiry you received from two of your constituents, Mr. and Mrs. Rupert Raymond. The Raymonds' letter principally concerns remarks made at a January 1995 meeting of the Federal Open Market Committee (FOMC) by Virgil Mattingly, in his capacity as general counsel to the FOMC. A memorandum addressed to me from Mr. Mattingly on this matter is enclosed for your information. The memorandum responds to the matter raised by the Raymonds in their letter.

I would like to take this opportunity to confirm the statements I made last year regarding the Federal Reserve and gold in a letter to one of your colleagues, Sen. Joseph Lieberman. In that letter I said:

"The Federal Reserve owns no gold and therefore could not sell or lease gold to influence its price. Likewise the Federal Reserve does not engage in financial transactions related to gold, such as trading in gold options or other derivatives. Most importantly, the Federal Reserve is in complete agreement with the proposition that any such transactions on our part, aimed at manipulating the free price of gold or otherwise interfering with the free trade of gold, would be wholly inappropriate."

These statements accurately reflect the facts and longstanding Federal Reserve policy with respect to gold.

I hope this information is helpful. Please let me know if I can be of further assistance.

Sincerely, Alan Greenspan Enclosure

***** EXHIBIT 5B - Memorandum dated June 8, 2001, from J.Virgil Mattingly to Alan Greenspan June 8, 2001 TO: Chairman Greenspan SUBJECT: Inquiries regarding "gold swaps" FROM: J. Virgil MattinglyThis memorandum responds to your request for information related to recent inquiries the Federal Reserve has received regarding remarks I made at a January 1995 meeting of the Federal Open Market Committee ("FOMC") in my capacity as general counsel.

These inquiries focus primarily on a statement attributed to me that appears on page 69 of the published transcript of the January 31-February 1, 1995, FOMC meeting to the effect that the Exchange Stabilization Fund ("ESF") has engaged in "gold swaps." Given the passage of time, some six years, I have no clear recollection of exactly what I said that day but I can confirm that I have no knowledge of any "gold swaps" by either the Federal Reserve or the ESF. I believe that my remarks, which were intended as a general description of the authority possessed by the Secretary of the Treasury to utilize the ESF, were transcribed inaccurately or otherwise became garbled. The Federal Reserve's lack of involvement with gold and gold-related financial instruments is set forth accurately in your January 19, 2000, letter to Senator Lieberman, a copy of which is attached. My remarks should not be interpreted as modifying in any respect what is set forth in that letter.

With respect to activities of the ESF, I note the Treasury Department stated in a recent federal court filing that the ESF has not held any gold since 1978.

Attachment